Nuveen LLC purchased a new position in shares of Geospace Technologies Corporation (NASDAQ:GEOS - Free Report) during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 16,684 shares of the oil and gas company's stock, valued at approximately $120,000. Nuveen LLC owned approximately 0.13% of Geospace Technologies at the end of the most recent reporting period.

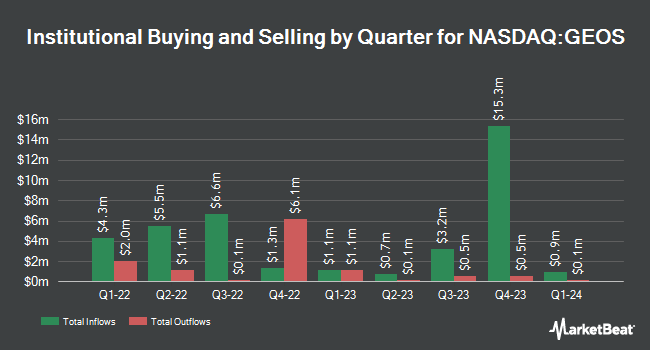

Several other institutional investors have also modified their holdings of GEOS. Grace & White Inc. NY lifted its stake in Geospace Technologies by 39.4% in the 1st quarter. Grace & White Inc. NY now owns 301,321 shares of the oil and gas company's stock valued at $2,173,000 after buying an additional 85,225 shares in the last quarter. Peapod Lane Capital LLC lifted its stake in Geospace Technologies by 10.4% in the 1st quarter. Peapod Lane Capital LLC now owns 280,051 shares of the oil and gas company's stock valued at $2,019,000 after buying an additional 26,399 shares in the last quarter. Moors & Cabot Inc. lifted its stake in Geospace Technologies by 5.3% in the 1st quarter. Moors & Cabot Inc. now owns 785,900 shares of the oil and gas company's stock valued at $5,666,000 after buying an additional 39,813 shares in the last quarter. US Bancorp DE lifted its stake in Geospace Technologies by 74.6% in the 1st quarter. US Bancorp DE now owns 124,034 shares of the oil and gas company's stock valued at $894,000 after buying an additional 53,001 shares in the last quarter. Finally, EagleClaw Capital Managment LLC lifted its stake in shares of Geospace Technologies by 193.1% during the 1st quarter. EagleClaw Capital Managment LLC now owns 40,150 shares of the oil and gas company's stock worth $289,000 after purchasing an additional 26,450 shares during the period. Hedge funds and other institutional investors own 57.15% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen raised Geospace Technologies from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th.

Check Out Our Latest Analysis on GEOS

Geospace Technologies Stock Performance

Shares of GEOS stock traded down $0.28 during trading hours on Friday, hitting $16.29. 83,517 shares of the company were exchanged, compared to its average volume of 187,173. The business's 50-day simple moving average is $15.68 and its two-hundred day simple moving average is $10.45. Geospace Technologies Corporation has a one year low of $5.51 and a one year high of $21.60. The stock has a market capitalization of $208.84 million, a price-to-earnings ratio of -15.37 and a beta of 0.70.

Geospace Technologies (NASDAQ:GEOS - Get Free Report) last issued its earnings results on Thursday, August 7th. The oil and gas company reported $0.06 earnings per share (EPS) for the quarter. Geospace Technologies had a negative net margin of 11.70% and a positive return on equity of 2.77%.

Geospace Technologies Company Profile

(

Free Report)

Geospace Technologies Corporation designs and manufactures instruments and equipment used in the oil and gas industry to acquire seismic data in order to locate, characterize, and monitor hydrocarbon producing reservoirs. The company operates through three segments: Oil and Gas Markets, Adjacent Markets, and Emerging Markets.

Featured Stories

Before you consider Geospace Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geospace Technologies wasn't on the list.

While Geospace Technologies currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.