Mackenzie Financial Corp trimmed its position in shares of Kenvue Inc. (NYSE:KVUE - Free Report) by 49.2% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 225,838 shares of the company's stock after selling 218,290 shares during the quarter. Mackenzie Financial Corp's holdings in Kenvue were worth $5,416,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

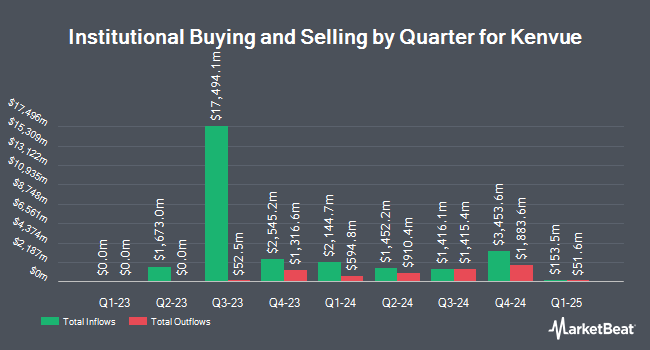

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Fulton Bank N.A. grew its position in Kenvue by 0.6% in the first quarter. Fulton Bank N.A. now owns 78,888 shares of the company's stock worth $1,892,000 after acquiring an additional 465 shares in the last quarter. Scott & Selber Inc. raised its stake in Kenvue by 0.4% in the first quarter. Scott & Selber Inc. now owns 106,621 shares of the company's stock worth $2,557,000 after buying an additional 475 shares in the last quarter. Wealth Alliance LLC raised its stake in Kenvue by 1.6% in the first quarter. Wealth Alliance LLC now owns 31,778 shares of the company's stock worth $762,000 after buying an additional 486 shares in the last quarter. Keystone Financial Group raised its stake in Kenvue by 4.8% in the fourth quarter. Keystone Financial Group now owns 12,736 shares of the company's stock worth $272,000 after buying an additional 578 shares in the last quarter. Finally, Transatlantique Private Wealth LLC increased its position in shares of Kenvue by 5.7% during the fourth quarter. Transatlantique Private Wealth LLC now owns 10,680 shares of the company's stock worth $228,000 after purchasing an additional 580 shares in the last quarter. 97.64% of the stock is owned by institutional investors.

Kenvue Stock Performance

NYSE KVUE traded up $0.67 during midday trading on Monday, hitting $22.26. The company had a trading volume of 32,707,553 shares, compared to its average volume of 18,768,468. Kenvue Inc. has a fifty-two week low of $18.10 and a fifty-two week high of $25.17. The stock has a market cap of $42.70 billion, a price-to-earnings ratio of 19.63, a P/E/G ratio of 3.62 and a beta of 0.83. The firm has a fifty day simple moving average of $21.82 and a two-hundred day simple moving average of $22.40. The company has a quick ratio of 0.60, a current ratio of 0.86 and a debt-to-equity ratio of 0.63.

Kenvue (NYSE:KVUE - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The company reported $0.24 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.23 by $0.01. Kenvue had a net margin of 6.90% and a return on equity of 20.87%. The firm had revenue of $3.74 billion during the quarter, compared to analysts' expectations of $3.69 billion. During the same quarter in the previous year, the company earned $0.28 earnings per share. The business's revenue for the quarter was down 3.9% on a year-over-year basis. Equities analysts forecast that Kenvue Inc. will post 1.14 earnings per share for the current fiscal year.

Kenvue Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, August 27th. Stockholders of record on Wednesday, August 13th will be paid a $0.2075 dividend. This represents a $0.83 dividend on an annualized basis and a dividend yield of 3.7%. The ex-dividend date is Wednesday, August 13th. This is an increase from Kenvue's previous quarterly dividend of $0.21. Kenvue's dividend payout ratio is 149.09%.

Analysts Set New Price Targets

KVUE has been the topic of several research analyst reports. Citigroup lowered their price objective on Kenvue from $24.50 to $22.00 and set a "neutral" rating on the stock in a report on Tuesday, July 15th. UBS Group lowered their price objective on Kenvue from $25.00 to $23.00 and set a "neutral" rating for the company in a research report on Thursday, July 17th. JPMorgan Chase & Co. lowered their price objective on Kenvue from $27.00 to $26.00 and set an "overweight" rating for the company in a research report on Friday, July 25th. Barclays decreased their price target on Kenvue from $23.00 to $22.00 and set an "equal weight" rating on the stock in a research note on Tuesday, July 15th. Finally, Bank of America reduced their price objective on Kenvue from $27.00 to $25.00 and set a "buy" rating on the stock in a research note on Tuesday, July 15th. Seven investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $24.79.

Read Our Latest Research Report on Kenvue

Kenvue Company Profile

(

Free Report)

Kenvue Inc operates as a consumer health company worldwide. The company operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. The Self Care segment offers cough, cold and allergy, pain care, digestive health, smoking cessation, eye care, and other products under the Tylenol, Motrin, Benadryl, Nicorette, Zarbee's, ORSLTM, Rhinocort, Calpol, and Zyrtec brands.

Read More

Before you consider Kenvue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kenvue wasn't on the list.

While Kenvue currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.