Annex Advisory Services LLC increased its position in Micron Technology, Inc. (NASDAQ:MU - Free Report) by 18.5% in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 12,817 shares of the semiconductor manufacturer's stock after purchasing an additional 2,000 shares during the quarter. Annex Advisory Services LLC's holdings in Micron Technology were worth $1,580,000 as of its most recent filing with the Securities and Exchange Commission.

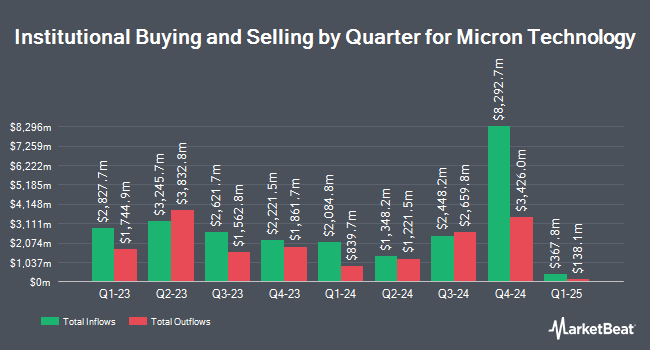

A number of other institutional investors have also added to or reduced their stakes in MU. Mission Wealth Management LP increased its holdings in shares of Micron Technology by 195.2% during the first quarter. Mission Wealth Management LP now owns 15,650 shares of the semiconductor manufacturer's stock worth $1,360,000 after buying an additional 10,348 shares in the last quarter. Centre Asset Management LLC purchased a new stake in shares of Micron Technology in the first quarter worth $7,720,000. Czech National Bank lifted its stake in shares of Micron Technology by 6.4% in the 1st quarter. Czech National Bank now owns 255,908 shares of the semiconductor manufacturer's stock valued at $22,236,000 after acquiring an additional 15,485 shares during the last quarter. TB Alternative Assets Ltd. boosted its position in Micron Technology by 331.3% during the 1st quarter. TB Alternative Assets Ltd. now owns 79,788 shares of the semiconductor manufacturer's stock valued at $6,933,000 after acquiring an additional 61,288 shares in the last quarter. Finally, Stock Yards Bank & Trust Co. bought a new position in shares of Micron Technology in the first quarter worth approximately $228,000. 80.84% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, Director Mary Pat Mccarthy sold 2,404 shares of the stock in a transaction dated Tuesday, September 2nd. The stock was sold at an average price of $115.67, for a total transaction of $278,070.68. Following the completion of the transaction, the director directly owned 20,146 shares in the company, valued at approximately $2,330,287.82. This trade represents a 10.66% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Manish H. Bhatia sold 80,000 shares of Micron Technology stock in a transaction on Monday, June 30th. The shares were sold at an average price of $123.16, for a total value of $9,852,800.00. Following the completion of the transaction, the executive vice president directly owned 275,067 shares of the company's stock, valued at $33,877,251.72. This represents a 22.53% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 290,946 shares of company stock valued at $36,685,159. Insiders own 0.30% of the company's stock.

Micron Technology Stock Performance

Shares of Micron Technology stock traded up $1.89 on Monday, hitting $164.62. The stock had a trading volume of 25,713,979 shares, compared to its average volume of 20,882,956. The company has a current ratio of 2.75, a quick ratio of 1.89 and a debt-to-equity ratio of 0.30. The company's 50 day moving average price is $124.74 and its 200 day moving average price is $106.27. Micron Technology, Inc. has a 52-week low of $61.54 and a 52-week high of $170.45. The stock has a market cap of $184.23 billion, a price-to-earnings ratio of 29.66 and a beta of 1.47.

Micron Technology (NASDAQ:MU - Get Free Report) last issued its quarterly earnings results on Wednesday, June 25th. The semiconductor manufacturer reported $1.91 earnings per share for the quarter, beating the consensus estimate of $1.57 by $0.34. Micron Technology had a return on equity of 13.60% and a net margin of 18.41%.The company had revenue of $9.30 billion during the quarter, compared to the consensus estimate of $8.83 billion. During the same period in the previous year, the firm posted $0.62 EPS. Micron Technology has set its Q4 2025 guidance at 2.350-2.650 EPS. On average, research analysts anticipate that Micron Technology, Inc. will post 6.08 EPS for the current year.

Micron Technology Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, July 22nd. Stockholders of record on Monday, July 7th were paid a $0.115 dividend. The ex-dividend date was Monday, July 7th. This represents a $0.46 dividend on an annualized basis and a dividend yield of 0.3%. Micron Technology's dividend payout ratio (DPR) is 8.29%.

Wall Street Analysts Forecast Growth

MU has been the subject of several research analyst reports. KeyCorp raised their price target on Micron Technology from $135.00 to $160.00 and gave the company an "overweight" rating in a report on Thursday, June 26th. Deutsche Bank Aktiengesellschaft raised their target price on Micron Technology from $150.00 to $175.00 and gave the stock a "buy" rating in a research note on Monday, September 15th. Wedbush upped their price objective on Micron Technology from $165.00 to $200.00 and gave the stock an "outperform" rating in a research report on Thursday. TD Cowen upped their target price on shares of Micron Technology from $150.00 to $180.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Zacks Research raised Micron Technology from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, August 19th. Two analysts have rated the stock with a Strong Buy rating, twenty-two have issued a Buy rating and five have assigned a Hold rating to the company. According to data from MarketBeat.com, Micron Technology currently has a consensus rating of "Moderate Buy" and a consensus target price of $165.54.

Read Our Latest Report on MU

Micron Technology Profile

(

Free Report)

Micron Technology, Inc designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.

Read More

Before you consider Micron Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Micron Technology wasn't on the list.

While Micron Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report