MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its holdings in IRSA Inversiones Y Representaciones S.A. (NYSE:IRS - Free Report) by 9.2% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 865,448 shares of the financial services provider's stock after acquiring an additional 72,738 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned 1.14% of IRSA Inversiones Y Representaciones worth $11,164,000 as of its most recent filing with the Securities and Exchange Commission.

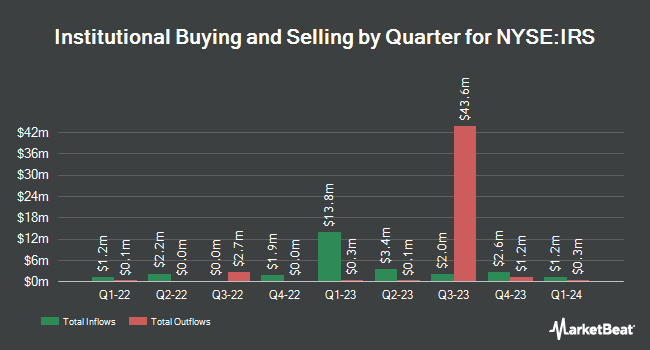

Other hedge funds have also added to or reduced their stakes in the company. Ridgewood Investments LLC lifted its holdings in IRSA Inversiones Y Representaciones by 810.8% during the 1st quarter. Ridgewood Investments LLC now owns 4,718 shares of the financial services provider's stock valued at $61,000 after purchasing an additional 4,200 shares during the last quarter. Jane Street Group LLC acquired a new stake in IRSA Inversiones Y Representaciones during the 4th quarter valued at $154,000. Deuterium Capital Management LLC acquired a new stake in IRSA Inversiones Y Representaciones during the 1st quarter valued at $136,000. Cubist Systematic Strategies LLC lifted its holdings in IRSA Inversiones Y Representaciones by 42.7% during the 1st quarter. Cubist Systematic Strategies LLC now owns 21,341 shares of the financial services provider's stock valued at $275,000 after purchasing an additional 6,390 shares during the last quarter. Finally, Tidal Investments LLC acquired a new stake in IRSA Inversiones Y Representaciones during the 4th quarter valued at $388,000. Institutional investors and hedge funds own 45.46% of the company's stock.

IRSA Inversiones Y Representaciones Stock Performance

IRS stock traded up $0.13 during trading hours on Monday, hitting $12.01. 56,703 shares of the stock were exchanged, compared to its average volume of 171,103. The company has a current ratio of 1.88, a quick ratio of 1.88 and a debt-to-equity ratio of 0.35. The firm has a market capitalization of $909.62 million, a P/E ratio of 5.84 and a beta of 1.47. The company has a 50-day simple moving average of $14.75 and a two-hundred day simple moving average of $14.27. IRSA Inversiones Y Representaciones S.A. has a 12 month low of $10.61 and a 12 month high of $17.67.

IRSA Inversiones Y Representaciones (NYSE:IRS - Get Free Report) last issued its quarterly earnings results on Tuesday, September 2nd. The financial services provider reported $1.74 EPS for the quarter. IRSA Inversiones Y Representaciones had a return on equity of 12.96% and a net margin of 36.40%.The company had revenue of $115.67 million for the quarter.

Analysts Set New Price Targets

Separately, Wall Street Zen cut IRSA Inversiones Y Representaciones from a "buy" rating to a "hold" rating in a research report on Saturday.

Get Our Latest Analysis on IRSA Inversiones Y Representaciones

About IRSA Inversiones Y Representaciones

(

Free Report)

IRSA Inversiones y Representaciones Sociedad Anónima, together with its subsidiaries, engages in the diversified real estate activities in Argentina. It operates through five segments: Shopping Malls, Offices, Hotels, Sales and Developments, and Others. The company is involved in the acquisition, development, and operation of shopping malls, office buildings, and other non-shopping mall properties primarily for rental purposes.

Read More

Before you consider IRSA Inversiones Y Representaciones, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IRSA Inversiones Y Representaciones wasn't on the list.

While IRSA Inversiones Y Representaciones currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.