Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in shares of Norfolk Southern Corporation (NYSE:NSC - Free Report) by 8.7% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 48,960 shares of the railroad operator's stock after buying an additional 3,932 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank's holdings in Norfolk Southern were worth $11,596,000 as of its most recent SEC filing.

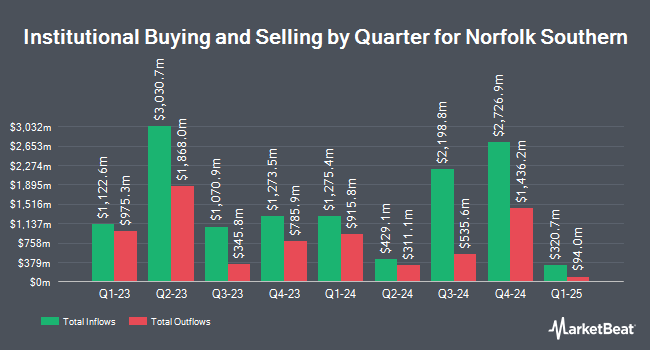

Several other large investors have also made changes to their positions in NSC. GAMMA Investing LLC grew its holdings in Norfolk Southern by 25,555.7% in the 1st quarter. GAMMA Investing LLC now owns 989,796 shares of the railroad operator's stock valued at $234,433,000 after buying an additional 985,938 shares in the last quarter. Price T Rowe Associates Inc. MD grew its holdings in Norfolk Southern by 11.9% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 8,608,080 shares of the railroad operator's stock valued at $2,020,318,000 after buying an additional 918,559 shares in the last quarter. The Manufacturers Life Insurance Company grew its holdings in Norfolk Southern by 293.7% in the 4th quarter. The Manufacturers Life Insurance Company now owns 671,680 shares of the railroad operator's stock valued at $157,643,000 after buying an additional 501,053 shares in the last quarter. Phoenix Financial Ltd. purchased a new stake in Norfolk Southern in the 1st quarter valued at $110,209,000. Finally, FMR LLC grew its holdings in Norfolk Southern by 13.8% in the 4th quarter. FMR LLC now owns 3,073,933 shares of the railroad operator's stock valued at $721,452,000 after buying an additional 371,589 shares in the last quarter. 75.10% of the stock is owned by institutional investors and hedge funds.

Norfolk Southern Trading Down 0.3%

Norfolk Southern stock traded down $0.82 during midday trading on Thursday, reaching $278.18. 3,690,924 shares of the stock traded hands, compared to its average volume of 2,714,172. The company has a 50-day simple moving average of $259.28 and a two-hundred day simple moving average of $244.45. Norfolk Southern Corporation has a 12-month low of $201.63 and a 12-month high of $288.11. The firm has a market cap of $62.49 billion, a PE ratio of 18.80, a price-to-earnings-growth ratio of 2.46 and a beta of 1.31. The company has a current ratio of 0.79, a quick ratio of 0.70 and a debt-to-equity ratio of 1.11.

Norfolk Southern (NYSE:NSC - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The railroad operator reported $3.29 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.24 by $0.05. The company had revenue of $3.11 billion for the quarter, compared to analyst estimates of $3.10 billion. Norfolk Southern had a return on equity of 19.35% and a net margin of 27.51%. Research analysts expect that Norfolk Southern Corporation will post 13 earnings per share for the current fiscal year.

Norfolk Southern Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, August 20th. Stockholders of record on Friday, August 1st will be paid a $1.35 dividend. This represents a $5.40 annualized dividend and a dividend yield of 1.9%. The ex-dividend date is Friday, August 1st. Norfolk Southern's dividend payout ratio (DPR) is presently 36.89%.

Analyst Ratings Changes

Several analysts have issued reports on NSC shares. Robert W. Baird upped their target price on Norfolk Southern from $255.00 to $300.00 and gave the company a "neutral" rating in a report on Tuesday, July 22nd. Bank of America upped their target price on Norfolk Southern from $290.00 to $305.00 and gave the company a "buy" rating in a report on Thursday, July 17th. BMO Capital Markets restated a "market perform" rating and issued a $255.00 target price on shares of Norfolk Southern in a report on Thursday, April 24th. Royal Bank Of Canada lowered their price target on Norfolk Southern from $271.00 to $270.00 and set an "outperform" rating for the company in a report on Thursday, April 24th. Finally, Stifel Nicolaus lowered their price target on Norfolk Southern from $265.00 to $247.00 and set a "hold" rating for the company in a report on Monday, April 14th. Thirteen investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat, Norfolk Southern presently has an average rating of "Hold" and an average price target of $285.15.

Check Out Our Latest Research Report on Norfolk Southern

Norfolk Southern Profile

(

Free Report)

Norfolk Southern Corporation, together with its subsidiaries, engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States. The company transports agriculture, forest, and consumer products comprising soybeans, wheat, corn, fertilizers, livestock and poultry feed, food products, food oils, flour, sweeteners, ethanol, lumber and wood products, pulp board and paper products, wood fibers, wood pulp, beverages, and canned goods; chemicals consist of sulfur and related chemicals, petroleum products comprising crude oil, chlorine and bleaching compounds, plastics, rubber, industrial chemicals, chemical wastes, sand, and natural gas liquids; metals and construction materials, such as steel, aluminum products, machinery, scrap metals, cement, aggregates, minerals, clay, transportation equipment, and military-related products; and automotive, including finished motor vehicles and automotive parts, as well as coal.

See Also

Before you consider Norfolk Southern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norfolk Southern wasn't on the list.

While Norfolk Southern currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report