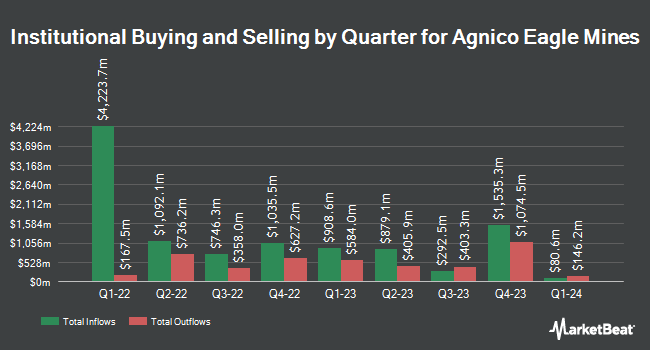

Mackenzie Financial Corp lessened its stake in shares of Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 0.5% during the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 8,617,626 shares of the mining company's stock after selling 40,979 shares during the period. Agnico Eagle Mines comprises approximately 1.3% of Mackenzie Financial Corp's investment portfolio, making the stock its 10th largest holding. Mackenzie Financial Corp owned 1.71% of Agnico Eagle Mines worth $933,639,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently modified their holdings of the company. Resolute Wealth Strategies LLC bought a new stake in shares of Agnico Eagle Mines in the first quarter valued at about $428,000. Zurcher Kantonalbank Zurich Cantonalbank raised its position in shares of Agnico Eagle Mines by 30.4% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 299,722 shares of the mining company's stock valued at $32,468,000 after buying an additional 69,910 shares in the last quarter. HB Wealth Management LLC grew its position in Agnico Eagle Mines by 85.3% during the first quarter. HB Wealth Management LLC now owns 4,932 shares of the mining company's stock worth $535,000 after buying an additional 2,270 shares in the last quarter. TD Asset Management Inc increased its stake in Agnico Eagle Mines by 42.8% during the 1st quarter. TD Asset Management Inc now owns 9,033,296 shares of the mining company's stock worth $978,553,000 after acquiring an additional 2,709,005 shares during the period. Finally, Mediolanum International Funds Ltd raised its holdings in Agnico Eagle Mines by 429.9% in the 1st quarter. Mediolanum International Funds Ltd now owns 48,011 shares of the mining company's stock valued at $5,170,000 after acquiring an additional 38,950 shares in the last quarter. 68.34% of the stock is owned by institutional investors.

Agnico Eagle Mines Stock Up 0.8%

Agnico Eagle Mines stock traded up $1.05 during midday trading on Thursday, reaching $124.42. The stock had a trading volume of 2,292,875 shares, compared to its average volume of 2,992,530. The company has a current ratio of 2.37, a quick ratio of 1.20 and a debt-to-equity ratio of 0.05. Agnico Eagle Mines Limited has a 12 month low of $69.72 and a 12 month high of $129.77. The company has a fifty day moving average price of $120.74 and a two-hundred day moving average price of $109.38. The company has a market capitalization of $62.56 billion, a P/E ratio of 26.47, a PEG ratio of 0.91 and a beta of 0.50.

Agnico Eagle Mines (NYSE:AEM - Get Free Report) TSE: AEM last released its quarterly earnings results on Wednesday, July 30th. The mining company reported $1.94 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.57 by $0.37. The business had revenue of $2.86 billion during the quarter, compared to the consensus estimate of $2.46 billion. Agnico Eagle Mines had a return on equity of 12.09% and a net margin of 26.48%. The company's quarterly revenue was up 35.6% on a year-over-year basis. During the same quarter in the previous year, the business earned $1.07 EPS. As a group, equities analysts expect that Agnico Eagle Mines Limited will post 4.63 EPS for the current fiscal year.

Agnico Eagle Mines Announces Dividend

The business also recently disclosed a dividend, which was paid on Monday, June 16th. Shareholders of record on Monday, June 2nd were paid a dividend of $0.40 per share. This represents a yield of 1.36%. The ex-dividend date of this dividend was Friday, May 30th. Agnico Eagle Mines's dividend payout ratio (DPR) is presently 34.04%.

Analysts Set New Price Targets

AEM has been the topic of several analyst reports. National Bankshares reissued an "outperform" rating on shares of Agnico Eagle Mines in a report on Tuesday, June 24th. TD Securities raised shares of Agnico Eagle Mines to a "strong-buy" rating in a report on Thursday, July 17th. Cfra Research raised shares of Agnico Eagle Mines to a "strong-buy" rating in a report on Friday, April 25th. Lake Street Capital restated a "buy" rating on shares of Agnico Eagle Mines in a research report on Monday, June 23rd. Finally, UBS Group boosted their price target on Agnico Eagle Mines from $110.00 to $115.00 and gave the stock a "neutral" rating in a report on Friday, April 11th. Two equities research analysts have rated the stock with a hold rating, eight have given a buy rating and five have given a strong buy rating to the company. Based on data from MarketBeat, Agnico Eagle Mines presently has an average rating of "Buy" and an average price target of $136.90.

Read Our Latest Research Report on Agnico Eagle Mines

Agnico Eagle Mines Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

See Also

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.