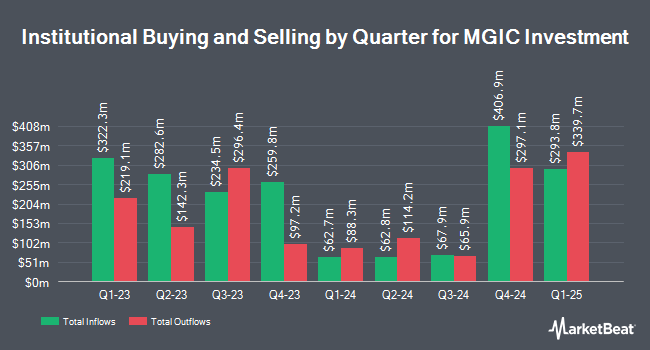

Mutual of America Capital Management LLC trimmed its position in shares of MGIC Investment Corporation (NYSE:MTG - Free Report) by 7.7% during the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 118,080 shares of the insurance provider's stock after selling 9,794 shares during the quarter. Mutual of America Capital Management LLC's holdings in MGIC Investment were worth $3,287,000 at the end of the most recent quarter.

Several other large investors have also bought and sold shares of the company. VIRGINIA RETIREMENT SYSTEMS ET Al bought a new stake in MGIC Investment during the 2nd quarter valued at approximately $29,139,000. Foster & Motley Inc. boosted its position in shares of MGIC Investment by 6.7% in the 2nd quarter. Foster & Motley Inc. now owns 282,546 shares of the insurance provider's stock worth $7,866,000 after purchasing an additional 17,710 shares in the last quarter. Allianz Asset Management GmbH boosted its position in shares of MGIC Investment by 40.6% in the 2nd quarter. Allianz Asset Management GmbH now owns 5,398,356 shares of the insurance provider's stock worth $150,290,000 after purchasing an additional 1,557,970 shares in the last quarter. New York State Teachers Retirement System boosted its position in shares of MGIC Investment by 4.1% in the 2nd quarter. New York State Teachers Retirement System now owns 327,018 shares of the insurance provider's stock worth $9,104,000 after purchasing an additional 12,870 shares in the last quarter. Finally, Ritholtz Wealth Management boosted its position in shares of MGIC Investment by 28.9% in the 2nd quarter. Ritholtz Wealth Management now owns 116,253 shares of the insurance provider's stock worth $3,236,000 after purchasing an additional 26,033 shares in the last quarter. 95.58% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of analysts have recently commented on MTG shares. Barclays boosted their price target on MGIC Investment from $27.00 to $28.00 and gave the stock a "cautious" rating in a research report on Monday, October 6th. Keefe, Bruyette & Woods boosted their price target on MGIC Investment from $26.00 to $27.00 and gave the stock a "market perform" rating in a research report on Monday, July 7th. Finally, Weiss Ratings reissued a "buy (a-)" rating on shares of MGIC Investment in a research report on Wednesday, October 8th. One equities research analyst has rated the stock with a Strong Buy rating, four have given a Hold rating and two have given a Sell rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $26.83.

Check Out Our Latest Stock Analysis on MGIC Investment

MGIC Investment Price Performance

Shares of NYSE MTG opened at $27.43 on Friday. MGIC Investment Corporation has a twelve month low of $21.94 and a twelve month high of $29.01. The firm has a market cap of $6.32 billion, a P/E ratio of 8.99, a PEG ratio of 1.98 and a beta of 0.88. The company has a 50 day moving average of $27.79 and a 200 day moving average of $26.63. The company has a quick ratio of 1.46, a current ratio of 1.46 and a debt-to-equity ratio of 0.13.

MGIC Investment (NYSE:MTG - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The insurance provider reported $0.82 earnings per share for the quarter, topping analysts' consensus estimates of $0.70 by $0.12. The company had revenue of $304.25 million during the quarter, compared to analyst estimates of $306.25 million. MGIC Investment had a net margin of 62.58% and a return on equity of 14.73%. The firm's revenue for the quarter was down .3% on a year-over-year basis. During the same period in the previous year, the business earned $0.77 EPS. As a group, research analysts expect that MGIC Investment Corporation will post 2.71 EPS for the current fiscal year.

Insiders Place Their Bets

In other MGIC Investment news, CEO Timothy J. Mattke sold 139,203 shares of the business's stock in a transaction on Tuesday, October 7th. The shares were sold at an average price of $27.09, for a total transaction of $3,771,009.27. Following the completion of the sale, the chief executive officer directly owned 961,791 shares in the company, valued at approximately $26,054,918.19. The trade was a 12.64% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, COO Salvatore A. Miosi sold 30,000 shares of the business's stock in a transaction on Wednesday, October 1st. The shares were sold at an average price of $28.15, for a total transaction of $844,500.00. Following the sale, the chief operating officer owned 189,401 shares of the company's stock, valued at approximately $5,331,638.15. This represents a 13.67% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 338,406 shares of company stock valued at $9,096,557. Company insiders own 1.05% of the company's stock.

MGIC Investment Profile

(

Free Report)

MGIC Investment Corporation, through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services to lenders and government sponsored entities in the United States, the District of Columbia, Puerto Rico, and Guam. The company offers primary mortgage insurance that provides mortgage default protection on individual loans, as well as covers unpaid loan principal, delinquent interest, and various expenses associated with the default and subsequent foreclosure.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MGIC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGIC Investment wasn't on the list.

While MGIC Investment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.