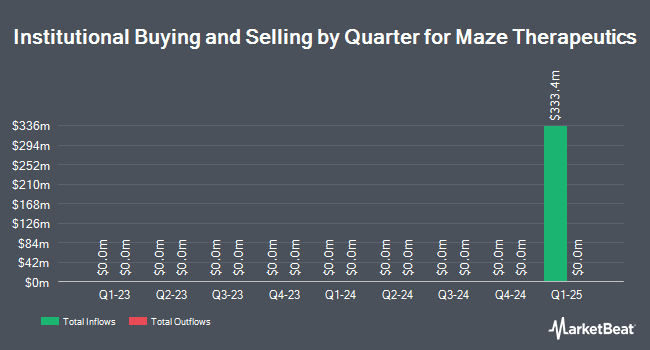

Matrix Capital Management Company LP bought a new stake in Maze Therapeutics, Inc. (NASDAQ:MAZE - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 2,486,184 shares of the company's stock, valued at approximately $27,373,000. Maze Therapeutics comprises approximately 7.9% of Matrix Capital Management Company LP's investment portfolio, making the stock its 3rd biggest position. Matrix Capital Management Company LP owned about 5.68% of Maze Therapeutics as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds also recently modified their holdings of the company. New York State Common Retirement Fund purchased a new position in shares of Maze Therapeutics during the 1st quarter worth $25,000. Deutsche Bank AG acquired a new position in Maze Therapeutics in the first quarter valued at $98,000. Nuveen LLC acquired a new position in Maze Therapeutics in the first quarter valued at $125,000. Bank of New York Mellon Corp purchased a new position in Maze Therapeutics during the first quarter worth about $190,000. Finally, Invesco Ltd. acquired a new stake in Maze Therapeutics in the 1st quarter worth about $226,000.

Wall Street Analyst Weigh In

MAZE has been the subject of several research analyst reports. Wedbush started coverage on shares of Maze Therapeutics in a research report on Tuesday, July 8th. They set an "outperform" rating and a $17.00 price target for the company. HC Wainwright began coverage on shares of Maze Therapeutics in a research note on Wednesday, July 23rd. They set a "buy" rating and a $34.00 price objective for the company. Finally, Wall Street Zen raised Maze Therapeutics from a "sell" rating to a "hold" rating in a research report on Saturday, August 16th. Two research analysts have rated the stock with a Strong Buy rating and five have issued a Buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and a consensus target price of $25.60.

Read Our Latest Analysis on Maze Therapeutics

Maze Therapeutics Stock Up 2.9%

NASDAQ MAZE traded up $0.40 during trading hours on Thursday, hitting $14.27. The company had a trading volume of 1,262,362 shares, compared to its average volume of 214,130. The firm's 50 day moving average is $14.05 and its 200 day moving average is $11.89. Maze Therapeutics, Inc. has a fifty-two week low of $6.71 and a fifty-two week high of $19.19.

Maze Therapeutics (NASDAQ:MAZE - Get Free Report) last announced its earnings results on Tuesday, August 12th. The company reported ($0.77) EPS for the quarter, beating the consensus estimate of ($0.79) by $0.02.

About Maze Therapeutics

(

Free Report)

We are a clinical-stage biopharmaceutical company harnessing the power of human genetics to develop novel, small molecule precision medicines for patients living with renal, cardiovascular and related metabolic diseases, including obesity. We are advancing a pipeline using our Compass platform, which allows us to identify and characterize genetic variants in disease and then link those variants to the biological pathways that drive disease in specific patient groups through a process we refer to as variant functionalization.

Featured Stories

Before you consider Maze Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maze Therapeutics wasn't on the list.

While Maze Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.