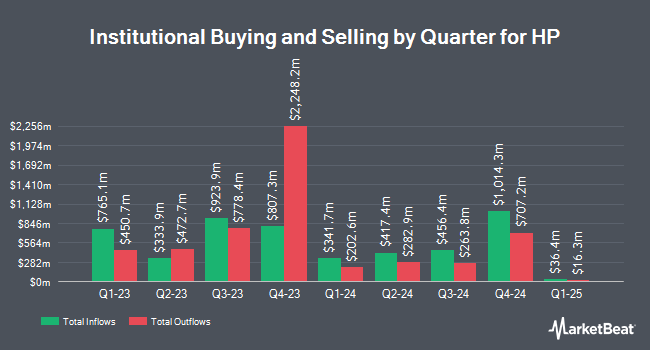

MBB Public Markets I LLC acquired a new stake in HP Inc. (NYSE:HPQ - Free Report) in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor acquired 11,049 shares of the computer maker's stock, valued at approximately $306,000.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Baird Financial Group Inc. boosted its position in HP by 18.3% during the 4th quarter. Baird Financial Group Inc. now owns 24,668 shares of the computer maker's stock valued at $805,000 after buying an additional 3,824 shares during the period. Cetera Investment Advisers boosted its position in HP by 13.7% during the 4th quarter. Cetera Investment Advisers now owns 144,009 shares of the computer maker's stock valued at $4,699,000 after buying an additional 17,376 shares during the period. CoreCap Advisors LLC boosted its position in HP by 71.9% during the 4th quarter. CoreCap Advisors LLC now owns 1,403 shares of the computer maker's stock valued at $46,000 after buying an additional 587 shares during the period. Focus Partners Wealth boosted its position in HP by 70.5% during the 4th quarter. Focus Partners Wealth now owns 156,514 shares of the computer maker's stock valued at $5,260,000 after buying an additional 64,711 shares during the period. Finally, Janus Henderson Group PLC boosted its position in HP by 6.8% during the 4th quarter. Janus Henderson Group PLC now owns 150,725 shares of the computer maker's stock valued at $4,916,000 after buying an additional 9,568 shares during the period. 77.53% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on HPQ shares. Dbs Bank cut shares of HP from a "moderate buy" rating to a "hold" rating in a research report on Wednesday, June 11th. TD Cowen dropped their price target on shares of HP from $38.00 to $28.00 and set a "hold" rating for the company in a research report on Thursday, May 29th. Citigroup decreased their price objective on shares of HP from $29.00 to $27.50 and set a "neutral" rating for the company in a report on Thursday, May 29th. Wells Fargo & Company decreased their price objective on shares of HP from $35.00 to $25.00 and set an "underweight" rating for the company in a report on Thursday, May 29th. Finally, UBS Group upped their price objective on shares of HP from $26.00 to $29.00 and gave the stock a "neutral" rating in a report on Thursday, August 28th. One investment analyst has rated the stock with a Buy rating, fourteen have given a Hold rating and one has issued a Sell rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $29.71.

Get Our Latest Stock Report on HPQ

HP Price Performance

Shares of HP stock opened at $28.38 on Thursday. The company has a 50-day moving average of $26.42 and a 200 day moving average of $26.54. The firm has a market cap of $26.53 billion, a price-to-earnings ratio of 10.36, a PEG ratio of 2.34 and a beta of 1.29. HP Inc. has a 1 year low of $21.21 and a 1 year high of $39.79.

HP (NYSE:HPQ - Get Free Report) last issued its quarterly earnings results on Wednesday, August 27th. The computer maker reported $0.75 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.75. HP had a net margin of 4.83% and a negative return on equity of 262.03%. The company had revenue of $13.93 billion during the quarter, compared to analyst estimates of $13.69 billion. During the same period last year, the business earned $0.83 EPS. HP's quarterly revenue was up 3.1% compared to the same quarter last year. HP has set its Q4 2025 guidance at 0.870-0.97 EPS. On average, equities analysts anticipate that HP Inc. will post 3.56 EPS for the current year.

About HP

(

Free Report)

HP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

Featured Stories

Want to see what other hedge funds are holding HPQ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for HP Inc. (NYSE:HPQ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HP wasn't on the list.

While HP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.