Vanguard Group Inc. reduced its position in shares of Minerals Technologies Inc. (NYSE:MTX - Free Report) by 1.3% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 3,674,388 shares of the basic materials company's stock after selling 47,181 shares during the period. Vanguard Group Inc. owned about 11.58% of Minerals Technologies worth $233,581,000 at the end of the most recent reporting period.

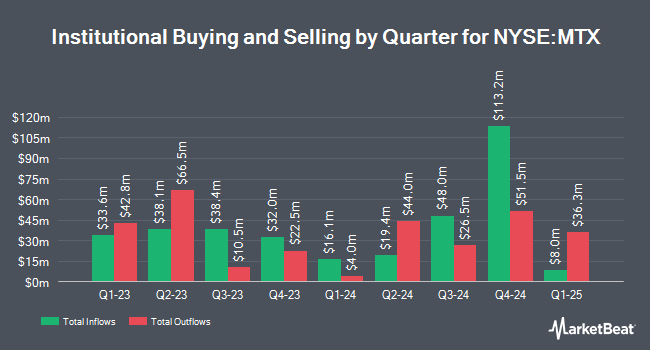

Several other institutional investors have also modified their holdings of MTX. LPL Financial LLC lifted its position in shares of Minerals Technologies by 21.5% during the 4th quarter. LPL Financial LLC now owns 7,742 shares of the basic materials company's stock worth $590,000 after purchasing an additional 1,368 shares during the last quarter. Wells Fargo & Company MN lifted its position in shares of Minerals Technologies by 27.9% during the 4th quarter. Wells Fargo & Company MN now owns 21,642 shares of the basic materials company's stock worth $1,649,000 after purchasing an additional 4,719 shares during the last quarter. Envestnet Asset Management Inc. lifted its position in shares of Minerals Technologies by 5.7% during the 4th quarter. Envestnet Asset Management Inc. now owns 18,125 shares of the basic materials company's stock worth $1,381,000 after purchasing an additional 973 shares during the last quarter. Bank of Montreal Can lifted its position in shares of Minerals Technologies by 4.5% during the 4th quarter. Bank of Montreal Can now owns 7,309 shares of the basic materials company's stock worth $557,000 after purchasing an additional 312 shares during the last quarter. Finally, Sterling Capital Management LLC lifted its position in shares of Minerals Technologies by 32.9% during the 4th quarter. Sterling Capital Management LLC now owns 3,589 shares of the basic materials company's stock worth $274,000 after purchasing an additional 888 shares during the last quarter. 97.29% of the stock is owned by hedge funds and other institutional investors.

Minerals Technologies Stock Performance

MTX traded up $2.6880 on Friday, reaching $63.8180. The company had a trading volume of 208,775 shares, compared to its average volume of 257,283. Minerals Technologies Inc. has a 1 year low of $49.54 and a 1 year high of $86.49. The stock has a market capitalization of $2.00 billion, a PE ratio of 1,063.81 and a beta of 1.22. The company has a quick ratio of 1.35, a current ratio of 1.95 and a debt-to-equity ratio of 0.57. The stock has a 50-day moving average price of $58.26 and a 200-day moving average price of $60.47.

Minerals Technologies (NYSE:MTX - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The basic materials company reported $1.55 earnings per share for the quarter, beating analysts' consensus estimates of $1.43 by $0.12. Minerals Technologies had a net margin of 0.10% and a return on equity of 10.64%. The firm had revenue of $528.90 million during the quarter, compared to analysts' expectations of $529.13 million. During the same period in the previous year, the company earned $1.65 earnings per share. Minerals Technologies's quarterly revenue was down 2.3% compared to the same quarter last year. As a group, research analysts forecast that Minerals Technologies Inc. will post 6.62 EPS for the current fiscal year.

Minerals Technologies Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 5th. Stockholders of record on Friday, August 15th will be issued a $0.11 dividend. This represents a $0.44 dividend on an annualized basis and a dividend yield of 0.7%. The ex-dividend date of this dividend is Friday, August 15th. Minerals Technologies's dividend payout ratio is presently 733.33%.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently issued reports on the stock. Wall Street Zen raised shares of Minerals Technologies from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. Truist Financial lifted their price objective on shares of Minerals Technologies from $80.00 to $84.00 and gave the stock a "buy" rating in a research report on Monday, July 28th. One equities research analyst has rated the stock with a Buy rating, According to data from MarketBeat, Minerals Technologies has an average rating of "Buy" and a consensus target price of $84.00.

View Our Latest Report on Minerals Technologies

About Minerals Technologies

(

Free Report)

Minerals Technologies Inc develops, produces, and markets various mineral, mineral-based, and related systems and services. The company operates through two segments, Consumer & Specialties, and Engineered Solutions segments. The Consumer & Specialties segment offers household and personal care products, such as pet litter, personal care, fabric care, edible oil and other fluid purification, animal health, and agricultural products; and specialty additives products, including precipitated calcium carbonate and ground calcium carbonate products that are used in the paper, paperboard, and fiber based packaging industries, as well as automotive, construction, and table and food applications.

Recommended Stories

Before you consider Minerals Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Minerals Technologies wasn't on the list.

While Minerals Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.