Mizuho Securities USA LLC cut its holdings in NXP Semiconductors N.V. (NASDAQ:NXPI - Free Report) by 15.5% in the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 20,350 shares of the semiconductor provider's stock after selling 3,738 shares during the quarter. Mizuho Securities USA LLC's holdings in NXP Semiconductors were worth $3,868,000 as of its most recent SEC filing.

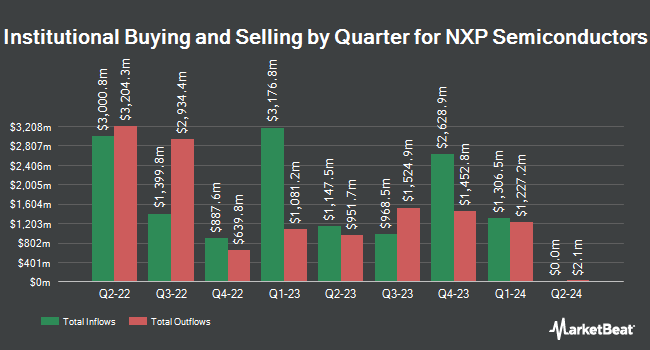

Several other institutional investors and hedge funds have also modified their holdings of NXPI. Hemington Wealth Management boosted its position in NXP Semiconductors by 50.0% during the 1st quarter. Hemington Wealth Management now owns 177 shares of the semiconductor provider's stock worth $33,000 after acquiring an additional 59 shares during the last quarter. Valley National Advisers Inc. boosted its position in NXP Semiconductors by 118.9% during the 1st quarter. Valley National Advisers Inc. now owns 232 shares of the semiconductor provider's stock worth $43,000 after acquiring an additional 126 shares during the last quarter. Ameriflex Group Inc. acquired a new position in NXP Semiconductors during the 4th quarter worth approximately $44,000. Rossby Financial LCC acquired a new position in NXP Semiconductors during the 1st quarter worth approximately $46,000. Finally, GoalVest Advisory LLC boosted its position in NXP Semiconductors by 472.9% during the 1st quarter. GoalVest Advisory LLC now owns 275 shares of the semiconductor provider's stock worth $52,000 after acquiring an additional 227 shares during the last quarter. 90.54% of the stock is currently owned by institutional investors and hedge funds.

NXP Semiconductors Price Performance

NXP Semiconductors stock traded up $1.02 during midday trading on Thursday, reaching $231.54. The company's stock had a trading volume of 2,807,858 shares, compared to its average volume of 3,021,522. NXP Semiconductors N.V. has a 52 week low of $148.09 and a 52 week high of $259.74. The company has a current ratio of 1.74, a quick ratio of 1.20 and a debt-to-equity ratio of 0.99. The business has a 50-day moving average price of $219.26 and a 200-day moving average price of $206.74. The stock has a market cap of $58.38 billion, a PE ratio of 27.60, a price-to-earnings-growth ratio of 2.49 and a beta of 1.41.

NXP Semiconductors (NASDAQ:NXPI - Get Free Report) last released its earnings results on Monday, July 21st. The semiconductor provider reported $2.72 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.66 by $0.06. NXP Semiconductors had a return on equity of 27.99% and a net margin of 17.72%. The firm had revenue of $2.93 billion for the quarter, compared to analysts' expectations of $2.90 billion. During the same quarter in the previous year, the business posted $3.20 earnings per share. The business's revenue for the quarter was down 6.4% on a year-over-year basis. On average, sell-side analysts predict that NXP Semiconductors N.V. will post 10.28 EPS for the current year.

NXP Semiconductors Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, July 9th. Stockholders of record on Wednesday, June 25th were paid a dividend of $1.014 per share. This represents a $4.06 dividend on an annualized basis and a dividend yield of 1.8%. The ex-dividend date of this dividend was Wednesday, June 25th. NXP Semiconductors's dividend payout ratio (DPR) is presently 48.39%.

Analyst Ratings Changes

NXPI has been the subject of a number of recent research reports. Wells Fargo & Company upped their price target on NXP Semiconductors from $250.00 to $260.00 and gave the stock an "overweight" rating in a research report on Wednesday, July 23rd. Evercore ISI reissued an "outperform" rating and issued a $289.00 price objective (up previously from $237.00) on shares of NXP Semiconductors in a report on Thursday, June 12th. TD Cowen increased their price objective on NXP Semiconductors from $185.00 to $210.00 and gave the company a "buy" rating in a report on Wednesday, April 30th. Truist Financial raised their price target on NXP Semiconductors from $230.00 to $252.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and set a $250.00 price target on shares of NXP Semiconductors in a report on Tuesday, July 22nd. Four investment analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, NXP Semiconductors presently has an average rating of "Moderate Buy" and an average price target of $256.05.

Get Our Latest Research Report on NXP Semiconductors

Insider Activity

In other news, EVP Jennifer Wuamett sold 9,132 shares of NXP Semiconductors stock in a transaction dated Wednesday, July 2nd. The stock was sold at an average price of $230.00, for a total transaction of $2,100,360.00. Following the sale, the executive vice president directly owned 27,088 shares of the company's stock, valued at approximately $6,230,240. This trade represents a 25.21% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, President Rafael Sotomayor sold 2,000 shares of NXP Semiconductors stock in a transaction dated Tuesday, August 12th. The shares were sold at an average price of $219.57, for a total value of $439,140.00. Following the sale, the president directly owned 4,958 shares in the company, valued at $1,088,628.06. The trade was a 28.74% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 17,917 shares of company stock valued at $4,082,002. 0.12% of the stock is currently owned by corporate insiders.

NXP Semiconductors Company Profile

(

Free Report)

NXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Featured Articles

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.