Northern Trust Corp boosted its stake in Kforce Inc. (NASDAQ:KFRC - Free Report) by 3.6% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 268,149 shares of the business services provider's stock after acquiring an additional 9,384 shares during the period. Northern Trust Corp owned 1.44% of Kforce worth $13,110,000 at the end of the most recent reporting period.

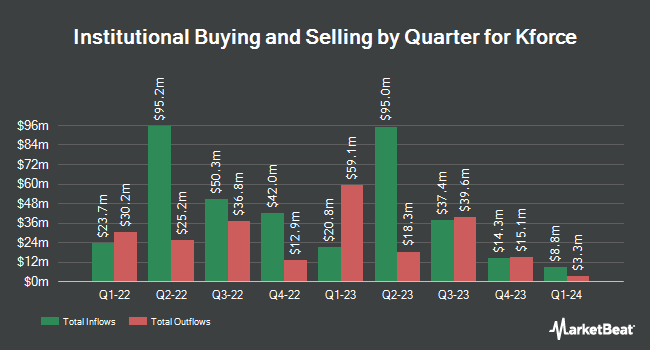

A number of other hedge funds have also recently modified their holdings of KFRC. Pacer Advisors Inc. bought a new stake in shares of Kforce during the 1st quarter valued at $5,584,000. Wellington Management Group LLP boosted its holdings in shares of Kforce by 36.3% during the 4th quarter. Wellington Management Group LLP now owns 297,111 shares of the business services provider's stock valued at $16,846,000 after buying an additional 79,100 shares in the last quarter. Voloridge Investment Management LLC boosted its holdings in shares of Kforce by 670.8% during the 4th quarter. Voloridge Investment Management LLC now owns 69,713 shares of the business services provider's stock valued at $3,953,000 after buying an additional 60,669 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Kforce by 6.6% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 809,007 shares of the business services provider's stock valued at $39,552,000 after buying an additional 50,044 shares in the last quarter. Finally, Squarepoint Ops LLC boosted its holdings in shares of Kforce by 912.4% during the 4th quarter. Squarepoint Ops LLC now owns 49,781 shares of the business services provider's stock valued at $2,823,000 after buying an additional 44,864 shares in the last quarter. Institutional investors own 92.77% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently commented on KFRC. UBS Group dropped their target price on shares of Kforce from $45.00 to $40.00 and set a "neutral" rating on the stock in a report on Wednesday, July 30th. Truist Financial lowered their price target on Kforce from $50.00 to $46.00 and set a "hold" rating for the company in a research report on Tuesday, July 29th. One equities research analyst has rated the stock with a Buy rating and two have issued a Hold rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $52.33.

Get Our Latest Research Report on Kforce

Kforce Price Performance

KFRC stock traded down $0.23 during midday trading on Tuesday, hitting $30.83. The company's stock had a trading volume of 34,483 shares, compared to its average volume of 175,209. Kforce Inc. has a 12 month low of $30.44 and a 12 month high of $64.07. The company has a quick ratio of 2.06, a current ratio of 2.06 and a debt-to-equity ratio of 0.16. The firm has a market capitalization of $573.31 million, a price-to-earnings ratio of 11.51 and a beta of 0.68. The company has a 50 day moving average of $37.19 and a two-hundred day moving average of $41.73.

Kforce (NASDAQ:KFRC - Get Free Report) last posted its earnings results on Monday, July 28th. The business services provider reported $0.59 EPS for the quarter, missing analysts' consensus estimates of $0.60 by ($0.01). Kforce had a net margin of 3.59% and a return on equity of 30.34%. The firm had revenue of $334.32 million for the quarter, compared to the consensus estimate of $333.78 million. During the same quarter in the prior year, the company posted $0.75 earnings per share. The firm's revenue was down 6.2% compared to the same quarter last year. Kforce has set its Q3 2025 guidance at 0.530-0.61 EPS. On average, analysts expect that Kforce Inc. will post 2.7 EPS for the current year.

Kforce Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 26th. Shareholders of record on Friday, September 12th will be paid a $0.39 dividend. The ex-dividend date is Friday, September 12th. This represents a $1.56 dividend on an annualized basis and a yield of 5.1%. Kforce's dividend payout ratio (DPR) is presently 65.27%.

Kforce Company Profile

(

Free Report)

Kforce Inc provides professional staffing services and solutions in the United States. It operates through two segments, Technology, and Finance and Accounting (FA). The Technology segment provides talent solutions to its clients primarily in the areas of information technology, such as systems/applications architecture and development, data management and analytics, business and artificial intelligence, machine learning, project and program management, and network architecture and security.

See Also

Before you consider Kforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kforce wasn't on the list.

While Kforce currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.