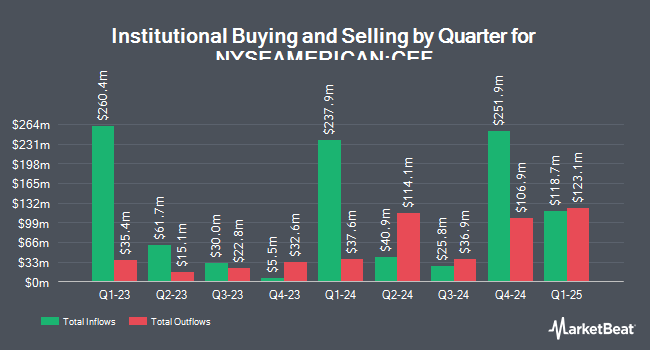

Manchester Financial Inc. raised its holdings in shares of Sprott Physical Gold and Silver Trust (NYSEAMERICAN:CEF - Free Report) by 56.7% in the second quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 47,141 shares of the company's stock after purchasing an additional 17,061 shares during the period. Manchester Financial Inc.'s holdings in Sprott Physical Gold and Silver Trust were worth $1,419,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also made changes to their positions in CEF. Kingstone Capital Partners Texas LLC bought a new position in shares of Sprott Physical Gold and Silver Trust during the second quarter valued at approximately $114,726,000. Bluefin Capital Management LLC bought a new stake in shares of Sprott Physical Gold and Silver Trust during the first quarter valued at approximately $37,797,000. Arkadios Wealth Advisors bought a new stake in shares of Sprott Physical Gold and Silver Trust during the first quarter valued at approximately $7,436,000. Jupiter Asset Management Ltd. increased its position in shares of Sprott Physical Gold and Silver Trust by 11.7% during the first quarter. Jupiter Asset Management Ltd. now owns 2,377,960 shares of the company's stock valued at $67,466,000 after acquiring an additional 248,489 shares in the last quarter. Finally, Royal Bank of Canada boosted its holdings in Sprott Physical Gold and Silver Trust by 3.9% in the first quarter. Royal Bank of Canada now owns 3,588,641 shares of the company's stock worth $101,953,000 after purchasing an additional 134,736 shares during the last quarter.

Sprott Physical Gold and Silver Trust Stock Performance

Shares of CEF stock opened at $39.60 on Friday. Sprott Physical Gold and Silver Trust has a 12-month low of $23.53 and a 12-month high of $41.20. The firm's 50 day moving average is $34.54 and its 200 day moving average is $31.37.

About Sprott Physical Gold and Silver Trust

(

Free Report)

Sprott Physical Gold & Silver Trust operates as a closed-ended investment fund/investment trust. The company was founded on October 26, 2017 and is headquartered in Toronto, Canada.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sprott Physical Gold and Silver Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprott Physical Gold and Silver Trust wasn't on the list.

While Sprott Physical Gold and Silver Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.