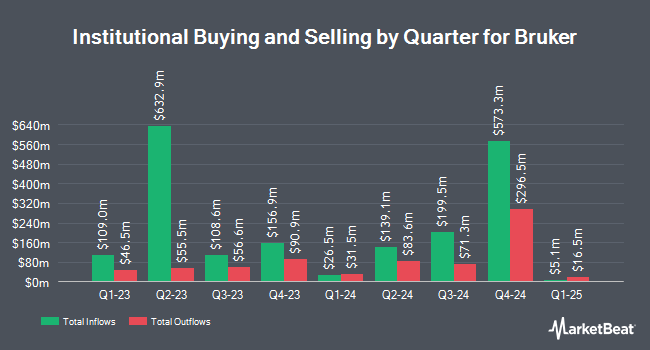

National Bank of Canada FI boosted its stake in shares of Bruker Corporation (NASDAQ:BRKR - Free Report) by 20.9% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 53,521 shares of the medical research company's stock after acquiring an additional 9,240 shares during the quarter. National Bank of Canada FI's holdings in Bruker were worth $2,234,000 at the end of the most recent reporting period.

Several other institutional investors also recently bought and sold shares of the stock. Pinnacle Bancorp Inc. purchased a new stake in shares of Bruker in the first quarter valued at approximately $29,000. Allworth Financial LP increased its position in shares of Bruker by 92.4% in the first quarter. Allworth Financial LP now owns 758 shares of the medical research company's stock valued at $30,000 after buying an additional 364 shares in the last quarter. Annis Gardner Whiting Capital Advisors LLC purchased a new stake in shares of Bruker in the first quarter valued at approximately $42,000. MassMutual Private Wealth & Trust FSB increased its position in shares of Bruker by 274.9% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 1,091 shares of the medical research company's stock valued at $46,000 after buying an additional 800 shares in the last quarter. Finally, Fifth Third Bancorp increased its position in shares of Bruker by 54.2% in the first quarter. Fifth Third Bancorp now owns 1,109 shares of the medical research company's stock valued at $46,000 after buying an additional 390 shares in the last quarter. 79.52% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Bruker

In related news, CEO Frank H. Laukien purchased 2,608 shares of the firm's stock in a transaction that occurred on Friday, June 6th. The stock was purchased at an average cost of $38.36 per share, with a total value of $100,042.88. Following the completion of the acquisition, the chief executive officer directly owned 38,462,171 shares in the company, valued at $1,475,408,879.56. This trade represents a 0.01% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. 27.30% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

A number of analysts have recently issued reports on BRKR shares. The Goldman Sachs Group lowered their price target on Bruker from $50.00 to $45.00 and set a "neutral" rating on the stock in a research note on Thursday, May 8th. Stifel Nicolaus set a $40.00 price target on Bruker and gave the stock a "hold" rating in a research note on Tuesday, August 5th. UBS Group lowered their price objective on Bruker from $57.00 to $45.00 and set a "neutral" rating on the stock in a research note on Thursday, May 8th. Wells Fargo & Company lowered their price objective on Bruker from $60.00 to $50.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 5th. Finally, Bank of America lowered their price objective on Bruker from $61.00 to $50.00 and set a "buy" rating on the stock in a research note on Thursday, June 26th. Five research analysts have rated the stock with a Buy rating and six have issued a Hold rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $51.30.

Check Out Our Latest Analysis on BRKR

Bruker Trading Up 3.3%

Shares of Bruker stock traded up $1.1460 during trading hours on Tuesday, hitting $35.3860. The company's stock had a trading volume of 544,552 shares, compared to its average volume of 2,445,655. Bruker Corporation has a twelve month low of $30.00 and a twelve month high of $72.94. The firm has a fifty day moving average of $38.89 and a 200-day moving average of $41.45. The stock has a market cap of $5.37 billion, a price-to-earnings ratio of 67.95, a P/E/G ratio of 2.77 and a beta of 1.16. The company has a debt-to-equity ratio of 1.31, a quick ratio of 0.70 and a current ratio of 1.61.

Bruker (NASDAQ:BRKR - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The medical research company reported $0.32 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.33 by ($0.01). Bruker had a net margin of 2.31% and a return on equity of 17.89%. The firm had revenue of $797.40 million during the quarter, compared to analysts' expectations of $811.17 million. During the same quarter in the prior year, the firm posted $0.52 EPS. Bruker's quarterly revenue was down .4% compared to the same quarter last year. Bruker has set its FY 2025 guidance at 1.950-2.050 EPS. Research analysts forecast that Bruker Corporation will post 2.69 EPS for the current year.

Bruker Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, October 3rd. Stockholders of record on Tuesday, September 23rd will be issued a $0.05 dividend. This represents a $0.20 annualized dividend and a dividend yield of 0.6%. The ex-dividend date of this dividend is Tuesday, September 23rd. Bruker's dividend payout ratio is presently 38.46%.

Bruker Company Profile

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

Featured Articles

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.