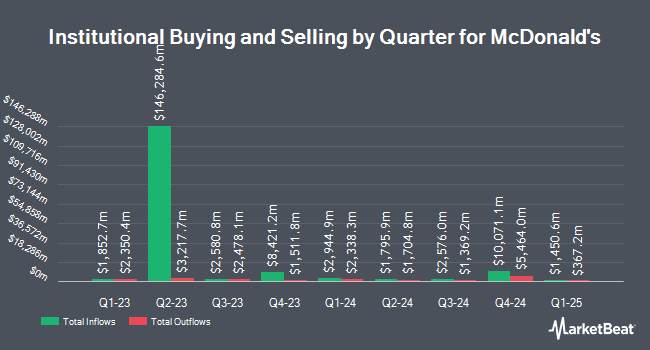

Atria Wealth Solutions Inc. lessened its holdings in shares of McDonald's Corporation (NYSE:MCD - Free Report) by 53.9% during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 24,901 shares of the fast-food giant's stock after selling 29,091 shares during the period. Atria Wealth Solutions Inc.'s holdings in McDonald's were worth $7,279,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds also recently made changes to their positions in MCD. Concord Asset Management LLC VA raised its holdings in McDonald's by 17.9% during the second quarter. Concord Asset Management LLC VA now owns 7,310 shares of the fast-food giant's stock worth $2,136,000 after purchasing an additional 1,111 shares in the last quarter. Total Clarity Wealth Management Inc. raised its holdings in McDonald's by 5.4% during the second quarter. Total Clarity Wealth Management Inc. now owns 2,223 shares of the fast-food giant's stock worth $650,000 after purchasing an additional 113 shares in the last quarter. MGO One Seven LLC raised its holdings in McDonald's by 5.0% during the second quarter. MGO One Seven LLC now owns 18,610 shares of the fast-food giant's stock worth $5,437,000 after purchasing an additional 879 shares in the last quarter. Welch Group LLC raised its holdings in McDonald's by 1.1% during the second quarter. Welch Group LLC now owns 206,004 shares of the fast-food giant's stock worth $60,188,000 after purchasing an additional 2,180 shares in the last quarter. Finally, Stephens Consulting LLC raised its holdings in McDonald's by 9.2% during the second quarter. Stephens Consulting LLC now owns 499 shares of the fast-food giant's stock worth $146,000 after purchasing an additional 42 shares in the last quarter. Institutional investors own 70.29% of the company's stock.

McDonald's Stock Performance

McDonald's stock opened at $300.10 on Tuesday. The firm has a market cap of $214.15 billion, a price-to-earnings ratio of 25.72, a price-to-earnings-growth ratio of 3.12 and a beta of 0.50. McDonald's Corporation has a 1 year low of $276.53 and a 1 year high of $326.32. The firm's 50 day moving average price is $306.23 and its two-hundred day moving average price is $305.64.

McDonald's (NYSE:MCD - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The fast-food giant reported $3.19 earnings per share for the quarter, topping the consensus estimate of $3.15 by $0.04. McDonald's had a net margin of 32.21% and a negative return on equity of 225.52%. The firm had revenue of $6.84 billion for the quarter, compared to analysts' expectations of $6.68 billion. During the same period in the previous year, the company posted $2.97 EPS. The company's quarterly revenue was up 5.4% compared to the same quarter last year. As a group, equities analysts predict that McDonald's Corporation will post 12.25 EPS for the current fiscal year.

McDonald's Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, September 16th. Shareholders of record on Tuesday, September 2nd were given a dividend of $1.77 per share. This represents a $7.08 annualized dividend and a yield of 2.4%. The ex-dividend date was Tuesday, September 2nd. McDonald's's payout ratio is presently 60.67%.

Insider Activity

In other McDonald's news, insider Joseph M. Erlinger sold 939 shares of McDonald's stock in a transaction that occurred on Wednesday, July 23rd. The shares were sold at an average price of $299.49, for a total transaction of $281,221.11. Following the transaction, the insider directly owned 9,283 shares in the company, valued at approximately $2,780,165.67. The trade was a 9.19% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Desiree Ralls-Morrison sold 2,487 shares of McDonald's stock in a transaction that occurred on Wednesday, August 6th. The stock was sold at an average price of $310.00, for a total transaction of $770,970.00. Following the transaction, the executive vice president owned 8,754 shares in the company, valued at approximately $2,713,740. The trade was a 22.12% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 6,402 shares of company stock valued at $1,973,407. 0.25% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on MCD shares. BMO Capital Markets boosted their target price on McDonald's from $350.00 to $360.00 and gave the stock an "outperform" rating in a report on Thursday, September 4th. Piper Sandler boosted their target price on McDonald's from $314.00 to $325.00 and gave the stock a "neutral" rating in a report on Thursday, August 7th. Stifel Nicolaus boosted their target price on McDonald's from $300.00 to $315.00 and gave the stock a "hold" rating in a report on Friday, August 22nd. Citigroup boosted their target price on McDonald's from $373.00 to $381.00 and gave the stock a "buy" rating in a report on Wednesday, September 17th. Finally, JPMorgan Chase & Co. lifted their price target on shares of McDonald's from $305.00 to $310.00 and gave the stock an "overweight" rating in a research report on Thursday, August 7th. Eleven analysts have rated the stock with a Buy rating, fifteen have assigned a Hold rating and two have issued a Sell rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $325.18.

Get Our Latest Stock Analysis on McDonald's

McDonald's Profile

(

Free Report)

McDonald's Corp. engages in the operation and franchising of restaurants. It operates through the following segments: U.S., International Operated Markets, and International Developmental Licensed Markets and Corporate. The U.S. segment focuses its operations on the United States. The International Operated Markets segment consists of operations and the franchising of restaurants in Australia, Canada, France, Germany, Italy, the Netherlands, Spain, and the U.K.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.