Neuberger Berman Group LLC boosted its stake in shares of GitLab Inc. (NASDAQ:GTLB - Free Report) by 80.2% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 49,456 shares of the company's stock after buying an additional 22,010 shares during the quarter. Neuberger Berman Group LLC's holdings in GitLab were worth $2,324,000 as of its most recent SEC filing.

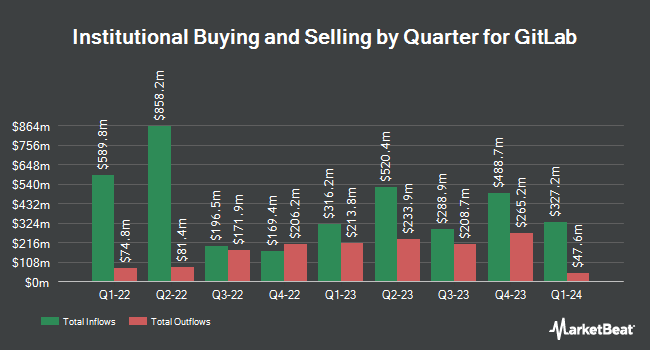

Several other hedge funds and other institutional investors have also made changes to their positions in the business. OneDigital Investment Advisors LLC boosted its stake in shares of GitLab by 4.3% in the fourth quarter. OneDigital Investment Advisors LLC now owns 4,047 shares of the company's stock valued at $228,000 after purchasing an additional 166 shares during the period. Utah Retirement Systems boosted its stake in shares of GitLab by 3.1% in the fourth quarter. Utah Retirement Systems now owns 6,600 shares of the company's stock valued at $372,000 after purchasing an additional 200 shares during the period. Mariner LLC boosted its stake in shares of GitLab by 1.7% in the fourth quarter. Mariner LLC now owns 12,583 shares of the company's stock valued at $709,000 after purchasing an additional 214 shares during the period. True Wealth Design LLC boosted its stake in shares of GitLab by 20.0% in the fourth quarter. True Wealth Design LLC now owns 1,297 shares of the company's stock valued at $73,000 after purchasing an additional 216 shares during the period. Finally, Graham Capital Management L.P. boosted its stake in shares of GitLab by 0.8% in the fourth quarter. Graham Capital Management L.P. now owns 30,806 shares of the company's stock valued at $1,736,000 after purchasing an additional 242 shares during the period. Hedge funds and other institutional investors own 95.04% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on the stock. Cantor Fitzgerald lowered their price objective on shares of GitLab from $70.00 to $60.00 and set an "overweight" rating for the company in a research note on Wednesday, June 11th. Canaccord Genuity Group reduced their target price on shares of GitLab from $78.00 to $76.00 and set a "buy" rating on the stock in a report on Thursday, June 12th. JPMorgan Chase & Co. reduced their target price on shares of GitLab from $58.00 to $52.00 and set a "neutral" rating on the stock in a report on Wednesday, June 11th. BTIG Research reduced their target price on shares of GitLab from $86.00 to $67.00 and set a "buy" rating on the stock in a report on Wednesday, June 11th. Finally, Barclays reduced their target price on shares of GitLab from $58.00 to $47.00 and set an "equal weight" rating on the stock in a report on Wednesday, June 11th. One research analyst has rated the stock with a Strong Buy rating, twenty have given a Buy rating, five have given a Hold rating and one has given a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $62.63.

Check Out Our Latest Stock Report on GTLB

Insider Activity at GitLab

In related news, Director Karen Blasing sold 3,250 shares of GitLab stock in a transaction on Friday, July 18th. The shares were sold at an average price of $45.00, for a total value of $146,250.00. Following the transaction, the director directly owned 107,139 shares in the company, valued at $4,821,255. This trade represents a 2.94% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Matthew Jacobson sold 129,400 shares of GitLab stock in a transaction on Wednesday, June 25th. The shares were sold at an average price of $42.32, for a total transaction of $5,476,208.00. Following the completion of the transaction, the director owned 551,997 shares in the company, valued at approximately $23,360,513.04. This trade represents a 18.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 353,100 shares of company stock worth $14,974,730 in the last three months. Insiders own 21.36% of the company's stock.

GitLab Trading Down 2.9%

Shares of GitLab stock traded down $1.33 during trading on Tuesday, reaching $44.02. The company's stock had a trading volume of 3,730,849 shares, compared to its average volume of 3,505,160. The company has a 50-day moving average price of $43.96 and a two-hundred day moving average price of $49.43. GitLab Inc. has a fifty-two week low of $37.90 and a fifty-two week high of $74.18. The firm has a market cap of $7.27 billion, a PE ratio of 439.79 and a beta of 0.73.

GitLab (NASDAQ:GTLB - Get Free Report) last posted its quarterly earnings data on Tuesday, June 10th. The company reported $0.17 earnings per share for the quarter, beating analysts' consensus estimates of $0.15 by $0.02. GitLab had a net margin of 2.17% and a negative return on equity of 4.07%. The firm had revenue of $214.51 million for the quarter, compared to analyst estimates of $213.21 million. During the same period last year, the firm posted $0.03 EPS. GitLab's quarterly revenue was up 26.8% on a year-over-year basis. GitLab has set its FY 2026 guidance at 0.740-0.750 EPS. Q2 2026 guidance at 0.160-0.17 EPS. On average, analysts predict that GitLab Inc. will post -0.31 earnings per share for the current fiscal year.

GitLab Company Profile

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Further Reading

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.