Nikko Asset Management Americas Inc. lowered its position in Unity Software Inc. (NYSE:U - Free Report) by 48.4% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,858,390 shares of the company's stock after selling 2,684,153 shares during the quarter. Nikko Asset Management Americas Inc. owned 0.69% of Unity Software worth $55,996,000 as of its most recent SEC filing.

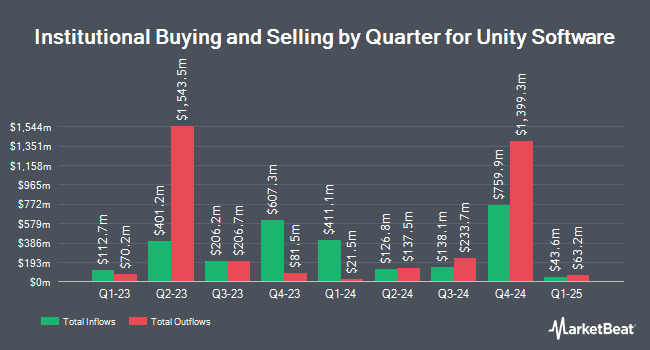

Other institutional investors also recently modified their holdings of the company. Janney Montgomery Scott LLC raised its position in shares of Unity Software by 116.2% during the first quarter. Janney Montgomery Scott LLC now owns 29,085 shares of the company's stock worth $570,000 after acquiring an additional 15,633 shares during the last quarter. Oppenheimer & Co. Inc. acquired a new stake in shares of Unity Software during the 1st quarter worth approximately $433,000. Vanguard Group Inc. raised its stake in shares of Unity Software by 2.1% during the fourth quarter. Vanguard Group Inc. now owns 31,123,035 shares of the company's stock worth $699,335,000 after buying an additional 625,872 shares during the last quarter. Raymond James Financial Inc. bought a new stake in shares of Unity Software during the fourth quarter worth approximately $1,151,000. Finally, GAMMA Investing LLC lifted its holdings in Unity Software by 72.5% in the first quarter. GAMMA Investing LLC now owns 2,822 shares of the company's stock valued at $55,000 after buying an additional 1,186 shares during the period. Institutional investors and hedge funds own 73.46% of the company's stock.

Unity Software Stock Down 3.0%

NYSE U traded down $0.99 during trading on Tuesday, hitting $32.50. The stock had a trading volume of 7,305,533 shares, compared to its average volume of 12,127,215. The company's 50-day moving average price is $26.60 and its two-hundred day moving average price is $23.34. The company has a debt-to-equity ratio of 0.70, a quick ratio of 2.74 and a current ratio of 2.74. The company has a market capitalization of $13.51 billion, a PE ratio of -29.02 and a beta of 2.29. Unity Software Inc. has a 12 month low of $13.90 and a 12 month high of $38.96.

Unity Software (NYSE:U - Get Free Report) last released its earnings results on Wednesday, May 7th. The company reported ($0.19) earnings per share for the quarter, beating analysts' consensus estimates of ($0.38) by $0.19. Unity Software had a negative net margin of 25.21% and a negative return on equity of 14.12%. The business had revenue of $435.00 million during the quarter, compared to the consensus estimate of $415.77 million. During the same quarter last year, the firm earned $0.28 earnings per share. The firm's revenue for the quarter was down 5.5% compared to the same quarter last year. As a group, sell-side analysts forecast that Unity Software Inc. will post -1.25 EPS for the current year.

Analysts Set New Price Targets

A number of equities research analysts recently commented on the company. Stifel Nicolaus dropped their price objective on Unity Software from $35.00 to $28.00 and set a "buy" rating for the company in a report on Thursday, May 8th. Wedbush upped their price target on Unity Software from $31.50 to $39.00 and gave the company an "outperform" rating in a research note on Thursday, July 17th. BTIG Research lowered shares of Unity Software from a "neutral" rating to a "sell" rating and set a $25.00 price objective on the stock. in a research note on Wednesday, July 23rd. Morgan Stanley decreased their price objective on shares of Unity Software from $32.00 to $25.00 and set an "overweight" rating for the company in a report on Thursday, April 17th. Finally, UBS Group increased their target price on shares of Unity Software from $22.00 to $33.00 and gave the stock a "neutral" rating in a report on Thursday, July 17th. Two analysts have rated the stock with a sell rating, ten have given a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $27.22.

View Our Latest Stock Report on Unity Software

Insider Activity

In related news, Director David Helgason sold 261,473 shares of the business's stock in a transaction on Friday, June 6th. The shares were sold at an average price of $25.70, for a total transaction of $6,719,856.10. Following the transaction, the director directly owned 7,489,173 shares in the company, valued at approximately $192,471,746.10. The trade was a 3.37% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Matthew S. Bromberg sold 133,072 shares of the stock in a transaction on Tuesday, May 27th. The shares were sold at an average price of $21.24, for a total transaction of $2,826,449.28. Following the completion of the sale, the chief executive officer owned 1,222,812 shares of the company's stock, valued at approximately $25,972,526.88. This represents a 9.81% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 1,276,809 shares of company stock valued at $31,561,623. Corporate insiders own 3.61% of the company's stock.

Unity Software Company Profile

(

Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

See Also

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report