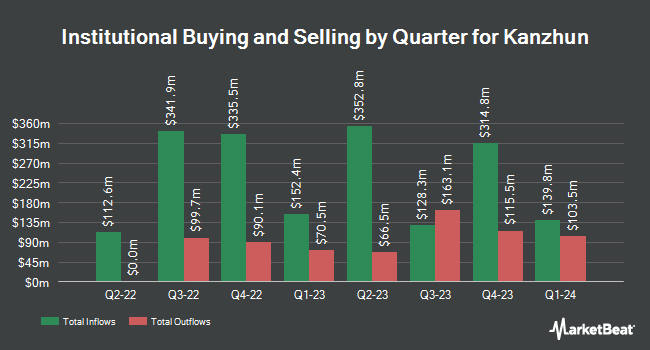

Northern Trust Corp cut its holdings in shares of KANZHUN LIMITED Sponsored ADR (NASDAQ:BZ - Free Report) by 1.5% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,223,821 shares of the company's stock after selling 18,563 shares during the period. Northern Trust Corp owned 0.31% of KANZHUN worth $23,461,000 at the end of the most recent quarter.

A number of other large investors have also recently made changes to their positions in the stock. First Horizon Advisors Inc. purchased a new stake in shares of KANZHUN in the 1st quarter valued at approximately $25,000. Brooklyn Investment Group boosted its holdings in KANZHUN by 3,115.4% during the first quarter. Brooklyn Investment Group now owns 2,926 shares of the company's stock worth $56,000 after buying an additional 2,835 shares in the last quarter. Tudor Investment Corp ET AL acquired a new position in KANZHUN during the fourth quarter worth about $160,000. Quantinno Capital Management LP acquired a new position in shares of KANZHUN in the fourth quarter valued at approximately $163,000. Finally, Lighthouse Investment Partners LLC acquired a new position in KANZHUN during the fourth quarter worth approximately $166,000. 60.67% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of analysts have commented on the stock. Daiwa America upgraded shares of KANZHUN from a "hold" rating to a "strong-buy" rating in a research report on Monday, June 2nd. UBS Group upgraded shares of KANZHUN from a "neutral" rating to a "buy" rating and set a $26.00 target price on the stock in a report on Thursday, August 21st. Jefferies Financial Group upped their price objective on shares of KANZHUN from $20.00 to $24.00 and gave the company a "buy" rating in a report on Wednesday, August 20th. Zacks Research lowered shares of KANZHUN from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 14th. Finally, Barclays lifted their price target on shares of KANZHUN from $22.00 to $25.00 and gave the company an "overweight" rating in a research report on Friday, August 22nd. One research analyst has rated the stock with a Strong Buy rating, five have issued a Buy rating and two have issued a Hold rating to the company. According to MarketBeat.com, KANZHUN presently has an average rating of "Moderate Buy" and an average price target of $21.17.

Get Our Latest Stock Report on BZ

KANZHUN Stock Performance

Shares of NASDAQ BZ traded down $0.10 during trading on Friday, hitting $23.91. 546,419 shares of the company were exchanged, compared to its average volume of 4,145,035. KANZHUN LIMITED Sponsored ADR has a 12-month low of $11.81 and a 12-month high of $24.33. The firm has a market capitalization of $9.81 billion, a PE ratio of 35.66 and a beta of 0.44. The company has a fifty day moving average price of $20.38 and a 200-day moving average price of $18.22.

KANZHUN Dividend Announcement

The business also recently announced a full year 25 dividend, which will be paid on Thursday, October 23rd. Shareholders of record on Wednesday, October 8th will be paid a $0.084 dividend. This represents a yield of 60.0%. The ex-dividend date is Wednesday, October 8th.

About KANZHUN

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Further Reading

Before you consider KANZHUN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KANZHUN wasn't on the list.

While KANZHUN currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.