Northwest & Ethical Investments L.P. acquired a new position in shares of Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm acquired 265,486 shares of the semiconductor company's stock, valued at approximately $16,346,000.

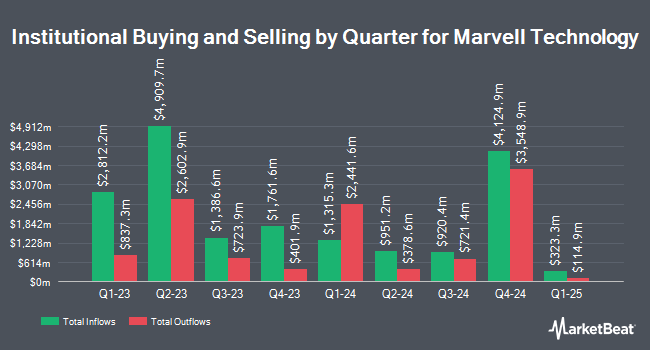

Several other large investors have also modified their holdings of MRVL. Point72 Asia Singapore Pte. Ltd. acquired a new stake in shares of Marvell Technology in the fourth quarter worth $234,000. Dynamic Advisor Solutions LLC boosted its position in shares of Marvell Technology by 5.0% in the first quarter. Dynamic Advisor Solutions LLC now owns 4,313 shares of the semiconductor company's stock worth $266,000 after buying an additional 206 shares during the period. Yousif Capital Management LLC boosted its position in shares of Marvell Technology by 8.4% in the first quarter. Yousif Capital Management LLC now owns 15,057 shares of the semiconductor company's stock worth $927,000 after buying an additional 1,164 shares during the period. Goldman Sachs Group Inc. boosted its position in shares of Marvell Technology by 32.3% in the first quarter. Goldman Sachs Group Inc. now owns 20,661,308 shares of the semiconductor company's stock worth $1,272,117,000 after buying an additional 5,050,159 shares during the period. Finally, Sargent Investment Group LLC boosted its position in shares of Marvell Technology by 55.7% in the first quarter. Sargent Investment Group LLC now owns 13,392 shares of the semiconductor company's stock worth $825,000 after buying an additional 4,792 shares during the period. 83.51% of the stock is owned by institutional investors.

Insider Activity at Marvell Technology

In related news, CFO Willem A. Meintjes sold 1,500 shares of the business's stock in a transaction dated Monday, June 16th. The stock was sold at an average price of $68.52, for a total transaction of $102,780.00. Following the transaction, the chief financial officer directly owned 121,348 shares in the company, valued at $8,314,764.96. The trade was a 1.22% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Mark Casper sold 3,000 shares of the business's stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $72.35, for a total value of $217,050.00. Following the transaction, the executive vice president owned 17,163 shares in the company, valued at $1,241,743.05. This represents a 14.88% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 5,783 shares of company stock worth $407,716 over the last three months. Company insiders own 0.33% of the company's stock.

Marvell Technology Stock Performance

Shares of NASDAQ:MRVL traded down $4.67 during midday trading on Tuesday, hitting $72.07. The company's stock had a trading volume of 16,930,406 shares, compared to its average volume of 15,413,750. The stock has a market capitalization of $62.26 billion, a price-to-earnings ratio of 58.58, a PEG ratio of 0.83 and a beta of 1.83. The stock's 50 day simple moving average is $74.52 and its 200 day simple moving average is $72.74. Marvell Technology, Inc. has a fifty-two week low of $47.08 and a fifty-two week high of $127.48. The company has a debt-to-equity ratio of 0.22, a quick ratio of 0.94 and a current ratio of 1.30.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last issued its quarterly earnings results on Thursday, May 29th. The semiconductor company reported $0.62 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.61 by $0.01. The company had revenue of $1.90 billion for the quarter, compared to the consensus estimate of $1.88 billion. Marvell Technology had a positive return on equity of 8.42% and a negative net margin of 7.56%.The firm's revenue was up 63.3% compared to the same quarter last year. During the same period last year, the business posted $0.24 earnings per share. Marvell Technology has set its Q2 2026 guidance at 0.620-0.720 EPS. As a group, research analysts anticipate that Marvell Technology, Inc. will post 0.91 earnings per share for the current year.

Marvell Technology Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Investors of record on Friday, July 11th were paid a dividend of $0.06 per share. This represents a $0.24 annualized dividend and a yield of 0.3%. The ex-dividend date was Friday, July 11th. Marvell Technology's payout ratio is currently -42.11%.

Analyst Ratings Changes

Several brokerages have recently commented on MRVL. KeyCorp decreased their target price on Marvell Technology from $115.00 to $90.00 and set an "overweight" rating for the company in a research report on Friday, May 30th. Melius lowered Marvell Technology from a "buy" rating to a "hold" rating and set a $66.00 price objective for the company. in a report on Thursday, May 22nd. Cantor Fitzgerald increased their price objective on Marvell Technology from $60.00 to $75.00 and gave the stock a "neutral" rating in a report on Wednesday, June 18th. Wall Street Zen lowered Marvell Technology from a "buy" rating to a "hold" rating in a report on Sunday. Finally, Loop Capital cut their price objective on Marvell Technology from $110.00 to $90.00 and set a "buy" rating for the company in a report on Friday, May 30th. One research analyst has rated the stock with a Strong Buy rating, twenty-two have assigned a Buy rating, seven have given a Hold rating and one has assigned a Sell rating to the company. Based on data from MarketBeat, Marvell Technology currently has a consensus rating of "Moderate Buy" and an average target price of $94.70.

View Our Latest Research Report on MRVL

Marvell Technology Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

Featured Stories

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report