Citigroup Inc. lifted its holdings in monday.com Ltd. (NASDAQ:MNDY - Free Report) by 279.2% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 163,974 shares of the company's stock after purchasing an additional 120,737 shares during the period. Citigroup Inc. owned about 0.32% of monday.com worth $39,872,000 as of its most recent filing with the Securities & Exchange Commission.

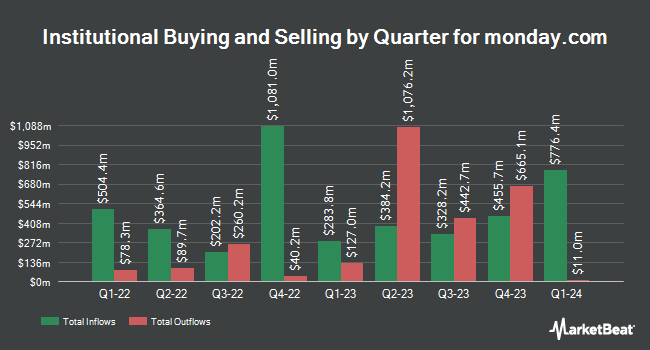

Several other institutional investors and hedge funds have also recently modified their holdings of MNDY. WCM Investment Management LLC lifted its position in shares of monday.com by 0.4% in the first quarter. WCM Investment Management LLC now owns 4,078,985 shares of the company's stock valued at $1,007,550,000 after acquiring an additional 17,371 shares in the last quarter. Rubicon Global Capital Ltd acquired a new position in shares of monday.com during the 1st quarter worth approximately $137,434,000. T. Rowe Price Investment Management Inc. acquired a new position in shares of monday.com during the 4th quarter worth approximately $109,605,000. Assenagon Asset Management S.A. boosted its holdings in shares of monday.com by 754.8% during the 1st quarter. Assenagon Asset Management S.A. now owns 440,622 shares of the company's stock worth $107,142,000 after purchasing an additional 389,073 shares during the last quarter. Finally, Driehaus Capital Management LLC boosted its holdings in shares of monday.com by 8.9% during the 4th quarter. Driehaus Capital Management LLC now owns 410,695 shares of the company's stock worth $96,694,000 after purchasing an additional 33,606 shares during the last quarter. Hedge funds and other institutional investors own 73.70% of the company's stock.

monday.com Trading Down 0.7%

Shares of NASDAQ MNDY traded down $1.18 during trading hours on Friday, reaching $175.74. The stock had a trading volume of 1,660,523 shares, compared to its average volume of 1,540,328. The firm has a market cap of $8.92 billion, a price-to-earnings ratio of 237.49, a PEG ratio of 5.95 and a beta of 1.27. monday.com Ltd. has a fifty-two week low of $171.54 and a fifty-two week high of $342.64. The firm has a 50-day moving average of $276.72 and a 200-day moving average of $274.37.

monday.com (NASDAQ:MNDY - Get Free Report) last released its quarterly earnings results on Monday, August 11th. The company reported $1.09 EPS for the quarter, topping the consensus estimate of $0.84 by $0.25. monday.com had a return on equity of 6.32% and a net margin of 3.63%. The business had revenue of $299.01 million during the quarter, compared to analysts' expectations of $293.60 million. During the same quarter in the prior year, the business earned $0.94 earnings per share. The company's quarterly revenue was up 26.6% compared to the same quarter last year. On average, equities analysts predict that monday.com Ltd. will post 0.46 EPS for the current year.

Analyst Ratings Changes

Several research analysts have recently weighed in on MNDY shares. Baird R W upgraded monday.com from a "hold" rating to a "strong-buy" rating in a report on Wednesday, August 6th. DA Davidson decreased their price objective on monday.com from $325.00 to $275.00 and set a "buy" rating on the stock in a report on Tuesday. Morgan Stanley upgraded monday.com from an "equal weight" rating to an "overweight" rating and decreased their price objective for the company from $330.00 to $260.00 in a report on Tuesday. UBS Group decreased their price objective on monday.com from $310.00 to $215.00 and set a "neutral" rating on the stock in a report on Tuesday. Finally, Barclays decreased their price objective on monday.com from $345.00 to $258.00 and set an "overweight" rating on the stock in a report on Tuesday. Two investment analysts have rated the stock with a hold rating, twenty-three have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $305.18.

Read Our Latest Analysis on MNDY

About monday.com

(

Free Report)

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally. The company provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

Featured Stories

Before you consider monday.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and monday.com wasn't on the list.

While monday.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.