Jupiter Asset Management Ltd. increased its position in shares of Morgan Stanley (NYSE:MS - Free Report) by 56.8% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 70,933 shares of the financial services provider's stock after acquiring an additional 25,705 shares during the quarter. Jupiter Asset Management Ltd.'s holdings in Morgan Stanley were worth $8,276,000 as of its most recent filing with the SEC.

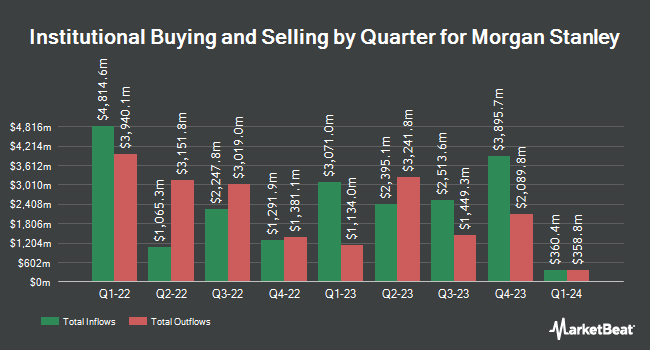

A number of other hedge funds have also recently bought and sold shares of MS. Minot DeBlois Advisors LLC acquired a new position in shares of Morgan Stanley in the 4th quarter valued at $25,000. MorganRosel Wealth Management LLC acquired a new position in shares of Morgan Stanley in the 1st quarter valued at $27,000. Garde Capital Inc. acquired a new position in shares of Morgan Stanley in the 1st quarter valued at $30,000. Hopwood Financial Services Inc. boosted its holdings in shares of Morgan Stanley by 50.0% in the 1st quarter. Hopwood Financial Services Inc. now owns 264 shares of the financial services provider's stock valued at $31,000 after purchasing an additional 88 shares during the last quarter. Finally, Ancora Advisors LLC boosted its holdings in shares of Morgan Stanley by 104.7% in the 4th quarter. Ancora Advisors LLC now owns 264 shares of the financial services provider's stock valued at $33,000 after purchasing an additional 135 shares during the last quarter. Institutional investors and hedge funds own 84.19% of the company's stock.

Insiders Place Their Bets

In other news, insider Michael A. Pizzi sold 18,000 shares of the stock in a transaction that occurred on Thursday, July 17th. The shares were sold at an average price of $140.62, for a total value of $2,531,160.00. Following the completion of the transaction, the insider directly owned 136,407 shares in the company, valued at $19,181,552.34. This trade represents a 11.66% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CFO Sharon Yeshaya sold 25,583 shares of the stock in a transaction that occurred on Thursday, July 17th. The shares were sold at an average price of $139.81, for a total transaction of $3,576,759.23. Following the completion of the transaction, the chief financial officer owned 128,662 shares of the company's stock, valued at $17,988,234.22. This trade represents a 16.59% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 148,149 shares of company stock valued at $20,841,628. 0.19% of the stock is currently owned by insiders.

Morgan Stanley Trading Down 2.4%

Morgan Stanley stock opened at $139.09 on Monday. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 3.11. The firm has a 50-day moving average price of $136.87 and a two-hundred day moving average price of $128.26. The firm has a market capitalization of $223.14 billion, a price-to-earnings ratio of 15.75, a PEG ratio of 1.75 and a beta of 1.32. Morgan Stanley has a 52-week low of $90.94 and a 52-week high of $145.48.

Morgan Stanley (NYSE:MS - Get Free Report) last posted its earnings results on Wednesday, July 16th. The financial services provider reported $2.13 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.98 by $0.15. The firm had revenue of $16.79 billion during the quarter, compared to analyst estimates of $16.15 billion. Morgan Stanley had a net margin of 13.06% and a return on equity of 15.33%. Morgan Stanley's revenue was up 11.8% on a year-over-year basis. During the same period in the previous year, the business posted $1.82 EPS. Sell-side analysts expect that Morgan Stanley will post 8.56 earnings per share for the current year.

Morgan Stanley announced that its board has initiated a share buyback plan on Tuesday, July 1st that permits the company to buyback $20.00 billion in outstanding shares. This buyback authorization permits the financial services provider to reacquire up to 8.9% of its stock through open market purchases. Stock buyback plans are usually a sign that the company's board of directors believes its shares are undervalued.

Morgan Stanley Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, August 15th. Stockholders of record on Thursday, July 31st will be issued a $1.00 dividend. This represents a $4.00 annualized dividend and a dividend yield of 2.9%. This is a boost from Morgan Stanley's previous quarterly dividend of $0.93. The ex-dividend date is Thursday, July 31st. Morgan Stanley's payout ratio is 45.30%.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on the stock. The Goldman Sachs Group raised their target price on shares of Morgan Stanley from $121.00 to $136.00 and gave the company a "neutral" rating in a research note on Tuesday, June 10th. JPMorgan Chase & Co. cut their target price on shares of Morgan Stanley from $125.00 to $122.00 and set a "neutral" rating on the stock in a research note on Monday, April 14th. Citigroup reissued a "neutral" rating and issued a $130.00 target price (up previously from $125.00) on shares of Morgan Stanley in a research note on Wednesday, June 18th. Wells Fargo & Company raised their target price on shares of Morgan Stanley from $120.00 to $145.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 8th. Finally, Erste Group Bank raised shares of Morgan Stanley from a "hold" rating to a "strong-buy" rating in a research note on Saturday, May 24th. Nine research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $138.25.

Get Our Latest Research Report on Morgan Stanley

Morgan Stanley Profile

(

Free Report)

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report