Mackenzie Financial Corp lessened its stake in shares of QUALCOMM Incorporated (NASDAQ:QCOM - Free Report) by 1.0% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 383,740 shares of the wireless technology company's stock after selling 3,970 shares during the quarter. Mackenzie Financial Corp's holdings in QUALCOMM were worth $58,946,000 as of its most recent filing with the Securities and Exchange Commission.

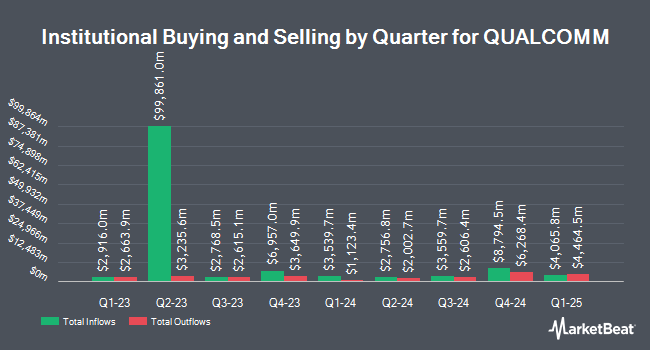

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in QCOM. GAMMA Investing LLC increased its position in QUALCOMM by 20,700.4% during the 1st quarter. GAMMA Investing LLC now owns 3,262,754 shares of the wireless technology company's stock worth $501,192,000 after purchasing an additional 3,247,068 shares in the last quarter. Northern Trust Corp increased its position in QUALCOMM by 12.7% during the 4th quarter. Northern Trust Corp now owns 13,289,513 shares of the wireless technology company's stock worth $2,041,535,000 after purchasing an additional 1,493,076 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in QUALCOMM by 17.0% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 9,780,687 shares of the wireless technology company's stock worth $1,502,509,000 after purchasing an additional 1,424,106 shares in the last quarter. Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in QUALCOMM during the 4th quarter worth about $204,085,000. Finally, Capital Research Global Investors increased its position in QUALCOMM by 525.5% during the 4th quarter. Capital Research Global Investors now owns 1,413,495 shares of the wireless technology company's stock worth $217,141,000 after purchasing an additional 1,187,531 shares in the last quarter. Hedge funds and other institutional investors own 74.35% of the company's stock.

Insider Activity

In other news, major shareholder Inc/De Qualcomm sold 412,500 shares of the business's stock in a transaction that occurred on Friday, May 23rd. The stock was sold at an average price of $16.00, for a total value of $6,600,000.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO Akash J. Palkhiwala sold 3,333 shares of the business's stock in a transaction that occurred on Wednesday, July 2nd. The shares were sold at an average price of $161.28, for a total value of $537,546.24. Following the completion of the sale, the chief financial officer owned 46,446 shares of the company's stock, valued at $7,490,810.88. This trade represents a 6.70% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 424,099 shares of company stock worth $8,310,735. 0.08% of the stock is currently owned by insiders.

QUALCOMM Price Performance

QCOM stock opened at $161.05 on Tuesday. The company has a quick ratio of 2.08, a current ratio of 2.73 and a debt-to-equity ratio of 0.48. QUALCOMM Incorporated has a 52-week low of $120.80 and a 52-week high of $182.64. The stock's 50 day moving average is $154.74 and its two-hundred day moving average is $155.00. The company has a market capitalization of $176.83 billion, a PE ratio of 16.40, a P/E/G ratio of 2.04 and a beta of 1.26.

QUALCOMM (NASDAQ:QCOM - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The wireless technology company reported $2.85 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.82 by $0.03. QUALCOMM had a return on equity of 40.11% and a net margin of 26.11%. The company had revenue of $10.98 billion for the quarter, compared to the consensus estimate of $10.58 billion. During the same period in the previous year, the business earned $2.44 EPS. QUALCOMM's revenue for the quarter was up 17.0% compared to the same quarter last year. Analysts predict that QUALCOMM Incorporated will post 9.39 earnings per share for the current fiscal year.

QUALCOMM Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, September 25th. Shareholders of record on Thursday, September 4th will be issued a dividend of $0.89 per share. The ex-dividend date of this dividend is Thursday, September 4th. This represents a $3.56 annualized dividend and a yield of 2.21%. QUALCOMM's dividend payout ratio is presently 36.25%.

Analyst Upgrades and Downgrades

A number of analysts have issued reports on the company. Robert W. Baird decreased their price target on QUALCOMM from $250.00 to $216.00 and set an "outperform" rating on the stock in a research note on Thursday, May 1st. Cantor Fitzgerald reissued a "neutral" rating and issued a $150.00 price target on shares of QUALCOMM in a research note on Thursday, May 1st. Bank of America decreased their price target on QUALCOMM from $245.00 to $200.00 and set a "buy" rating on the stock in a research note on Tuesday, June 17th. Benchmark decreased their price target on QUALCOMM from $240.00 to $200.00 and set a "buy" rating on the stock in a research note on Thursday, May 1st. Finally, Susquehanna decreased their price target on QUALCOMM from $210.00 to $190.00 and set a "positive" rating on the stock in a research note on Thursday, May 1st. One research analyst has rated the stock with a sell rating, thirteen have given a hold rating and thirteen have given a buy rating to the stock. According to MarketBeat, QUALCOMM has a consensus rating of "Hold" and an average target price of $183.95.

View Our Latest Research Report on QUALCOMM

About QUALCOMM

(

Free Report)

QUALCOMM Incorporated engages in the development and commercialization of foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on 3G/4G/5G and other technologies for use in wireless voice and data communications, networking, computing, multimedia, and position location products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider QUALCOMM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QUALCOMM wasn't on the list.

While QUALCOMM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report