Needham Investment Management LLC cut its holdings in shares of KVH Industries, Inc. (NASDAQ:KVHI - Free Report) by 16.9% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 926,545 shares of the communications equipment provider's stock after selling 188,605 shares during the quarter. Needham Investment Management LLC owned 4.73% of KVH Industries worth $4,901,000 as of its most recent SEC filing.

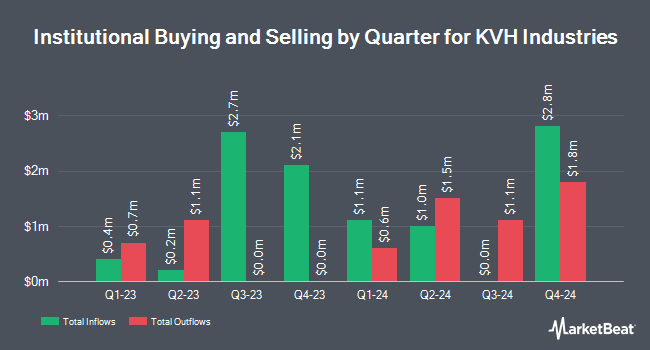

Several other hedge funds also recently made changes to their positions in the business. Hsbc Holdings PLC increased its holdings in shares of KVH Industries by 4.5% during the fourth quarter. Hsbc Holdings PLC now owns 41,830 shares of the communications equipment provider's stock worth $226,000 after purchasing an additional 1,796 shares during the period. Northern Trust Corp boosted its position in shares of KVH Industries by 24.8% during the 4th quarter. Northern Trust Corp now owns 79,584 shares of the communications equipment provider's stock worth $454,000 after acquiring an additional 15,796 shares in the last quarter. Systematic Financial Management LP boosted its position in shares of KVH Industries by 1.4% during the 1st quarter. Systematic Financial Management LP now owns 1,198,028 shares of the communications equipment provider's stock worth $6,338,000 after acquiring an additional 16,471 shares in the last quarter. Dimensional Fund Advisors LP boosted its position in shares of KVH Industries by 2.2% during the 4th quarter. Dimensional Fund Advisors LP now owns 840,622 shares of the communications equipment provider's stock worth $4,791,000 after acquiring an additional 18,448 shares in the last quarter. Finally, Squarepoint Ops LLC acquired a new stake in shares of KVH Industries during the 4th quarter worth approximately $154,000. 73.66% of the stock is owned by institutional investors.

KVH Industries Stock Performance

Shares of NASDAQ KVHI traded up $0.17 during trading hours on Thursday, hitting $6.03. 8,582 shares of the stock were exchanged, compared to its average volume of 29,126. The company has a market cap of $117.59 million, a PE ratio of -18.84 and a beta of 0.81. The company's fifty day simple moving average is $5.45 and its two-hundred day simple moving average is $5.31. KVH Industries, Inc. has a 1-year low of $4.35 and a 1-year high of $6.37.

About KVH Industries

(

Free Report)

KVH Industries, Inc, together with its subsidiaries, engages in the design, development, manufacture, and marketing of mobile connectivity solutions for the marine and land mobile markets in the United States and internationally. The company offers Internet and VoIP airtime services; AgilePlans, a Connectivity as a Service solution; KVH Link, a crew wellbeing content subscription service with delivery by IP-Mobilecast; and OpenNet, a KVH VSAT data delivering service for non-KVH Ku-band VSAT terminals.

Featured Stories

Before you consider KVH Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KVH Industries wasn't on the list.

While KVH Industries currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.