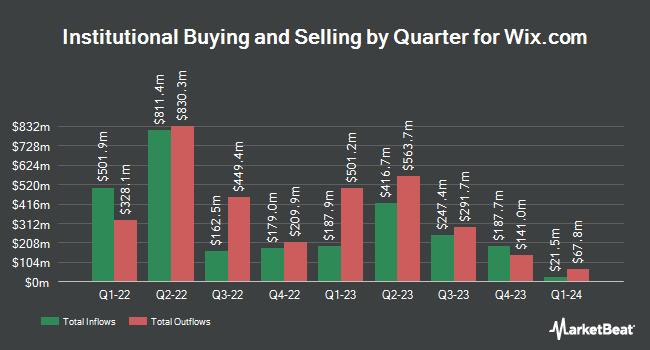

Mackenzie Financial Corp cut its holdings in Wix.com Ltd. (NASDAQ:WIX - Free Report) by 74.1% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 7,607 shares of the information services provider's stock after selling 21,788 shares during the period. Mackenzie Financial Corp's holdings in Wix.com were worth $1,243,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Mirae Asset Global Investments Co. Ltd. boosted its holdings in Wix.com by 31.8% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,989 shares of the information services provider's stock worth $830,000 after buying an additional 1,204 shares during the period. Yousif Capital Management LLC boosted its holdings in Wix.com by 4.9% in the 1st quarter. Yousif Capital Management LLC now owns 1,833 shares of the information services provider's stock valued at $299,000 after purchasing an additional 85 shares during the period. Janney Montgomery Scott LLC bought a new position in Wix.com in the 1st quarter valued at $5,367,000. Envestnet Asset Management Inc. boosted its holdings in Wix.com by 27.1% in the 1st quarter. Envestnet Asset Management Inc. now owns 35,177 shares of the information services provider's stock valued at $5,747,000 after purchasing an additional 7,507 shares during the period. Finally, LPL Financial LLC boosted its holdings in Wix.com by 24.4% in the 4th quarter. LPL Financial LLC now owns 7,277 shares of the information services provider's stock valued at $1,561,000 after purchasing an additional 1,429 shares during the period. 81.52% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research analysts have commented on WIX shares. Wall Street Zen downgraded shares of Wix.com from a "strong-buy" rating to a "buy" rating in a report on Sunday, July 13th. Wells Fargo & Company raised shares of Wix.com from an "equal weight" rating to an "overweight" rating and raised their price target for the company from $173.00 to $216.00 in a report on Monday, June 16th. Robert W. Baird raised shares of Wix.com from a "neutral" rating to an "outperform" rating and dropped their price objective for the stock from $215.00 to $190.00 in a report on Friday, May 23rd. Morgan Stanley dropped their price objective on shares of Wix.com from $276.00 to $207.00 and set an "overweight" rating for the company in a report on Wednesday, April 16th. Finally, UBS Group dropped their price objective on shares of Wix.com from $255.00 to $230.00 and set a "buy" rating for the company in a report on Thursday, May 22nd. Two research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and three have given a strong buy rating to the company's stock. According to MarketBeat.com, Wix.com has a consensus rating of "Buy" and a consensus price target of $228.95.

Check Out Our Latest Stock Analysis on WIX

Wix.com Trading Up 1.9%

WIX stock opened at $131.44 on Tuesday. The firm's 50-day moving average price is $153.74 and its two-hundred day moving average price is $174.75. Wix.com Ltd. has a 12-month low of $128.10 and a 12-month high of $247.11. The stock has a market capitalization of $7.38 billion, a price-to-earnings ratio of 52.37, a PEG ratio of 2.06 and a beta of 1.27.

Wix.com Company Profile

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Featured Stories

Want to see what other hedge funds are holding WIX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Wix.com Ltd. (NASDAQ:WIX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.