Neuberger Berman Group LLC cut its stake in shares of Rambus, Inc. (NASDAQ:RMBS - Free Report) by 22.7% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,282,168 shares of the semiconductor company's stock after selling 376,196 shares during the period. Neuberger Berman Group LLC owned approximately 1.19% of Rambus worth $66,664,000 at the end of the most recent quarter.

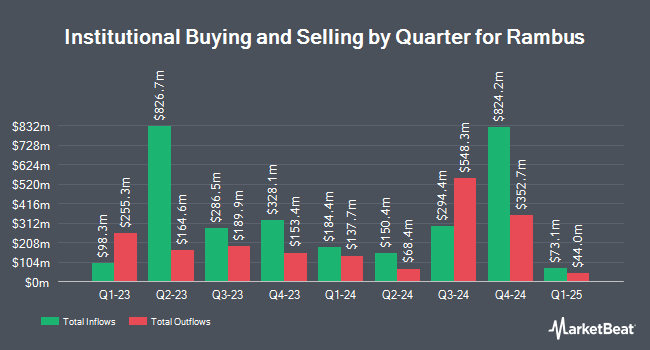

Other institutional investors and hedge funds also recently modified their holdings of the company. Banque Cantonale Vaudoise acquired a new stake in shares of Rambus during the first quarter worth $25,000. Tsfg LLC acquired a new position in Rambus during the first quarter valued at $26,000. Orion Capital Management LLC acquired a new position in Rambus during the fourth quarter valued at $37,000. Larson Financial Group LLC raised its position in Rambus by 1,260.3% during the first quarter. Larson Financial Group LLC now owns 857 shares of the semiconductor company's stock valued at $44,000 after buying an additional 794 shares during the period. Finally, Quarry LP raised its position in Rambus by 26.9% during the fourth quarter. Quarry LP now owns 1,166 shares of the semiconductor company's stock valued at $62,000 after buying an additional 247 shares during the period. 88.54% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on RMBS shares. Susquehanna upped their price target on Rambus from $70.00 to $75.00 and gave the company a "positive" rating in a research report on Tuesday, July 29th. Rosenblatt Securities upped their price target on Rambus from $80.00 to $90.00 and gave the company a "buy" rating in a research report on Tuesday, July 29th. Wall Street Zen lowered Rambus from a "buy" rating to a "hold" rating in a research report on Sunday, August 10th. Finally, Jefferies Financial Group upped their price target on Rambus from $69.00 to $75.00 and gave the company a "buy" rating in a research report on Tuesday, July 29th. One investment analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Buy" and an average target price of $77.71.

Get Our Latest Report on Rambus

Insider Buying and Selling at Rambus

In other news, Director Emiko Higashi sold 1,111 shares of the company's stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $75.00, for a total transaction of $83,325.00. Following the completion of the sale, the director owned 63,371 shares in the company, valued at approximately $4,752,825. This represents a 1.72% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Steven Laub sold 1,847 shares of the company's stock in a transaction dated Tuesday, May 27th. The stock was sold at an average price of $55.12, for a total value of $101,806.64. Following the sale, the director owned 9,057 shares of the company's stock, valued at approximately $499,221.84. This trade represents a 16.94% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 11,533 shares of company stock worth $820,188 over the last 90 days. 1.00% of the stock is currently owned by corporate insiders.

Rambus Trading Up 2.1%

NASDAQ RMBS traded up $1.56 on Monday, reaching $75.77. The stock had a trading volume of 605,446 shares, compared to its average volume of 1,054,117. The business has a 50 day moving average price of $66.37 and a 200 day moving average price of $58.65. Rambus, Inc. has a 1 year low of $37.42 and a 1 year high of $78.16. The company has a market capitalization of $8.15 billion, a price-to-earnings ratio of 35.74 and a beta of 1.28.

Rambus Profile

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

Further Reading

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.