Mediolanum International Funds Ltd increased its position in Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) by 14.5% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 134,005 shares of the company's stock after buying an additional 17,014 shares during the quarter. Mediolanum International Funds Ltd owned 0.08% of Take-Two Interactive Software worth $28,204,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

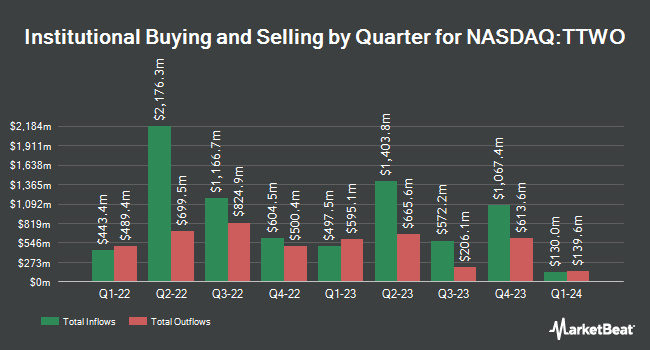

A number of other hedge funds also recently bought and sold shares of the company. Norges Bank bought a new stake in Take-Two Interactive Software in the fourth quarter valued at approximately $495,086,000. GAMMA Investing LLC lifted its position in Take-Two Interactive Software by 27,563.6% in the first quarter. GAMMA Investing LLC now owns 693,251 shares of the company's stock valued at $143,676,000 after purchasing an additional 690,745 shares during the last quarter. Alyeska Investment Group L.P. lifted its position in Take-Two Interactive Software by 74.3% in the fourth quarter. Alyeska Investment Group L.P. now owns 1,347,150 shares of the company's stock valued at $247,983,000 after purchasing an additional 574,326 shares during the last quarter. Capital International Investors lifted its position in Take-Two Interactive Software by 9.5% in the fourth quarter. Capital International Investors now owns 4,883,746 shares of the company's stock valued at $899,036,000 after purchasing an additional 424,893 shares during the last quarter. Finally, FMR LLC lifted its position in Take-Two Interactive Software by 67.7% in the fourth quarter. FMR LLC now owns 960,654 shares of the company's stock valued at $176,837,000 after purchasing an additional 387,923 shares during the last quarter. Institutional investors own 95.46% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on TTWO shares. Benchmark boosted their target price on Take-Two Interactive Software from $225.00 to $250.00 and gave the company a "buy" rating in a research note on Friday, May 16th. Morgan Stanley boosted their target price on Take-Two Interactive Software from $210.00 to $265.00 and gave the company an "overweight" rating in a research note on Monday, May 19th. Wall Street Zen cut Take-Two Interactive Software from a "hold" rating to a "sell" rating in a research note on Wednesday, May 21st. Wells Fargo & Company started coverage on Take-Two Interactive Software in a research note on Monday. They set an "overweight" rating and a $265.00 target price on the stock. Finally, DA Davidson boosted their target price on Take-Two Interactive Software from $250.00 to $270.00 and gave the company a "buy" rating in a research note on Friday, May 16th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, nineteen have assigned a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, Take-Two Interactive Software presently has an average rating of "Moderate Buy" and a consensus price target of $234.05.

View Our Latest Stock Report on TTWO

Take-Two Interactive Software Stock Up 0.5%

Shares of NASDAQ TTWO traded up $1.22 during trading on Wednesday, reaching $225.20. The company had a trading volume of 430,530 shares, compared to its average volume of 2,024,561. The stock has a market cap of $39.96 billion, a PE ratio of -8.86, a P/E/G ratio of 5.88 and a beta of 1.03. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 1.18. Take-Two Interactive Software, Inc. has a 12-month low of $135.24 and a 12-month high of $245.07. The business's 50-day moving average is $233.91 and its 200 day moving average is $217.05.

Insiders Place Their Bets

In other news, President Karl Slatoff sold 216,661 shares of the company's stock in a transaction on Friday, May 30th. The stock was sold at an average price of $225.75, for a total transaction of $48,911,220.75. Following the transaction, the president directly owned 1,206,427 shares of the company's stock, valued at $272,350,895.25. This represents a 15.22% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Strauss Zelnick sold 216,661 shares of the company's stock in a transaction on Friday, May 30th. The shares were sold at an average price of $225.75, for a total value of $48,911,220.75. Following the transaction, the chief executive officer directly owned 1,206,427 shares in the company, valued at approximately $272,350,895.25. The trade was a 15.22% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 460,792 shares of company stock valued at $104,014,443. Company insiders own 1.45% of the company's stock.

About Take-Two Interactive Software

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Featured Articles

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.