Natixis Advisors LLC cut its holdings in Choice Hotels International, Inc. (NYSE:CHH - Free Report) by 1.6% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 152,397 shares of the company's stock after selling 2,513 shares during the period. Natixis Advisors LLC owned 0.33% of Choice Hotels International worth $20,235,000 as of its most recent SEC filing.

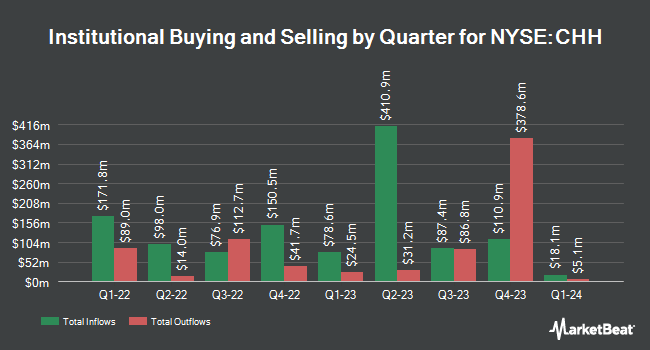

Several other institutional investors have also added to or reduced their stakes in the business. Barclays PLC lifted its position in Choice Hotels International by 56.9% during the fourth quarter. Barclays PLC now owns 17,902 shares of the company's stock valued at $2,541,000 after purchasing an additional 6,493 shares during the last quarter. SG Americas Securities LLC lifted its position in Choice Hotels International by 492.4% during the first quarter. SG Americas Securities LLC now owns 5,207 shares of the company's stock valued at $691,000 after purchasing an additional 4,328 shares during the last quarter. Bank of New York Mellon Corp lifted its position in Choice Hotels International by 3.2% during the first quarter. Bank of New York Mellon Corp now owns 234,047 shares of the company's stock valued at $31,077,000 after purchasing an additional 7,159 shares during the last quarter. MQS Management LLC bought a new stake in shares of Choice Hotels International in the 1st quarter worth about $434,000. Finally, Essex Financial Services Inc. bought a new stake in shares of Choice Hotels International in the 1st quarter worth about $278,000. 65.57% of the stock is currently owned by institutional investors.

Choice Hotels International Stock Up 1.0%

Shares of CHH stock traded up $1.27 during trading hours on Monday, hitting $127.19. 366,580 shares of the company were exchanged, compared to its average volume of 423,542. The firm has a market cap of $5.90 billion, a PE ratio of 19.42, a PEG ratio of 2.65 and a beta of 0.96. The firm has a fifty day moving average of $129.04 and a 200 day moving average of $133.14. Choice Hotels International, Inc. has a 1 year low of $116.20 and a 1 year high of $157.86.

Choice Hotels International (NYSE:CHH - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported $1.34 EPS for the quarter, missing the consensus estimate of $1.38 by ($0.04). Choice Hotels International had a net margin of 19.75% and a negative return on equity of 377.51%. The business had revenue of $332.86 million during the quarter, compared to analysts' expectations of $348.52 million. During the same quarter in the previous year, the business posted $1.28 EPS. The company's quarterly revenue was up .3% on a year-over-year basis. Analysts expect that Choice Hotels International, Inc. will post 7.07 earnings per share for the current year.

Choice Hotels International Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, July 16th. Stockholders of record on Tuesday, July 1st were given a dividend of $0.2875 per share. The ex-dividend date of this dividend was Tuesday, July 1st. This represents a $1.15 dividend on an annualized basis and a dividend yield of 0.9%. Choice Hotels International's dividend payout ratio (DPR) is presently 17.56%.

Insider Buying and Selling

In other news, Director Ervin R. Shames sold 2,000 shares of the business's stock in a transaction on Monday, May 19th. The shares were sold at an average price of $129.56, for a total transaction of $259,120.00. Following the completion of the transaction, the director owned 52,212 shares of the company's stock, valued at approximately $6,764,586.72. The trade was a 3.69% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, EVP Dominic Dragisich sold 2,500 shares of the business's stock in a transaction on Wednesday, July 23rd. The shares were sold at an average price of $136.45, for a total transaction of $341,125.00. Following the transaction, the executive vice president directly owned 68,381 shares of the company's stock, valued at approximately $9,330,587.45. This trade represents a 3.53% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 14,500 shares of company stock valued at $1,906,520 in the last three months. Corporate insiders own 23.78% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on the stock. Barclays raised their target price on shares of Choice Hotels International from $111.00 to $121.00 and gave the stock an "underweight" rating in a report on Tuesday, July 15th. Morgan Stanley restated an "underweight" rating and issued a $121.00 target price on shares of Choice Hotels International in a report on Tuesday, July 15th. Truist Financial lowered their target price on shares of Choice Hotels International from $144.00 to $128.00 and set a "hold" rating for the company in a report on Friday, May 30th. JPMorgan Chase & Co. assumed coverage on shares of Choice Hotels International in a report on Monday, June 23rd. They set an "underweight" rating and a $124.00 price objective for the company. Finally, Jefferies Financial Group decreased their price objective on shares of Choice Hotels International from $154.00 to $133.00 and set a "hold" rating for the company in a report on Wednesday, April 9th. Four analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $134.38.

Get Our Latest Analysis on CHH

About Choice Hotels International

(

Free Report)

Choice Hotels International, Inc, together with its subsidiaries, operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising & Management and Corporate & Other segments. The company franchises lodging properties under the brand names of Comfort Inn, Comfort Suites, Quality, Clarion, Clarion Pointe, Sleep Inn, Ascend Hotel Collection, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Studios, WoodSpring Suites, Everhome Suites, Cambria Hotels, Radisson Blu, Radisson RED, Radisson, Park Plaza, Country Inn & Suites by Radisson, Radisson Inn & Suites, Park Inn by Radisson, Radisson Individuals, and Radisson Collection.

Recommended Stories

Before you consider Choice Hotels International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Choice Hotels International wasn't on the list.

While Choice Hotels International currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report