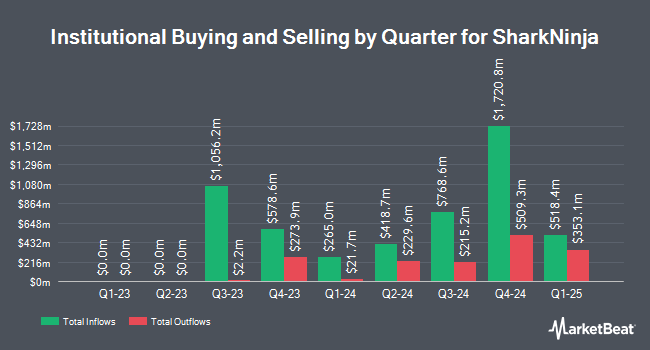

New York State Common Retirement Fund decreased its stake in shares of SharkNinja, Inc. (NYSE:SN - Free Report) by 44.4% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 99,559 shares of the company's stock after selling 79,511 shares during the quarter. New York State Common Retirement Fund owned about 0.07% of SharkNinja worth $8,304,000 at the end of the most recent reporting period.

A number of other hedge funds have also bought and sold shares of the stock. GAMMA Investing LLC increased its stake in shares of SharkNinja by 77.9% in the first quarter. GAMMA Investing LLC now owns 354 shares of the company's stock worth $30,000 after acquiring an additional 155 shares during the period. Quarry LP acquired a new stake in shares of SharkNinja in the fourth quarter worth $47,000. Continuum Advisory LLC increased its stake in shares of SharkNinja by 6,875.0% in the fourth quarter. Continuum Advisory LLC now owns 558 shares of the company's stock worth $54,000 after acquiring an additional 550 shares during the period. Covestor Ltd increased its stake in shares of SharkNinja by 284.4% in the fourth quarter. Covestor Ltd now owns 642 shares of the company's stock worth $63,000 after acquiring an additional 475 shares during the period. Finally, Safe Harbor Fiduciary LLC increased its stake in shares of SharkNinja by 200.0% in the fourth quarter. Safe Harbor Fiduciary LLC now owns 1,500 shares of the company's stock worth $146,000 after acquiring an additional 1,000 shares during the period. Institutional investors and hedge funds own 34.77% of the company's stock.

Wall Street Analyst Weigh In

SN has been the topic of a number of recent analyst reports. Jefferies Financial Group set a $175.00 price target on shares of SharkNinja in a report on Monday, June 30th. Morgan Stanley increased their price target on shares of SharkNinja from $85.00 to $101.00 and gave the stock an "equal weight" rating in a report on Friday, May 9th. Canaccord Genuity Group increased their price target on shares of SharkNinja from $127.00 to $136.00 and gave the stock a "buy" rating in a report on Thursday, July 17th. Guggenheim lowered their price target on shares of SharkNinja from $135.00 to $120.00 and set a "buy" rating on the stock in a report on Friday, May 9th. Finally, Oppenheimer increased their price target on shares of SharkNinja from $105.00 to $120.00 and gave the stock an "outperform" rating in a report on Friday, May 9th. One equities research analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $121.50.

Check Out Our Latest Research Report on SharkNinja

SharkNinja Price Performance

SN traded up $2.47 during midday trading on Wednesday, hitting $119.62. 1,883,243 shares of the company traded hands, compared to its average volume of 1,556,824. The company has a current ratio of 1.97, a quick ratio of 1.17 and a debt-to-equity ratio of 0.36. The company has a market capitalization of $16.87 billion, a price-to-earnings ratio of 37.85, a PEG ratio of 2.26 and a beta of 1.66. SharkNinja, Inc. has a 52-week low of $60.50 and a 52-week high of $123.00. The business has a 50 day simple moving average of $98.70 and a two-hundred day simple moving average of $95.69.

SharkNinja (NYSE:SN - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The company reported $0.87 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.73 by $0.14. The business had revenue of $1.22 billion for the quarter, compared to the consensus estimate of $1.17 billion. SharkNinja had a net margin of 7.86% and a return on equity of 28.89%. The company's revenue was up 14.7% compared to the same quarter last year. During the same period last year, the firm posted $1.06 earnings per share. On average, equities analysts forecast that SharkNinja, Inc. will post 4.52 earnings per share for the current fiscal year.

SharkNinja Company Profile

(

Free Report)

SharkNinja, Inc, a product design and technology company, engages in the provision of various solutions for consumers worldwide. It offers cleaning appliances, including corded and cordless vacuums, including handheld and robotic vacuums, as well as other floorcare products comprising steam mops, wet/dry cleaning floor products, and carpet extraction; cooking and beverage appliances, such as air fryers, multi-cookers, outdoor and countertop grills and ovens, coffee systems, carbonation, cookware, cutlery, kettles, toasters and bakeware; food preparation appliances comprising blenders, food processors, ice cream makers, and juicers; and beauty appliances, such as hair dryers and stylers, as well as home environment products comprising air purifiers and humidifiers.

Featured Articles

Before you consider SharkNinja, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SharkNinja wasn't on the list.

While SharkNinja currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.