Moors & Cabot Inc. bought a new stake in shares of Wingstop Inc. (NASDAQ:WING - Free Report) during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund bought 925 shares of the restaurant operator's stock, valued at approximately $209,000.

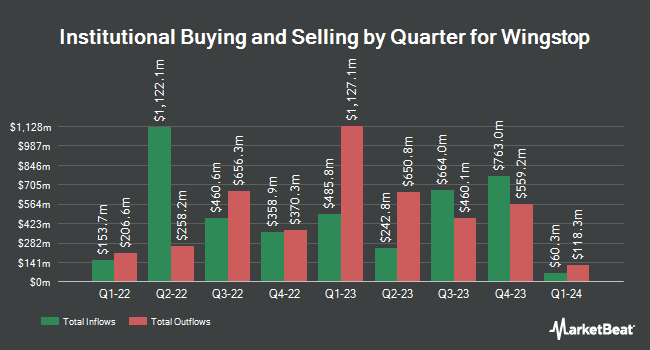

Other hedge funds also recently bought and sold shares of the company. US Bancorp DE lifted its holdings in shares of Wingstop by 8.8% in the first quarter. US Bancorp DE now owns 6,883 shares of the restaurant operator's stock worth $1,553,000 after buying an additional 559 shares in the last quarter. Natixis Advisors LLC bought a new stake in Wingstop in the 1st quarter valued at $2,746,000. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in Wingstop by 1.9% in the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,778 shares of the restaurant operator's stock worth $1,755,000 after purchasing an additional 148 shares in the last quarter. TD Asset Management Inc bought a new position in shares of Wingstop during the 1st quarter valued at about $11,400,000. Finally, Assetmark Inc. grew its position in shares of Wingstop by 5.3% during the first quarter. Assetmark Inc. now owns 9,522 shares of the restaurant operator's stock valued at $2,148,000 after purchasing an additional 480 shares in the last quarter.

Insider Activity at Wingstop

In other news, SVP Marisa Carona sold 11,938 shares of the company's stock in a transaction on Friday, August 1st. The stock was sold at an average price of $370.34, for a total transaction of $4,421,118.92. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. Also, CEO Michael Skipworth sold 4,500 shares of the stock in a transaction on Friday, August 1st. The shares were sold at an average price of $370.34, for a total value of $1,666,530.00. Following the sale, the chief executive officer owned 42,777 shares of the company's stock, valued at approximately $15,842,034.18. This represents a 9.52% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 31,838 shares of company stock valued at $11,491,935 over the last quarter. 0.72% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Several research firms have weighed in on WING. Guggenheim raised their price target on Wingstop from $325.00 to $410.00 and gave the company a "buy" rating in a report on Thursday, July 31st. TD Securities reissued a "buy" rating and issued a $440.00 target price on shares of Wingstop in a report on Tuesday, June 17th. Benchmark boosted their price target on shares of Wingstop from $325.00 to $410.00 and gave the stock a "buy" rating in a research report on Thursday, July 31st. BMO Capital Markets increased their price objective on shares of Wingstop from $275.00 to $345.00 and gave the company a "market perform" rating in a research report on Thursday, July 31st. Finally, Wells Fargo & Company boosted their target price on shares of Wingstop from $375.00 to $415.00 and gave the stock an "overweight" rating in a report on Thursday, July 31st. One analyst has rated the stock with a sell rating, five have assigned a hold rating, twenty-one have assigned a buy rating and three have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $379.52.

View Our Latest Report on Wingstop

Wingstop Stock Performance

NASDAQ WING traded down $2.62 on Wednesday, reaching $335.95. 641,884 shares of the stock traded hands, compared to its average volume of 846,248. Wingstop Inc. has a 12 month low of $204.00 and a 12 month high of $433.86. The company has a fifty day moving average price of $341.03 and a 200-day moving average price of $286.96. The company has a market cap of $9.38 billion, a price-to-earnings ratio of 55.99, a PEG ratio of 4.26 and a beta of 1.84.

Wingstop (NASDAQ:WING - Get Free Report) last issued its earnings results on Wednesday, July 30th. The restaurant operator reported $1.00 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.88 by $0.12. Wingstop had a net margin of 25.61% and a negative return on equity of 17.07%. The company had revenue of $174.33 million for the quarter, compared to analysts' expectations of $172.60 million. During the same period in the prior year, the business earned $0.93 EPS. The firm's quarterly revenue was up 12.0% on a year-over-year basis. As a group, research analysts anticipate that Wingstop Inc. will post 4.18 earnings per share for the current fiscal year.

Wingstop Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 5th. Investors of record on Friday, August 15th will be given a dividend of $0.30 per share. The ex-dividend date of this dividend is Friday, August 15th. This is an increase from Wingstop's previous quarterly dividend of $0.27. This represents a $1.20 dividend on an annualized basis and a yield of 0.4%. Wingstop's dividend payout ratio is 18.00%.

Wingstop Company Profile

(

Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

See Also

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.