Mackenzie Financial Corp increased its position in shares of Shell PLC Unsponsored ADR (NYSE:SHEL - Free Report) by 3.3% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,315,629 shares of the energy company's stock after acquiring an additional 41,663 shares during the quarter. Mackenzie Financial Corp's holdings in Shell were worth $96,409,000 at the end of the most recent quarter.

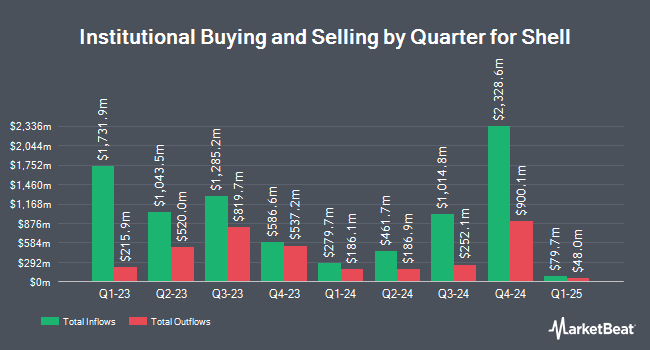

Several other large investors have also made changes to their positions in the company. First Wilshire Securities Management Inc. increased its holdings in Shell by 1.6% in the fourth quarter. First Wilshire Securities Management Inc. now owns 9,518 shares of the energy company's stock valued at $596,000 after purchasing an additional 153 shares during the last quarter. Titleist Asset Management LLC increased its holdings in Shell by 3.1% in the fourth quarter. Titleist Asset Management LLC now owns 5,526 shares of the energy company's stock valued at $346,000 after purchasing an additional 164 shares during the last quarter. Warther Private Wealth LLC increased its holdings in Shell by 5.0% in the first quarter. Warther Private Wealth LLC now owns 3,433 shares of the energy company's stock valued at $252,000 after purchasing an additional 165 shares during the last quarter. Harbour Capital Advisors LLC increased its holdings in Shell by 2.4% in the first quarter. Harbour Capital Advisors LLC now owns 7,235 shares of the energy company's stock valued at $505,000 after purchasing an additional 170 shares during the last quarter. Finally, Golden State Equity Partners increased its holdings in Shell by 5.1% in the first quarter. Golden State Equity Partners now owns 3,562 shares of the energy company's stock valued at $261,000 after purchasing an additional 173 shares during the last quarter. Institutional investors and hedge funds own 28.60% of the company's stock.

Shell Stock Up 1.3%

Shares of NYSE:SHEL traded up $0.93 during mid-day trading on Tuesday, reaching $73.14. 3,917,928 shares of the stock were exchanged, compared to its average volume of 3,747,716. The stock's 50 day simple moving average is $69.97 and its 200-day simple moving average is $67.82. Shell PLC Unsponsored ADR has a one year low of $58.54 and a one year high of $74.46. The company has a quick ratio of 1.08, a current ratio of 1.32 and a debt-to-equity ratio of 0.36. The company has a market cap of $216.21 billion, a P/E ratio of 16.85, a P/E/G ratio of 2.09 and a beta of 0.40.

Shell (NYSE:SHEL - Get Free Report) last issued its quarterly earnings results on Friday, May 2nd. The energy company reported $1.84 EPS for the quarter, beating the consensus estimate of $1.54 by $0.30. Shell had a return on equity of 11.71% and a net margin of 4.75%. The firm had revenue of $69.23 billion during the quarter, compared to analysts' expectations of $79.18 billion. During the same period in the prior year, the firm posted $2.40 earnings per share. As a group, equities research analysts predict that Shell PLC Unsponsored ADR will post 7.67 EPS for the current year.

Shell declared that its Board of Directors has approved a stock repurchase plan on Friday, May 2nd that authorizes the company to buyback $3.50 billion in shares. This buyback authorization authorizes the energy company to purchase up to 1.8% of its shares through open market purchases. Shares buyback plans are usually a sign that the company's board believes its stock is undervalued.

Shell Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, June 23rd. Investors of record on Friday, May 16th were given a dividend of $0.716 per share. The ex-dividend date was Friday, May 16th. This represents a $2.86 annualized dividend and a yield of 3.92%. Shell's dividend payout ratio (DPR) is presently 65.90%.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on SHEL. Piper Sandler upped their price objective on Shell from $83.00 to $84.00 and gave the company an "overweight" rating in a report on Tuesday, July 15th. Wells Fargo & Company lowered their price target on Shell from $80.00 to $79.00 and set an "overweight" rating for the company in a report on Thursday, June 26th. Hsbc Global Res upgraded Shell to a "strong-buy" rating in a report on Tuesday, May 13th. Sanford C. Bernstein downgraded Shell from an "outperform" rating to a "market perform" rating in a report on Monday, June 16th. Finally, TD Cowen lowered their price target on Shell from $82.00 to $76.00 and set a "buy" rating for the company in a report on Tuesday, April 8th. Three equities research analysts have rated the stock with a hold rating, ten have issued a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $78.69.

Get Our Latest Stock Analysis on SHEL

Shell Company Profile

(

Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

Further Reading

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.