Integrated Investment Consultants LLC grew its holdings in shares of Motorola Solutions, Inc. (NYSE:MSI - Free Report) by 166.3% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,169 shares of the communications equipment provider's stock after purchasing an additional 730 shares during the period. Integrated Investment Consultants LLC's holdings in Motorola Solutions were worth $512,000 at the end of the most recent quarter.

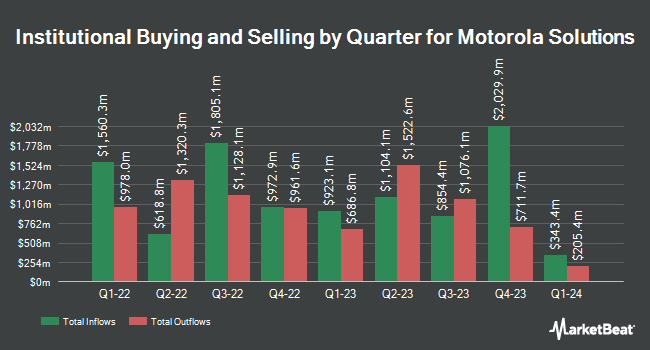

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Geode Capital Management LLC grew its position in shares of Motorola Solutions by 12.1% during the 4th quarter. Geode Capital Management LLC now owns 4,187,217 shares of the communications equipment provider's stock valued at $1,933,360,000 after acquiring an additional 451,172 shares during the period. FMR LLC increased its holdings in shares of Motorola Solutions by 12.4% in the fourth quarter. FMR LLC now owns 3,030,915 shares of the communications equipment provider's stock valued at $1,400,980,000 after purchasing an additional 334,639 shares during the last quarter. Northern Trust Corp increased its holdings in shares of Motorola Solutions by 15.9% in the fourth quarter. Northern Trust Corp now owns 1,868,559 shares of the communications equipment provider's stock valued at $863,704,000 after purchasing an additional 256,707 shares during the last quarter. JPMorgan Chase & Co. increased its holdings in shares of Motorola Solutions by 2.0% in the fourth quarter. JPMorgan Chase & Co. now owns 1,618,744 shares of the communications equipment provider's stock valued at $748,233,000 after purchasing an additional 31,396 shares during the last quarter. Finally, Nuveen Asset Management LLC increased its holdings in shares of Motorola Solutions by 15.7% in the fourth quarter. Nuveen Asset Management LLC now owns 1,554,252 shares of the communications equipment provider's stock valued at $718,422,000 after purchasing an additional 210,662 shares during the last quarter. Hedge funds and other institutional investors own 84.17% of the company's stock.

Analyst Ratings Changes

MSI has been the topic of a number of recent analyst reports. Wolfe Research started coverage on Motorola Solutions in a report on Monday, July 7th. They issued a "peer perform" rating on the stock. UBS Group started coverage on Motorola Solutions in a research report on Wednesday, July 16th. They issued a "buy" rating and a $490.00 target price on the stock. Barclays cut their target price on Motorola Solutions from $527.00 to $511.00 and set an "overweight" rating on the stock in a research report on Monday, May 5th. Wall Street Zen lowered Motorola Solutions from a "buy" rating to a "hold" rating in a research report on Thursday, May 22nd. Finally, JPMorgan Chase & Co. cut their price objective on Motorola Solutions from $570.00 to $515.00 and set an "overweight" rating on the stock in a research report on Thursday, April 17th. Three research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $510.67.

Read Our Latest Analysis on Motorola Solutions

Motorola Solutions Stock Up 0.6%

MSI stock traded up $2.53 during trading hours on Wednesday, hitting $436.48. The company's stock had a trading volume of 280,756 shares, compared to its average volume of 883,761. The company has a quick ratio of 1.03, a current ratio of 1.20 and a debt-to-equity ratio of 3.42. The company has a market capitalization of $72.86 billion, a PE ratio of 36.39, a price-to-earnings-growth ratio of 3.70 and a beta of 0.95. Motorola Solutions, Inc. has a 12 month low of $388.90 and a 12 month high of $507.82. The stock has a 50 day moving average price of $417.81 and a two-hundred day moving average price of $428.86.

Motorola Solutions (NYSE:MSI - Get Free Report) last posted its quarterly earnings data on Thursday, May 1st. The communications equipment provider reported $3.18 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.01 by $0.17. The business had revenue of $2.53 billion during the quarter, compared to the consensus estimate of $2.52 billion. Motorola Solutions had a net margin of 18.67% and a return on equity of 160.93%. Motorola Solutions's quarterly revenue was up 5.8% compared to the same quarter last year. During the same period in the prior year, the firm earned $2.81 EPS. On average, equities research analysts expect that Motorola Solutions, Inc. will post 13.55 earnings per share for the current year.

Motorola Solutions Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Friday, June 13th were paid a $1.09 dividend. This represents a $4.36 dividend on an annualized basis and a dividend yield of 1.00%. The ex-dividend date was Friday, June 13th. Motorola Solutions's dividend payout ratio is 36.39%.

Insider Activity

In other news, CAO Katherine A. Maher sold 1,073 shares of the stock in a transaction on Thursday, May 29th. The shares were sold at an average price of $418.68, for a total value of $449,243.64. Following the completion of the transaction, the chief accounting officer owned 804 shares in the company, valued at approximately $336,618.72. This represents a 57.17% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 1.44% of the company's stock.

Motorola Solutions Profile

(

Free Report)

Motorola Solutions, Inc provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. The Products and Systems Integration segment offers a portfolio of infrastructure, devices, accessories, and video security devices and infrastructure, as well as the implementation and integration of systems, devices, software, and applications for government, public safety, and commercial customers who operate private communications networks and video security solutions, as well as manage a mobile workforce.

Featured Stories

Before you consider Motorola Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Motorola Solutions wasn't on the list.

While Motorola Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report