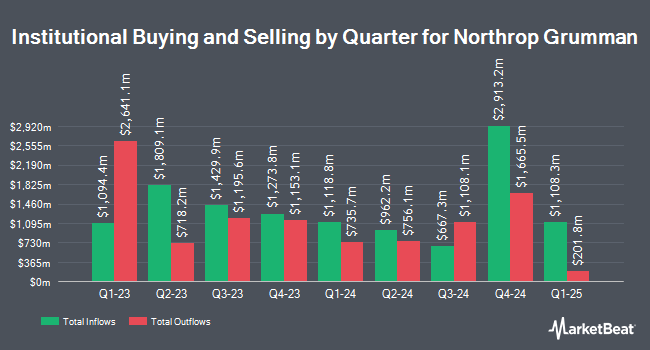

Mitchell Mcleod Pugh & Williams Inc. increased its stake in shares of Northrop Grumman Corporation (NYSE:NOC - Free Report) by 29.4% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,848 shares of the aerospace company's stock after purchasing an additional 420 shares during the quarter. Mitchell Mcleod Pugh & Williams Inc.'s holdings in Northrop Grumman were worth $924,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of NOC. Vanguard Group Inc. boosted its position in shares of Northrop Grumman by 4.6% during the 1st quarter. Vanguard Group Inc. now owns 13,266,301 shares of the aerospace company's stock worth $6,792,479,000 after acquiring an additional 588,520 shares in the last quarter. Wellington Management Group LLP boosted its position in shares of Northrop Grumman by 23.4% during the 1st quarter. Wellington Management Group LLP now owns 5,139,333 shares of the aerospace company's stock worth $2,631,390,000 after acquiring an additional 974,633 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its position in shares of Northrop Grumman by 10.4% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,241,144 shares of the aerospace company's stock worth $1,147,489,000 after acquiring an additional 210,500 shares in the last quarter. Invesco Ltd. boosted its position in shares of Northrop Grumman by 12.1% during the 1st quarter. Invesco Ltd. now owns 1,944,186 shares of the aerospace company's stock worth $995,443,000 after acquiring an additional 210,506 shares in the last quarter. Finally, Royal Bank of Canada boosted its position in shares of Northrop Grumman by 12.0% during the 1st quarter. Royal Bank of Canada now owns 1,115,625 shares of the aerospace company's stock worth $571,211,000 after acquiring an additional 119,693 shares in the last quarter. 83.40% of the stock is owned by institutional investors and hedge funds.

Northrop Grumman Stock Up 1.2%

Shares of NYSE NOC opened at $626.22 on Wednesday. The stock has a market cap of $89.66 billion, a PE ratio of 23.08, a price-to-earnings-growth ratio of 6.01 and a beta of 0.10. The company has a quick ratio of 0.93, a current ratio of 1.04 and a debt-to-equity ratio of 0.98. Northrop Grumman Corporation has a 52-week low of $426.24 and a 52-week high of $640.90. The business has a 50-day moving average price of $591.60 and a 200 day moving average price of $535.36.

Northrop Grumman (NYSE:NOC - Get Free Report) last announced its earnings results on Tuesday, July 22nd. The aerospace company reported $7.11 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $6.84 by $0.27. The firm had revenue of $10.35 billion during the quarter, compared to analysts' expectations of $10.15 billion. Northrop Grumman had a return on equity of 25.52% and a net margin of 9.74%.The business's revenue was up 1.3% on a year-over-year basis. During the same period in the prior year, the firm earned $6.36 EPS. Northrop Grumman has set its FY 2025 guidance at 25.000-25.400 EPS. Equities research analysts forecast that Northrop Grumman Corporation will post 28.05 earnings per share for the current year.

Northrop Grumman Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, September 17th. Shareholders of record on Tuesday, September 2nd were paid a dividend of $2.31 per share. The ex-dividend date of this dividend was Tuesday, September 2nd. This represents a $9.24 annualized dividend and a yield of 1.5%. Northrop Grumman's dividend payout ratio is currently 34.06%.

Analysts Set New Price Targets

Several research analysts have recently issued reports on the company. Robert W. Baird upped their price objective on Northrop Grumman from $547.00 to $565.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. Susquehanna upped their price objective on Northrop Grumman from $557.00 to $650.00 and gave the stock a "positive" rating in a research report on Tuesday, July 22nd. JPMorgan Chase & Co. upped their price objective on Northrop Grumman from $480.00 to $585.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. Sanford C. Bernstein reaffirmed a "market perform" rating on shares of Northrop Grumman in a research report on Monday, July 14th. Finally, Wall Street Zen raised Northrop Grumman from a "hold" rating to a "buy" rating in a report on Friday, September 5th. One analyst has rated the stock with a Strong Buy rating, ten have issued a Buy rating and six have issued a Hold rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $601.00.

Read Our Latest Analysis on NOC

Northrop Grumman Profile

(

Free Report)

Northrop Grumman Corporation operates as an aerospace and defense technology company in the United States, Asia/Pacific, Europe, and internationally. The company's Aeronautics Systems segment designs, develops, manufactures, integrates, and sustains aircraft systems. This segment also offers unmanned autonomous aircraft systems, including high-altitude long-endurance strategic ISR systems and vertical take-off and landing tactical ISR systems; and strategic long-range strike aircraft, tactical fighter and air dominance aircraft, and airborne battle management and command and control systems.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Northrop Grumman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northrop Grumman wasn't on the list.

While Northrop Grumman currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.