MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. cut its stake in Louisiana-Pacific Corporation (NYSE:LPX - Free Report) by 6.0% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 466,251 shares of the building manufacturing company's stock after selling 29,995 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned 0.67% of Louisiana-Pacific worth $42,886,000 at the end of the most recent reporting period.

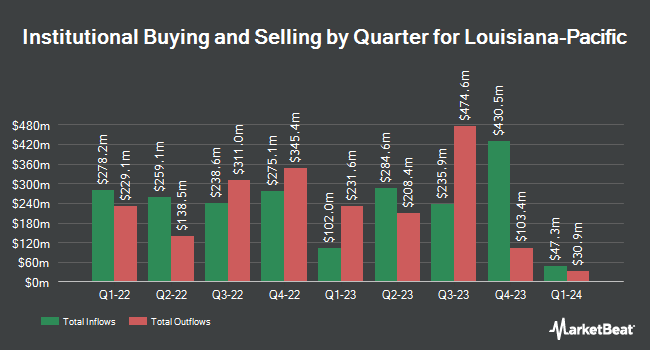

Several other institutional investors have also recently added to or reduced their stakes in the stock. CWM LLC raised its holdings in Louisiana-Pacific by 4.1% in the first quarter. CWM LLC now owns 2,919 shares of the building manufacturing company's stock valued at $268,000 after acquiring an additional 115 shares in the last quarter. Xponance Inc. raised its holdings in Louisiana-Pacific by 1.1% in the first quarter. Xponance Inc. now owns 11,370 shares of the building manufacturing company's stock valued at $1,046,000 after acquiring an additional 127 shares in the last quarter. Kingswood Wealth Advisors LLC raised its holdings in Louisiana-Pacific by 3.1% in the first quarter. Kingswood Wealth Advisors LLC now owns 4,658 shares of the building manufacturing company's stock valued at $425,000 after acquiring an additional 140 shares in the last quarter. Advisors Asset Management Inc. raised its holdings in Louisiana-Pacific by 2.2% in the first quarter. Advisors Asset Management Inc. now owns 7,962 shares of the building manufacturing company's stock valued at $732,000 after acquiring an additional 170 shares in the last quarter. Finally, Capital Advisory Group Advisory Services LLC raised its holdings in Louisiana-Pacific by 7.3% in the first quarter. Capital Advisory Group Advisory Services LLC now owns 2,543 shares of the building manufacturing company's stock valued at $234,000 after acquiring an additional 173 shares in the last quarter. 94.73% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research firms have weighed in on LPX. DA Davidson lowered their target price on shares of Louisiana-Pacific from $123.00 to $117.00 and set a "buy" rating for the company in a research note on Wednesday, June 25th. Wall Street Zen lowered shares of Louisiana-Pacific from a "hold" rating to a "sell" rating in a research note on Sunday, August 3rd. Finally, Truist Financial lowered their target price on shares of Louisiana-Pacific from $111.00 to $108.00 and set a "buy" rating for the company in a research note on Friday, July 11th. Four analysts have rated the stock with a Buy rating, two have assigned a Hold rating and one has given a Sell rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $110.57.

Read Our Latest Analysis on LPX

Louisiana-Pacific Stock Performance

Shares of LPX stock traded down $0.95 during trading hours on Friday, reaching $96.79. The stock had a trading volume of 60,732 shares, compared to its average volume of 745,152. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.84 and a quick ratio of 1.67. Louisiana-Pacific Corporation has a twelve month low of $78.82 and a twelve month high of $122.87. The firm has a 50-day simple moving average of $93.34 and a 200-day simple moving average of $91.33. The firm has a market capitalization of $6.74 billion, a PE ratio of 22.83, a price-to-earnings-growth ratio of 2.13 and a beta of 1.84.

Louisiana-Pacific (NYSE:LPX - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The building manufacturing company reported $0.99 earnings per share for the quarter, topping analysts' consensus estimates of $0.97 by $0.02. Louisiana-Pacific had a net margin of 10.34% and a return on equity of 18.67%. The business had revenue of $755.00 million for the quarter, compared to analysts' expectations of $751.15 million. During the same quarter last year, the company earned $2.09 EPS. The company's revenue for the quarter was down 7.2% compared to the same quarter last year. As a group, equities analysts forecast that Louisiana-Pacific Corporation will post 5.27 earnings per share for the current year.

Louisiana-Pacific Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Friday, August 15th were given a $0.28 dividend. This represents a $1.12 dividend on an annualized basis and a yield of 1.2%. The ex-dividend date was Friday, August 15th. Louisiana-Pacific's dividend payout ratio is currently 26.42%.

Insider Transactions at Louisiana-Pacific

In related news, Director Ozey K. Horton, Jr. sold 500 shares of the stock in a transaction dated Thursday, August 14th. The shares were sold at an average price of $101.00, for a total value of $50,500.00. Following the completion of the transaction, the director owned 29,728 shares in the company, valued at $3,002,528. This represents a 1.65% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. 1.42% of the stock is owned by corporate insiders.

Louisiana-Pacific Company Profile

(

Free Report)

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling, and outdoor structure markets. It operates through Siding, Oriented Strand Board, LP South America, and Other segments. The Siding segment offers LP SmartSide trim and siding products, LP SmartSide ExpertFinish trim and siding products, LP BuilderSeries lap siding products, and LP Outdoor Building Solutions; and engineered wood siding, trim, soffit, and fascia products.

See Also

Before you consider Louisiana-Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Louisiana-Pacific wasn't on the list.

While Louisiana-Pacific currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.