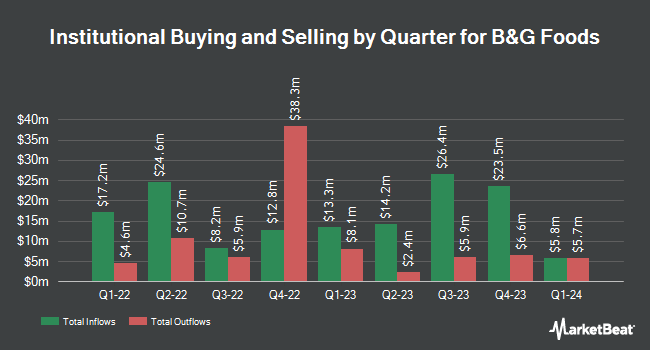

Northern Trust Corp lifted its stake in B&G Foods, Inc. (NYSE:BGS - Free Report) by 10.0% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 872,186 shares of the company's stock after purchasing an additional 79,226 shares during the quarter. Northern Trust Corp owned about 1.10% of B&G Foods worth $6,009,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Stratos Wealth Partners LTD. lifted its stake in shares of B&G Foods by 12.3% in the fourth quarter. Stratos Wealth Partners LTD. now owns 14,647 shares of the company's stock worth $101,000 after buying an additional 1,599 shares in the last quarter. Tower Research Capital LLC TRC raised its holdings in B&G Foods by 5.8% in the 4th quarter. Tower Research Capital LLC TRC now owns 31,158 shares of the company's stock worth $215,000 after acquiring an additional 1,718 shares during the last quarter. PNC Financial Services Group Inc. lifted its position in B&G Foods by 50.6% in the 4th quarter. PNC Financial Services Group Inc. now owns 7,913 shares of the company's stock valued at $55,000 after acquiring an additional 2,658 shares in the last quarter. Rhumbline Advisers lifted its position in B&G Foods by 1.2% in the 4th quarter. Rhumbline Advisers now owns 251,087 shares of the company's stock valued at $1,730,000 after acquiring an additional 2,898 shares in the last quarter. Finally, Geode Capital Management LLC boosted its stake in B&G Foods by 0.3% during the 4th quarter. Geode Capital Management LLC now owns 1,809,054 shares of the company's stock valued at $12,468,000 after purchasing an additional 5,646 shares during the last quarter. Hedge funds and other institutional investors own 66.15% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts have issued reports on the stock. Barclays lowered their target price on shares of B&G Foods from $7.00 to $5.00 and set an "equal weight" rating on the stock in a research note on Thursday, May 8th. Piper Sandler reduced their price objective on B&G Foods from $7.00 to $5.00 and set a "neutral" rating for the company in a research report on Thursday, May 8th. One analyst has rated the stock with a sell rating and five have assigned a hold rating to the stock. According to MarketBeat.com, B&G Foods has a consensus rating of "Hold" and an average price target of $7.30.

Get Our Latest Analysis on BGS

B&G Foods Stock Performance

Shares of BGS stock traded down $0.04 during trading hours on Monday, reaching $4.02. 1,847,451 shares of the company traded hands, compared to its average volume of 1,631,737. The firm has a 50-day moving average price of $5.95 and a 200 day moving average price of $6.48. The company has a market cap of $320.39 million, a P/E ratio of -11.81 and a beta of 0.74. The company has a debt-to-equity ratio of 2.40, a current ratio of 1.64 and a quick ratio of 0.49. B&G Foods, Inc. has a 12-month low of $3.97 and a 12-month high of $9.74.

B&G Foods (NYSE:BGS - Get Free Report) last posted its quarterly earnings results on Wednesday, May 7th. The company reported $0.04 earnings per share for the quarter, missing analysts' consensus estimates of $0.16 by ($0.12). The firm had revenue of $425.40 million during the quarter, compared to the consensus estimate of $459.40 million. B&G Foods had a positive return on equity of 6.97% and a negative net margin of 1.34%. The business's revenue for the quarter was down 10.5% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.18 earnings per share. As a group, sell-side analysts predict that B&G Foods, Inc. will post 0.7 earnings per share for the current fiscal year.

B&G Foods Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, July 30th. Stockholders of record on Monday, June 30th will be paid a $0.19 dividend. This represents a $0.76 dividend on an annualized basis and a dividend yield of 18.93%. The ex-dividend date is Monday, June 30th. B&G Foods's dividend payout ratio (DPR) is -28.57%.

About B&G Foods

(

Free Report)

B&G Foods, Inc is a holding company, which engages in the manufacture, sale, and distribution of shelf-stable frozen food, and household products in the U.S., Canada, and Puerto Rico. It operates through the following segments: Specialty, Meals, Frozen & Vegetables, and Spices & Flavor Solutions.

See Also

Before you consider B&G Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B&G Foods wasn't on the list.

While B&G Foods currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.