Mizuho Markets Americas LLC cut its holdings in Vishay Intertechnology, Inc. (NYSE:VSH - Free Report) by 7.4% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 932,467 shares of the semiconductor company's stock after selling 75,000 shares during the period. Mizuho Markets Americas LLC owned 0.69% of Vishay Intertechnology worth $14,826,000 as of its most recent SEC filing.

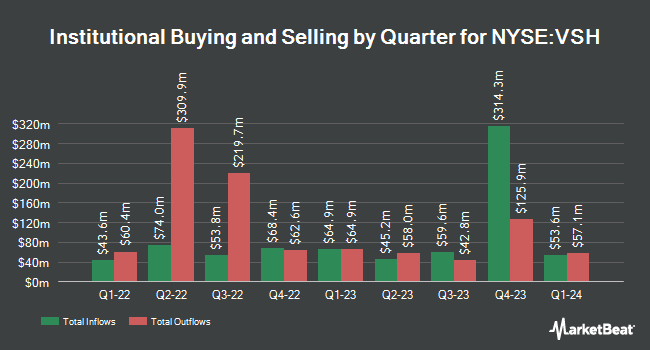

Other large investors have also recently bought and sold shares of the company. GAMMA Investing LLC boosted its holdings in Vishay Intertechnology by 602.1% in the 1st quarter. GAMMA Investing LLC now owns 2,696 shares of the semiconductor company's stock valued at $43,000 after purchasing an additional 2,312 shares during the period. Larson Financial Group LLC boosted its holdings in Vishay Intertechnology by 27,083.3% in the 1st quarter. Larson Financial Group LLC now owns 3,262 shares of the semiconductor company's stock valued at $52,000 after purchasing an additional 3,250 shares during the period. CWM LLC boosted its holdings in Vishay Intertechnology by 76.0% in the 1st quarter. CWM LLC now owns 3,473 shares of the semiconductor company's stock valued at $55,000 after purchasing an additional 1,500 shares during the period. Sterling Capital Management LLC boosted its holdings in Vishay Intertechnology by 819.2% in the 4th quarter. Sterling Capital Management LLC now owns 3,980 shares of the semiconductor company's stock valued at $67,000 after purchasing an additional 3,547 shares during the period. Finally, State of Wyoming raised its position in shares of Vishay Intertechnology by 234.2% during the 4th quarter. State of Wyoming now owns 8,893 shares of the semiconductor company's stock valued at $151,000 after buying an additional 6,232 shares in the last quarter. 93.66% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Wall Street Zen upgraded shares of Vishay Intertechnology from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th.

Read Our Latest Report on VSH

Insider Buying and Selling

In other Vishay Intertechnology news, Director Michael J. Cody bought 3,500 shares of the firm's stock in a transaction that occurred on Wednesday, June 11th. The shares were bought at an average price of $16.12 per share, for a total transaction of $56,420.00. Following the transaction, the director directly owned 60,169 shares in the company, valued at $969,924.28. This trade represents a 6.18% increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 8.32% of the stock is currently owned by insiders.

Vishay Intertechnology Price Performance

Shares of Vishay Intertechnology stock traded down $0.25 on Thursday, hitting $15.22. 652,145 shares of the company traded hands, compared to its average volume of 1,996,475. The firm's 50-day simple moving average is $16.19 and its 200 day simple moving average is $15.53. The company has a current ratio of 2.70, a quick ratio of 1.64 and a debt-to-equity ratio of 0.44. The company has a market cap of $2.06 billion, a P/E ratio of -23.42 and a beta of 1.13. Vishay Intertechnology, Inc. has a 12-month low of $10.35 and a 12-month high of $20.91.

Vishay Intertechnology (NYSE:VSH - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The semiconductor company reported ($0.07) earnings per share for the quarter, missing the consensus estimate of $0.02 by ($0.09). The company had revenue of $762.25 million for the quarter, compared to analysts' expectations of $756.07 million. Vishay Intertechnology had a negative net margin of 3.00% and a negative return on equity of 0.10%. The business's quarterly revenue was up 2.8% compared to the same quarter last year. During the same quarter last year, the business posted $0.17 EPS. Analysts expect that Vishay Intertechnology, Inc. will post 0.53 earnings per share for the current fiscal year.

Vishay Intertechnology Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, September 25th. Investors of record on Thursday, September 11th will be given a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a yield of 2.6%. The ex-dividend date is Thursday, September 11th. Vishay Intertechnology's dividend payout ratio (DPR) is presently -61.54%.

About Vishay Intertechnology

(

Free Report)

Vishay Intertechnology, Inc manufactures and sells discrete semiconductors and passive electronic components in Asia, Europe, and the Americas. The company operates through Metal Oxide Semiconductor Field Effect Transistors (MOSFETs), Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors segments.

Further Reading

Before you consider Vishay Intertechnology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vishay Intertechnology wasn't on the list.

While Vishay Intertechnology currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.