M&T Bank Corp trimmed its holdings in shares of Hess Midstream Partners LP (NYSE:HESM - Free Report) by 28.3% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 21,500 shares of the company's stock after selling 8,500 shares during the quarter. M&T Bank Corp's holdings in Hess Midstream Partners were worth $909,000 as of its most recent filing with the SEC.

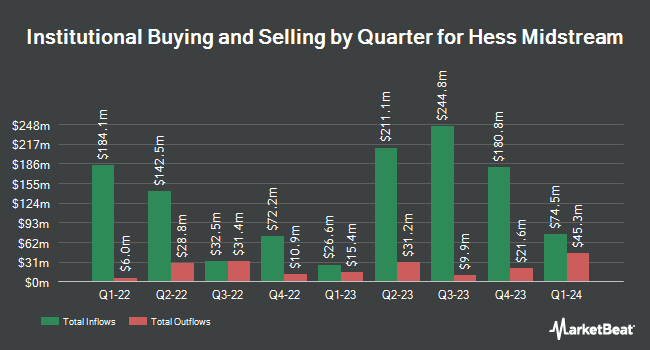

Other hedge funds and other institutional investors have also modified their holdings of the company. Farther Finance Advisors LLC increased its position in shares of Hess Midstream Partners by 840.2% during the first quarter. Farther Finance Advisors LLC now owns 1,053 shares of the company's stock worth $45,000 after acquiring an additional 941 shares during the last quarter. Steward Partners Investment Advisory LLC increased its position in shares of Hess Midstream Partners by 77.2% during the fourth quarter. Steward Partners Investment Advisory LLC now owns 1,329 shares of the company's stock worth $49,000 after acquiring an additional 579 shares during the last quarter. FSC Wealth Advisors LLC purchased a new stake in shares of Hess Midstream Partners during the first quarter worth about $58,000. US Bancorp DE increased its holdings in Hess Midstream Partners by 34.0% in the fourth quarter. US Bancorp DE now owns 2,010 shares of the company's stock valued at $74,000 after buying an additional 510 shares during the last quarter. Finally, Virtus ETF Advisers LLC increased its holdings in Hess Midstream Partners by 9.5% in the fourth quarter. Virtus ETF Advisers LLC now owns 4,972 shares of the company's stock valued at $184,000 after buying an additional 432 shares during the last quarter. 98.97% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on HESM shares. Wells Fargo & Company lowered their price objective on Hess Midstream Partners from $42.00 to $41.00 and set an "equal weight" rating for the company in a report on Thursday, May 1st. JPMorgan Chase & Co. boosted their price objective on Hess Midstream Partners from $39.00 to $44.00 and gave the company a "neutral" rating in a report on Thursday, March 27th.

Check Out Our Latest Stock Report on HESM

Hess Midstream Partners Stock Performance

Shares of NYSE:HESM traded up $2.40 during trading on Friday, hitting $40.81. 1,939,984 shares of the company traded hands, compared to its average volume of 1,057,744. The stock has a market capitalization of $8.79 billion, a price-to-earnings ratio of 16.01 and a beta of 0.63. The business's fifty day moving average is $38.36 and its 200-day moving average is $39.20. Hess Midstream Partners LP has a one year low of $33.59 and a one year high of $44.05. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 6.92.

Hess Midstream Partners (NYSE:HESM - Get Free Report) last issued its quarterly earnings data on Wednesday, April 30th. The company reported $0.65 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.63 by $0.02. The business had revenue of $382.00 million during the quarter, compared to the consensus estimate of $384.28 million. Hess Midstream Partners had a return on equity of 54.89% and a net margin of 16.43%. The business's revenue was up 7.4% on a year-over-year basis. During the same period in the previous year, the firm posted $0.60 earnings per share. As a group, equities analysts predict that Hess Midstream Partners LP will post 2.5 earnings per share for the current fiscal year.

Hess Midstream Partners Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, May 14th. Stockholders of record on Thursday, May 8th were given a dividend of $0.7098 per share. The ex-dividend date of this dividend was Thursday, May 8th. This is an increase from Hess Midstream Partners's previous quarterly dividend of $0.70. This represents a $2.84 annualized dividend and a dividend yield of 6.96%. Hess Midstream Partners's payout ratio is currently 111.37%.

Insider Activity at Hess Midstream Partners

In other Hess Midstream Partners news, major shareholder Blackrock Portfolio Management sold 15,022,517 shares of the company's stock in a transaction that occurred on Friday, May 30th. The stock was sold at an average price of $36.86, for a total value of $553,729,976.62. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Geurt G. Schoonman sold 3,249 shares of the company's stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $39.10, for a total value of $127,035.90. The disclosure for this sale can be found here.

About Hess Midstream Partners

(

Free Report)

Hess Midstream LP owns, develops, operates, and acquires midstream assets and provide fee-based services to Hess and third-party customers in the United States. It operates through three segments: Gathering; Processing and Storage; and Terminaling and Export. The Gathering segment owns natural gas gathering and compression systems; crude oil gathering systems; and produced water gathering and disposal facilities.

See Also

Before you consider Hess Midstream Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hess Midstream Partners wasn't on the list.

While Hess Midstream Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.