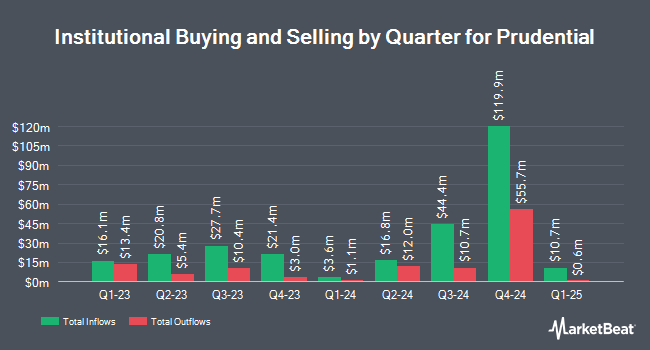

Naviter Wealth LLC acquired a new stake in Prudential Public Limited Company (NYSE:PUK - Free Report) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 16,858 shares of the financial services provider's stock, valued at approximately $422,000.

Several other institutional investors and hedge funds have also modified their holdings of PUK. GAMMA Investing LLC lifted its holdings in shares of Prudential Public by 182.6% in the 1st quarter. GAMMA Investing LLC now owns 6,508 shares of the financial services provider's stock valued at $140,000 after buying an additional 4,205 shares during the period. Janney Montgomery Scott LLC acquired a new position in shares of Prudential Public in the 1st quarter valued at about $201,000. QRG Capital Management Inc. acquired a new position in shares of Prudential Public in the 1st quarter valued at about $369,000. Cambridge Investment Research Advisors Inc. acquired a new position in shares of Prudential Public in the 1st quarter valued at about $216,000. Finally, Oppenheimer Asset Management Inc. lifted its holdings in shares of Prudential Public by 26.1% in the 1st quarter. Oppenheimer Asset Management Inc. now owns 138,958 shares of the financial services provider's stock valued at $2,988,000 after buying an additional 28,804 shares during the period. Institutional investors and hedge funds own 1.90% of the company's stock.

Prudential Public Trading Up 1.8%

NYSE:PUK opened at $27.58 on Wednesday. Prudential Public Limited Company has a 12 month low of $14.39 and a 12 month high of $28.32. The stock has a 50 day moving average of $27.08 and a two-hundred day moving average of $24.41. The firm has a market cap of $35.42 billion, a P/E ratio of 11.89, a price-to-earnings-growth ratio of 0.78 and a beta of 1.02.

Prudential Public Dividend Announcement

The company also recently disclosed a dividend, which will be paid on Thursday, October 16th. Shareholders of record on Friday, September 5th will be paid a dividend of $0.1542 per share. This represents a yield of 117.0%. The ex-dividend date is Friday, September 5th. Prudential Public's payout ratio is 12.50%.

Analyst Upgrades and Downgrades

PUK has been the subject of several analyst reports. UBS Group reissued a "buy" rating on shares of Prudential Public in a report on Thursday, August 28th. Wall Street Zen lowered Prudential Public from a "buy" rating to a "hold" rating in a research note on Saturday, August 30th. Weiss Ratings restated a "hold (c+)" rating on shares of Prudential Public in a research note on Tuesday. Finally, Barclays restated an "overweight" rating on shares of Prudential Public in a research note on Monday, September 8th. Five research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy".

View Our Latest Analysis on Prudential Public

About Prudential Public

(

Free Report)

Prudential plc, through its subsidiaries, provides life and health insurance, and asset management solutions to individuals in Asia and Africa. The company was founded in 1848 and is headquartered in Central, Hong Kong.

See Also

Want to see what other hedge funds are holding PUK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Prudential Public Limited Company (NYSE:PUK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Prudential Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prudential Public wasn't on the list.

While Prudential Public currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.