Northern Trust Corp boosted its position in shares of Sony Corporation (NYSE:SONY - Free Report) by 3.4% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 7,845,521 shares of the company's stock after buying an additional 257,838 shares during the period. Northern Trust Corp owned approximately 0.13% of Sony worth $199,198,000 as of its most recent SEC filing.

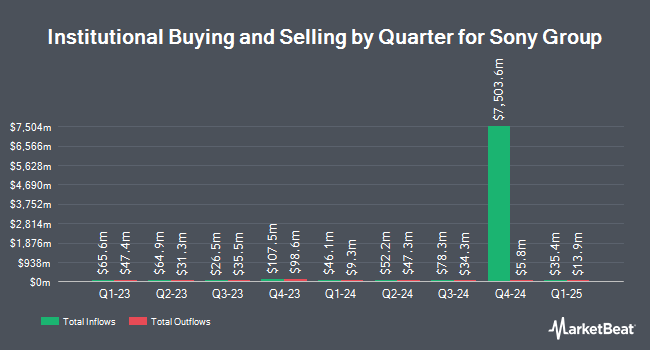

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Brighton Jones LLC lifted its stake in shares of Sony by 422.0% in the 4th quarter. Brighton Jones LLC now owns 19,908 shares of the company's stock valued at $421,000 after purchasing an additional 16,094 shares during the last quarter. Russell Investments Group Ltd. lifted its stake in shares of Sony by 557.8% in the 4th quarter. Russell Investments Group Ltd. now owns 7,696 shares of the company's stock valued at $163,000 after purchasing an additional 6,526 shares during the last quarter. Barclays PLC lifted its stake in shares of Sony by 2,071.0% in the 4th quarter. Barclays PLC now owns 72,510 shares of the company's stock valued at $1,535,000 after purchasing an additional 69,170 shares during the last quarter. NewEdge Advisors LLC lifted its stake in shares of Sony by 535.9% in the 4th quarter. NewEdge Advisors LLC now owns 48,092 shares of the company's stock valued at $1,018,000 after purchasing an additional 40,529 shares during the last quarter. Finally, Commerce Bank lifted its stake in shares of Sony by 393.3% in the 4th quarter. Commerce Bank now owns 11,824 shares of the company's stock valued at $250,000 after purchasing an additional 9,427 shares during the last quarter. 14.05% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen lowered Sony from a "buy" rating to a "hold" rating in a research note on Thursday, May 22nd. One equities research analyst has rated the stock with a Strong Buy rating, four have given a Buy rating and one has assigned a Hold rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Buy" and an average price target of $28.00.

View Our Latest Research Report on SONY

Sony Trading Down 1.9%

Shares of NYSE SONY opened at $27.5950 on Friday. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.03 and a current ratio of 1.09. The business's 50 day moving average price is $25.56 and its 200-day moving average price is $24.91. Sony Corporation has a fifty-two week low of $17.42 and a fifty-two week high of $29.16. The company has a market cap of $166.89 billion, a price-to-earnings ratio of 21.90 and a beta of 0.91.

Sony (NYSE:SONY - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The company reported $0.30 earnings per share for the quarter, topping the consensus estimate of $0.24 by $0.06. Sony had a return on equity of 13.88% and a net margin of 9.14%.The firm had revenue of $17.79 billion for the quarter, compared to the consensus estimate of $18.88 billion. During the same period in the prior year, the business posted $189.90 earnings per share. Sony has set its FY 2025 guidance at EPS. On average, sell-side analysts expect that Sony Corporation will post 1.23 earnings per share for the current year.

Sony Profile

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sony, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony wasn't on the list.

While Sony currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.