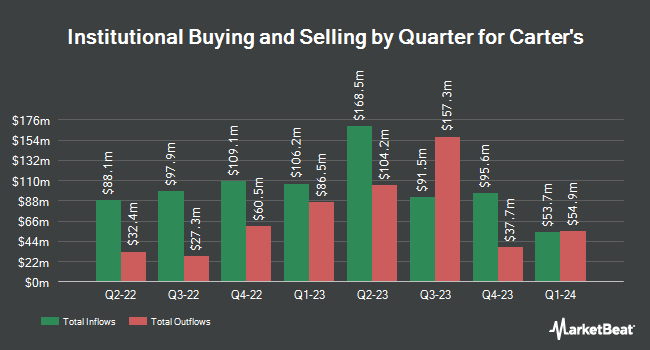

Northern Trust Corp cut its stake in Carter's, Inc. (NYSE:CRI - Free Report) by 9.6% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 400,991 shares of the textile maker's stock after selling 42,511 shares during the period. Northern Trust Corp owned about 1.10% of Carter's worth $16,401,000 at the end of the most recent quarter.

Other institutional investors also recently bought and sold shares of the company. Allworth Financial LP lifted its holdings in Carter's by 313.1% during the 1st quarter. Allworth Financial LP now owns 723 shares of the textile maker's stock worth $28,000 after buying an additional 548 shares during the last quarter. Colonial Trust Co SC purchased a new stake in Carter's during the 4th quarter worth about $29,000. Parallel Advisors LLC lifted its holdings in Carter's by 80.9% during the 1st quarter. Parallel Advisors LLC now owns 1,062 shares of the textile maker's stock worth $43,000 after buying an additional 475 shares during the last quarter. Headlands Technologies LLC purchased a new stake in Carter's during the 1st quarter worth about $58,000. Finally, US Bancorp DE lifted its holdings in Carter's by 45.0% during the 1st quarter. US Bancorp DE now owns 1,408 shares of the textile maker's stock worth $58,000 after buying an additional 437 shares during the last quarter.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on CRI. Barclays decreased their price target on Carter's from $25.00 to $22.00 and set an "underweight" rating for the company in a report on Tuesday, July 29th. Wells Fargo & Company lifted their price target on Carter's from $25.00 to $28.00 and gave the stock an "underweight" rating in a report on Wednesday, May 14th. Zacks Research cut Carter's from a "hold" rating to a "strong sell" rating in a research report on Wednesday, August 13th. Finally, UBS Group cut their target price on Carter's from $32.00 to $26.00 and set a "neutral" rating on the stock in a research report on Monday, July 28th. Two equities research analysts have rated the stock with a Hold rating and three have assigned a Sell rating to the company's stock. According to MarketBeat, Carter's has a consensus rating of "Strong Sell" and a consensus price target of $30.25.

Read Our Latest Research Report on CRI

Carter's Stock Performance

Shares of CRI traded up $0.04 during midday trading on Friday, reaching $28.66. 1,104,528 shares of the stock were exchanged, compared to its average volume of 1,281,489. The business's 50-day moving average price is $28.40 and its 200 day moving average price is $33.56. The company has a debt-to-equity ratio of 0.58, a current ratio of 2.20 and a quick ratio of 1.03. Carter's, Inc. has a twelve month low of $23.38 and a twelve month high of $71.99. The company has a market capitalization of $1.04 billion, a price-to-earnings ratio of 7.60 and a beta of 1.02.

Carter's (NYSE:CRI - Get Free Report) last issued its quarterly earnings results on Friday, July 25th. The textile maker reported $0.17 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.43 by ($0.26). The company had revenue of $585.31 million during the quarter, compared to analyst estimates of $563.24 million. Carter's had a net margin of 4.79% and a return on equity of 20.68%. The business's revenue was up 3.7% on a year-over-year basis. During the same quarter last year, the firm earned $0.76 EPS. On average, sell-side analysts expect that Carter's, Inc. will post 5.15 EPS for the current fiscal year.

Carter's Cuts Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, September 12th. Investors of record on Tuesday, August 26th will be given a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 3.5%. The ex-dividend date is Tuesday, August 26th. Carter's's payout ratio is 26.53%.

About Carter's

(

Free Report)

Carter's, Inc engages in the business of brand marketing of young children's apparel. It operates through the following segments: the United States (US) Retail, US Wholesale, and International. The US Retail segment includes selling products through retail stores and ecommerce websites. The US Wholesale segment focuses on wholesale partners.

Featured Articles

Before you consider Carter's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carter's wasn't on the list.

While Carter's currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.