Maridea Wealth Management LLC acquired a new stake in Primerica, Inc. (NYSE:PRI - Free Report) during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm acquired 1,601 shares of the financial services provider's stock, valued at approximately $456,000.

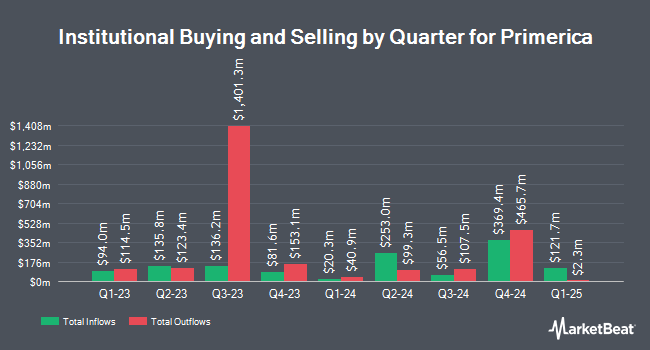

A number of other large investors also recently made changes to their positions in PRI. GAMMA Investing LLC lifted its position in shares of Primerica by 39,199.5% during the first quarter. GAMMA Investing LLC now owns 443,298 shares of the financial services provider's stock valued at $126,132,000 after purchasing an additional 442,170 shares in the last quarter. Raymond James Financial Inc. bought a new position in shares of Primerica during the fourth quarter valued at about $34,191,000. AQR Capital Management LLC lifted its position in shares of Primerica by 254.5% during the fourth quarter. AQR Capital Management LLC now owns 116,271 shares of the financial services provider's stock valued at $31,558,000 after purchasing an additional 83,477 shares in the last quarter. Geode Capital Management LLC lifted its position in shares of Primerica by 11.9% during the fourth quarter. Geode Capital Management LLC now owns 779,760 shares of the financial services provider's stock valued at $211,691,000 after purchasing an additional 82,921 shares in the last quarter. Finally, FIL Ltd increased its holdings in Primerica by 85.5% during the fourth quarter. FIL Ltd now owns 131,365 shares of the financial services provider's stock worth $35,655,000 after buying an additional 60,565 shares during the last quarter. 90.88% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

PRI has been the subject of a number of research analyst reports. Keefe, Bruyette & Woods decreased their price objective on shares of Primerica from $320.00 to $315.00 and set a "market perform" rating for the company in a report on Wednesday, April 9th. Morgan Stanley raised their price objective on shares of Primerica from $274.00 to $296.00 and gave the stock an "equal weight" rating in a report on Monday, May 19th. Five research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, Primerica presently has an average rating of "Hold" and an average price target of $317.83.

Check Out Our Latest Analysis on PRI

Primerica Price Performance

Shares of PRI traded up $5.41 during trading hours on Thursday, hitting $267.28. The company's stock had a trading volume of 63,863 shares, compared to its average volume of 170,083. The company has a market cap of $8.84 billion, a price-to-earnings ratio of 17.96 and a beta of 0.98. The business has a 50 day simple moving average of $266.70 and a two-hundred day simple moving average of $273.33. Primerica, Inc. has a 52-week low of $230.98 and a 52-week high of $307.91.

Primerica (NYSE:PRI - Get Free Report) last posted its earnings results on Wednesday, May 7th. The financial services provider reported $5.02 earnings per share for the quarter, topping the consensus estimate of $4.77 by $0.25. The firm had revenue of $803.56 million during the quarter, compared to the consensus estimate of $783.54 million. Primerica had a net margin of 15.82% and a return on equity of 32.30%. The company's revenue was up 8.3% on a year-over-year basis. During the same quarter last year, the company earned $3.91 earnings per share. Research analysts predict that Primerica, Inc. will post 20.6 earnings per share for the current year.

Primerica Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Thursday, May 22nd were paid a $1.04 dividend. The ex-dividend date was Thursday, May 22nd. This represents a $4.16 annualized dividend and a dividend yield of 1.56%. Primerica's payout ratio is 27.98%.

Primerica Company Profile

(

Free Report)

Primerica, Inc, together with its subsidiaries, provides financial products and services to middle-income households in the United States and Canada. The company operates in four segments: Term Life Insurance; Investment and Savings Products; Senior Health; and Corporate and Other Distributed Products.

Featured Articles

Before you consider Primerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primerica wasn't on the list.

While Primerica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.