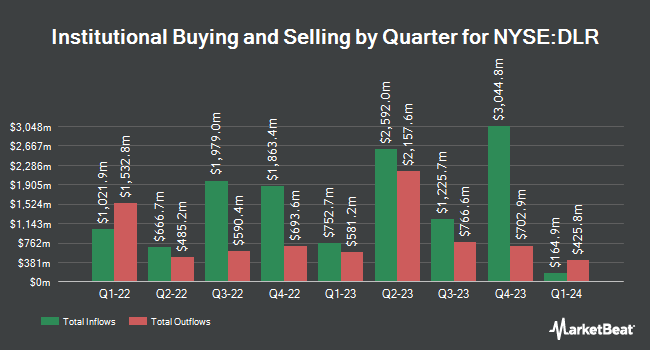

Nordea Investment Management AB reduced its holdings in shares of Digital Realty Trust, Inc. (NYSE:DLR - Free Report) by 93.6% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 54,030 shares of the real estate investment trust's stock after selling 795,864 shares during the period. Nordea Investment Management AB's holdings in Digital Realty Trust were worth $9,342,000 at the end of the most recent reporting period.

A number of other institutional investors also recently made changes to their positions in the business. Vanguard Group Inc. raised its position in Digital Realty Trust by 1.8% in the 1st quarter. Vanguard Group Inc. now owns 52,378,860 shares of the real estate investment trust's stock worth $7,505,367,000 after purchasing an additional 925,674 shares during the period. Canada Pension Plan Investment Board grew its stake in shares of Digital Realty Trust by 63.0% during the first quarter. Canada Pension Plan Investment Board now owns 7,144,737 shares of the real estate investment trust's stock valued at $1,023,769,000 after buying an additional 2,760,286 shares during the last quarter. Northern Trust Corp increased its holdings in shares of Digital Realty Trust by 4.3% in the first quarter. Northern Trust Corp now owns 5,301,199 shares of the real estate investment trust's stock worth $759,609,000 after buying an additional 220,649 shares during the period. Dimensional Fund Advisors LP lifted its stake in shares of Digital Realty Trust by 1.2% in the 1st quarter. Dimensional Fund Advisors LP now owns 4,714,045 shares of the real estate investment trust's stock valued at $675,456,000 after acquiring an additional 57,312 shares during the last quarter. Finally, Invesco Ltd. lifted its stake in shares of Digital Realty Trust by 4.8% in the 1st quarter. Invesco Ltd. now owns 4,092,496 shares of the real estate investment trust's stock valued at $586,414,000 after acquiring an additional 186,613 shares during the last quarter. Hedge funds and other institutional investors own 99.71% of the company's stock.

Insider Buying and Selling

In other Digital Realty Trust news, CEO Andrew Power sold 53,269 shares of the firm's stock in a transaction on Monday, September 15th. The stock was sold at an average price of $175.16, for a total transaction of $9,330,598.04. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 0.17% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have commented on the company. Raymond James Financial lifted their price target on Digital Realty Trust from $190.00 to $205.00 and gave the stock a "strong-buy" rating in a research note on Friday, July 25th. Moffett Nathanson lifted their target price on shares of Digital Realty Trust from $163.00 to $166.00 and gave the stock a "neutral" rating in a research note on Monday, October 6th. Stifel Nicolaus increased their price target on shares of Digital Realty Trust from $190.00 to $205.00 and gave the company a "buy" rating in a research report on Friday, July 25th. Guggenheim began coverage on shares of Digital Realty Trust in a report on Wednesday, July 9th. They issued a "neutral" rating on the stock. Finally, Wells Fargo & Company upped their price objective on shares of Digital Realty Trust from $185.00 to $195.00 and gave the company an "overweight" rating in a research note on Friday, July 25th. Two investment analysts have rated the stock with a Strong Buy rating, seventeen have issued a Buy rating, five have issued a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $191.38.

View Our Latest Analysis on DLR

Digital Realty Trust Trading Up 0.1%

Shares of DLR opened at $172.91 on Tuesday. Digital Realty Trust, Inc. has a 1-year low of $129.95 and a 1-year high of $198.00. The company has a current ratio of 2.22, a quick ratio of 2.22 and a debt-to-equity ratio of 0.82. The firm's 50-day moving average price is $170.10 and its 200-day moving average price is $168.23. The firm has a market capitalization of $58.97 billion, a price-to-earnings ratio of 45.38, a PEG ratio of 4.86 and a beta of 0.96.

Digital Realty Trust (NYSE:DLR - Get Free Report) last issued its quarterly earnings data on Thursday, July 24th. The real estate investment trust reported $1.87 EPS for the quarter, topping the consensus estimate of $1.74 by $0.13. The business had revenue of $1.49 billion during the quarter, compared to analyst estimates of $1.44 billion. Digital Realty Trust had a net margin of 23.98% and a return on equity of 6.46%. Digital Realty Trust's quarterly revenue was up 10.0% compared to the same quarter last year. During the same period last year, the business posted $1.65 earnings per share. Digital Realty Trust has set its FY 2025 guidance at 7.150-7.250 EPS. Sell-side analysts anticipate that Digital Realty Trust, Inc. will post 7.07 EPS for the current year.

Digital Realty Trust Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 30th. Investors of record on Monday, September 15th were paid a $1.22 dividend. This represents a $4.88 annualized dividend and a yield of 2.8%. The ex-dividend date of this dividend was Monday, September 15th. Digital Realty Trust's dividend payout ratio is presently 128.08%.

About Digital Realty Trust

(

Free Report)

Digital Realty Trust, Inc operates as a real estate investment trust, which engages in the provision of data center, colocation and interconnection solutions. It serves the following industries: artificial intelligence (AI), networks, cloud, digital media, mobile, financial services, healthcare, and gaming.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Digital Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Realty Trust wasn't on the list.

While Digital Realty Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report