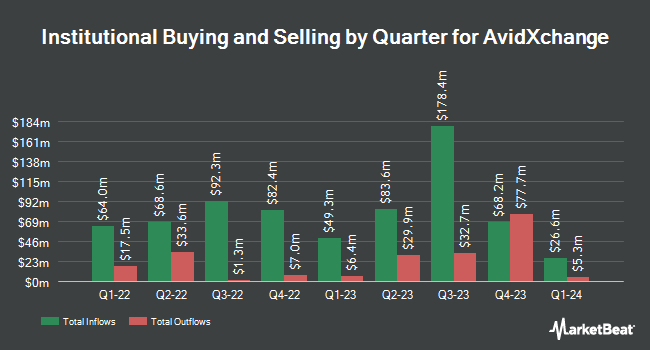

Northern Trust Corp reduced its position in shares of AvidXchange Holdings, Inc. (NASDAQ:AVDX - Free Report) by 2.4% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,613,829 shares of the company's stock after selling 39,344 shares during the period. Northern Trust Corp owned approximately 0.78% of AvidXchange worth $13,685,000 at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in the company. Vanguard Group Inc. grew its position in shares of AvidXchange by 0.7% during the 1st quarter. Vanguard Group Inc. now owns 18,236,837 shares of the company's stock valued at $154,648,000 after purchasing an additional 126,786 shares in the last quarter. Jacobs Levy Equity Management Inc. lifted its holdings in shares of AvidXchange by 8.7% during the 4th quarter. Jacobs Levy Equity Management Inc. now owns 3,397,658 shares of the company's stock worth $35,132,000 after acquiring an additional 273,194 shares during the last quarter. Tremblant Capital Group lifted its holdings in shares of AvidXchange by 2.3% during the 4th quarter. Tremblant Capital Group now owns 3,231,149 shares of the company's stock worth $33,410,000 after acquiring an additional 73,802 shares during the last quarter. Jennison Associates LLC lifted its holdings in shares of AvidXchange by 45.7% during the 1st quarter. Jennison Associates LLC now owns 3,171,634 shares of the company's stock worth $26,895,000 after acquiring an additional 995,109 shares during the last quarter. Finally, Point72 Asset Management L.P. lifted its holdings in shares of AvidXchange by 74.1% during the 4th quarter. Point72 Asset Management L.P. now owns 1,700,334 shares of the company's stock worth $17,581,000 after acquiring an additional 723,724 shares during the last quarter. 80.58% of the stock is currently owned by hedge funds and other institutional investors.

AvidXchange Price Performance

Shares of NASDAQ AVDX traded up $0.01 during mid-day trading on Tuesday, reaching $9.94. 94,282 shares of the company were exchanged, compared to its average volume of 2,729,702. AvidXchange Holdings, Inc. has a 52 week low of $6.61 and a 52 week high of $11.68. The company has a quick ratio of 1.33, a current ratio of 1.33 and a debt-to-equity ratio of 0.10. The stock has a market capitalization of $2.06 billion, a PE ratio of -198.66 and a beta of 1.20. The company's 50 day moving average price is $9.88 and its 200 day moving average price is $9.10.

AvidXchange (NASDAQ:AVDX - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $0.05 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.06 by ($0.01). AvidXchange had a positive return on equity of 1.15% and a negative net margin of 1.80%.The company had revenue of $110.57 million for the quarter, compared to the consensus estimate of $110.18 million. During the same period in the prior year, the firm posted $0.05 earnings per share. The business's revenue was up 5.2% on a year-over-year basis. Sell-side analysts forecast that AvidXchange Holdings, Inc. will post 0.02 earnings per share for the current fiscal year.

AvidXchange Company Profile

(

Free Report)

AvidXchange Holdings, Inc provides accounts payable (AP) automation software and payment solutions for middle market businesses and their suppliers in North America. The company offers AP automation software, a SaaS-based solution that automates and digitizes capture, review, approval, and payment of invoices for buyers; the AvidPay network that connects two-sided payments with buyers and suppliers; and the AvidXchange Supplier Hub, which provides supplier insights to cash flow, tools for in-network invoices and payments, and early payment feature.

Featured Stories

Before you consider AvidXchange, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvidXchange wasn't on the list.

While AvidXchange currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.