Navellier & Associates Inc. lessened its holdings in shares of Universal Corporation (NYSE:UVV - Free Report) by 9.8% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 66,807 shares of the company's stock after selling 7,271 shares during the period. Navellier & Associates Inc. owned approximately 0.27% of Universal worth $3,921,000 at the end of the most recent quarter.

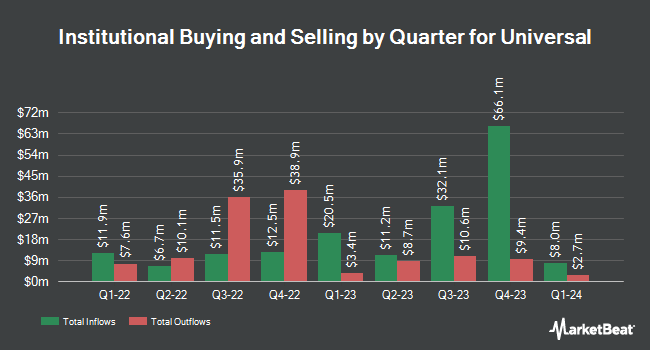

Several other hedge funds and other institutional investors have also recently made changes to their positions in the business. Cetera Investment Advisers purchased a new stake in shares of Universal during the 1st quarter valued at $233,000. Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in shares of Universal in the 1st quarter valued at $702,000. Allianz Asset Management GmbH increased its position in shares of Universal by 26.9% in the 1st quarter. Allianz Asset Management GmbH now owns 123,813 shares of the company's stock valued at $6,940,000 after acquiring an additional 26,210 shares during the period. Denali Advisors LLC acquired a new position in shares of Universal in the 1st quarter valued at $443,000. Finally, Private Advisor Group LLC acquired a new position in shares of Universal in the 1st quarter valued at $281,000. Hedge funds and other institutional investors own 81.00% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wall Street Zen downgraded Universal from a "buy" rating to a "hold" rating in a research report on Saturday, May 31st.

Check Out Our Latest Stock Analysis on UVV

Universal Stock Performance

Shares of NYSE UVV traded down $0.53 during mid-day trading on Monday, hitting $54.35. The stock had a trading volume of 38,509 shares, compared to its average volume of 212,661. The company has a debt-to-equity ratio of 0.41, a quick ratio of 1.55 and a current ratio of 2.87. The company has a 50 day moving average of $58.64 and a two-hundred day moving average of $55.64. Universal Corporation has a twelve month low of $49.05 and a twelve month high of $67.33. The firm has a market cap of $1.35 billion, a PE ratio of 14.38 and a beta of 0.73.

Universal (NYSE:UVV - Get Free Report) last released its earnings results on Thursday, May 29th. The company reported $0.80 earnings per share (EPS) for the quarter. Universal had a return on equity of 7.89% and a net margin of 3.22%. The firm had revenue of $702.28 million for the quarter.

Universal Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, August 4th. Shareholders of record on Monday, July 14th will be given a dividend of $0.82 per share. This is an increase from Universal's previous quarterly dividend of $0.81. This represents a $3.28 annualized dividend and a yield of 6.04%. The ex-dividend date of this dividend is Monday, July 14th. Universal's dividend payout ratio (DPR) is currently 86.77%.

Universal Company Profile

(

Free Report)

Universal Corporation processes and supplies leaf tobacco and plant-based ingredients worldwide. The company operates through two segments, Tobacco Operations; and Ingredients Operations. It is involved in the procuring, financing, processing, packing, storing, and shipping leaf tobacco for sale to manufacturers of consumer tobacco products.

Featured Articles

Before you consider Universal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal wasn't on the list.

While Universal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.