HB Wealth Management LLC lessened its holdings in Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 32.8% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 8,476 shares of the semiconductor company's stock after selling 4,141 shares during the period. HB Wealth Management LLC's holdings in Marvell Technology were worth $656,000 as of its most recent filing with the Securities & Exchange Commission.

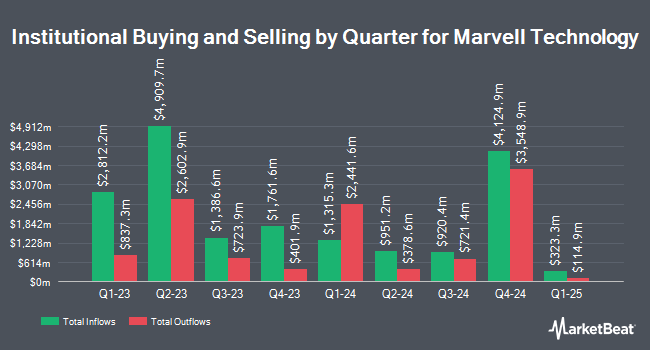

Other institutional investors and hedge funds have also recently modified their holdings of the company. Hughes Financial Services LLC purchased a new position in shares of Marvell Technology in the 1st quarter valued at about $26,000. Financial Connections Group Inc. increased its stake in shares of Marvell Technology by 776.0% in the 1st quarter. Financial Connections Group Inc. now owns 438 shares of the semiconductor company's stock valued at $27,000 after purchasing an additional 388 shares in the last quarter. Rossby Financial LCC purchased a new position in shares of Marvell Technology in the 1st quarter valued at about $27,000. Vision Financial Markets LLC purchased a new position in shares of Marvell Technology in the 1st quarter valued at about $28,000. Finally, Security National Bank purchased a new position in shares of Marvell Technology in the 1st quarter valued at about $31,000. Hedge funds and other institutional investors own 83.51% of the company's stock.

Marvell Technology Stock Performance

Shares of MRVL stock opened at $86.22 on Friday. The stock's 50-day moving average is $74.27 and its two-hundred day moving average is $68.15. The firm has a market cap of $74.33 billion, a price-to-earnings ratio of -663.23, a PEG ratio of 1.06 and a beta of 1.94. Marvell Technology, Inc. has a 1 year low of $47.08 and a 1 year high of $127.48. The company has a debt-to-equity ratio of 0.30, a quick ratio of 1.44 and a current ratio of 1.88.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last issued its quarterly earnings data on Thursday, August 28th. The semiconductor company reported $0.67 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.67. Marvell Technology had a positive return on equity of 11.01% and a negative net margin of 1.43%.The company had revenue of $2.01 billion for the quarter, compared to analyst estimates of $2.01 billion. During the same quarter last year, the company posted $0.30 earnings per share. The business's quarterly revenue was up 57.6% compared to the same quarter last year. Marvell Technology has set its Q3 2026 guidance at 0.690-0.790 EPS. Analysts predict that Marvell Technology, Inc. will post 0.91 earnings per share for the current year.

Marvell Technology declared that its Board of Directors has initiated a stock buyback program on Wednesday, September 24th that authorizes the company to buyback $5.00 billion in shares. This buyback authorization authorizes the semiconductor company to purchase up to 7.8% of its stock through open market purchases. Stock buyback programs are generally a sign that the company's board of directors believes its stock is undervalued.

Marvell Technology Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, October 30th. Investors of record on Friday, October 10th will be given a $0.06 dividend. The ex-dividend date is Friday, October 10th. This represents a $0.24 dividend on an annualized basis and a yield of 0.3%. Marvell Technology's dividend payout ratio (DPR) is presently -184.62%.

Insider Transactions at Marvell Technology

In related news, EVP Mark Casper sold 3,000 shares of the firm's stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $72.35, for a total value of $217,050.00. Following the completion of the sale, the executive vice president owned 17,163 shares in the company, valued at $1,241,743.05. This trade represents a 14.88% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, COO Chris Koopmans acquired 6,800 shares of Marvell Technology stock in a transaction that occurred on Thursday, September 25th. The stock was purchased at an average price of $78.03 per share, with a total value of $530,604.00. Following the transaction, the chief operating officer owned 104,825 shares of the company's stock, valued at $8,179,494.75. This trade represents a 6.94% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have acquired 27,200 shares of company stock valued at $2,109,632 over the last 90 days. Insiders own 0.19% of the company's stock.

Wall Street Analysts Forecast Growth

MRVL has been the subject of several research reports. Oppenheimer reiterated an "outperform" rating and set a $95.00 price objective on shares of Marvell Technology in a research note on Friday, August 29th. Cantor Fitzgerald reiterated a "neutral" rating and set a $75.00 price objective on shares of Marvell Technology in a research note on Friday, August 29th. Cowen lowered Marvell Technology from a "buy" rating to a "hold" rating in a research note on Tuesday. Weiss Ratings reiterated a "hold (c-)" rating on shares of Marvell Technology in a research note on Saturday, September 27th. Finally, Wall Street Zen upgraded Marvell Technology from a "hold" rating to a "buy" rating in a research note on Saturday, September 13th. Two research analysts have rated the stock with a Strong Buy rating, twenty-one have assigned a Buy rating and twelve have given a Hold rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $91.67.

Check Out Our Latest Stock Analysis on MRVL

Marvell Technology Company Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

Further Reading

Want to see what other hedge funds are holding MRVL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Marvell Technology, Inc. (NASDAQ:MRVL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.