Nuveen LLC bought a new stake in Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 174,374 shares of the construction company's stock, valued at approximately $19,741,000. Nuveen LLC owned about 0.57% of Sterling Infrastructure as of its most recent SEC filing.

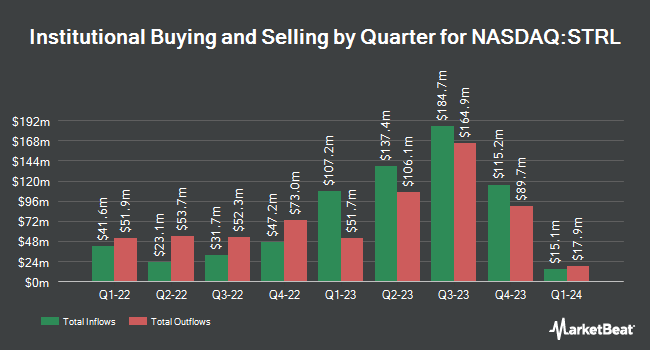

Other institutional investors and hedge funds have also recently made changes to their positions in the company. Assetmark Inc. raised its holdings in Sterling Infrastructure by 5.4% in the 1st quarter. Assetmark Inc. now owns 1,372 shares of the construction company's stock valued at $155,000 after buying an additional 70 shares during the last quarter. Peterson Wealth Services increased its position in Sterling Infrastructure by 2.1% in the 1st quarter. Peterson Wealth Services now owns 5,054 shares of the construction company's stock valued at $572,000 after acquiring an additional 103 shares during the period. D.A. Davidson & CO. raised its stake in shares of Sterling Infrastructure by 5.0% during the first quarter. D.A. Davidson & CO. now owns 2,424 shares of the construction company's stock valued at $274,000 after acquiring an additional 116 shares during the last quarter. JT Stratford LLC raised its stake in shares of Sterling Infrastructure by 1.0% during the fourth quarter. JT Stratford LLC now owns 12,465 shares of the construction company's stock valued at $2,100,000 after acquiring an additional 121 shares during the last quarter. Finally, Xponance Inc. lifted its holdings in shares of Sterling Infrastructure by 6.0% during the first quarter. Xponance Inc. now owns 2,272 shares of the construction company's stock worth $257,000 after purchasing an additional 128 shares during the period. Institutional investors own 80.95% of the company's stock.

Sterling Infrastructure Stock Up 0.6%

Shares of STRL traded up $1.55 during trading hours on Friday, hitting $279.58. The stock had a trading volume of 493,572 shares, compared to its average volume of 576,158. Sterling Infrastructure, Inc. has a 1-year low of $96.34 and a 1-year high of $321.79. The firm has a market capitalization of $8.50 billion, a P/E ratio of 30.39, a price-to-earnings-growth ratio of 2.11 and a beta of 1.46. The firm has a 50 day simple moving average of $253.70 and a 200-day simple moving average of $184.54. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.42 and a quick ratio of 1.42.

Insider Activity at Sterling Infrastructure

In related news, General Counsel Mark D. Wolf sold 3,500 shares of the stock in a transaction on Tuesday, June 24th. The stock was sold at an average price of $225.87, for a total value of $790,545.00. Following the transaction, the general counsel directly owned 29,315 shares in the company, valued at $6,621,379.05. This trade represents a 10.67% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Dana C. O'brien sold 10,154 shares of the firm's stock in a transaction dated Monday, June 16th. The shares were sold at an average price of $206.58, for a total transaction of $2,097,613.32. Following the completion of the transaction, the director directly owned 16,498 shares in the company, valued at approximately $3,408,156.84. The trade was a 38.10% decrease in their position. The disclosure for this sale can be found here. Insiders own 3.70% of the company's stock.

Analysts Set New Price Targets

Several brokerages have commented on STRL. Wall Street Zen raised Sterling Infrastructure from a "hold" rating to a "buy" rating in a report on Saturday, August 9th. DA Davidson upped their target price on Sterling Infrastructure from $265.00 to $355.00 and gave the company a "buy" rating in a report on Wednesday, August 6th. Two analysts have rated the stock with a Buy rating, According to MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $355.00.

Read Our Latest Analysis on STRL

About Sterling Infrastructure

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

See Also

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.