Ninety One UK Ltd purchased a new stake in Brookfield Infrastructure Co. (NYSE:BIPC - Free Report) during the second quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 341,102 shares of the company's stock, valued at approximately $14,190,000. Ninety One UK Ltd owned approximately 0.29% of Brookfield Infrastructure at the end of the most recent reporting period.

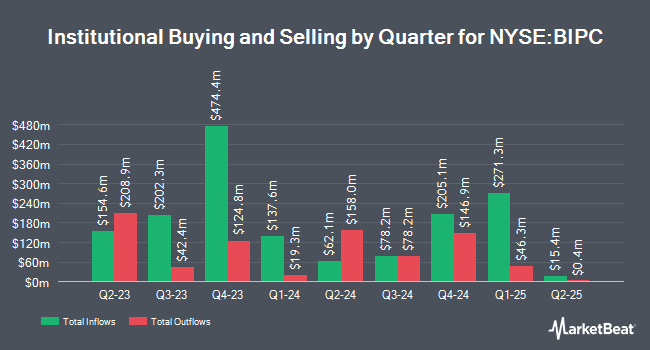

Other institutional investors also recently modified their holdings of the company. Envestnet Asset Management Inc. lifted its holdings in shares of Brookfield Infrastructure by 8.9% in the first quarter. Envestnet Asset Management Inc. now owns 904,535 shares of the company's stock valued at $32,729,000 after purchasing an additional 73,659 shares in the last quarter. Intech Investment Management LLC lifted its holdings in shares of Brookfield Infrastructure by 42.5% in the first quarter. Intech Investment Management LLC now owns 65,225 shares of the company's stock valued at $2,360,000 after purchasing an additional 19,453 shares in the last quarter. GAMMA Investing LLC bought a new stake in shares of Brookfield Infrastructure in the first quarter valued at about $660,000. Cerity Partners LLC bought a new stake in shares of Brookfield Infrastructure in the first quarter valued at about $280,000. Finally, Fifth Third Bancorp increased its position in shares of Brookfield Infrastructure by 79.1% in the first quarter. Fifth Third Bancorp now owns 1,501 shares of the company's stock valued at $54,000 after acquiring an additional 663 shares during the last quarter. 70.38% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several analysts recently issued reports on BIPC shares. Wall Street Zen upgraded Brookfield Infrastructure from a "sell" rating to a "hold" rating in a report on Friday, September 26th. Morgan Stanley upped their target price on Brookfield Infrastructure from $45.00 to $46.00 and gave the stock an "equal weight" rating in a report on Tuesday, August 26th. One equities research analyst has rated the stock with a Hold rating, Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $46.00.

Read Our Latest Report on Brookfield Infrastructure

Brookfield Infrastructure Stock Up 1.2%

NYSE:BIPC opened at $41.61 on Thursday. The stock's 50 day moving average price is $40.17 and its two-hundred day moving average price is $39.20. The firm has a market capitalization of $4.95 billion, a price-to-earnings ratio of 28.90 and a beta of 1.38. Brookfield Infrastructure Co. has a 12-month low of $32.08 and a 12-month high of $45.29.

Brookfield Infrastructure Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 29th. Shareholders of record on Friday, August 29th were paid a $0.43 dividend. The ex-dividend date was Friday, August 29th. This represents a $1.72 annualized dividend and a yield of 4.1%. Brookfield Infrastructure's dividend payout ratio is currently 119.44%.

Brookfield Infrastructure Profile

(

Free Report)

Brookfield Infrastructure Corporation, together with its subsidiaries, owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Brookfield Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure wasn't on the list.

While Brookfield Infrastructure currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.