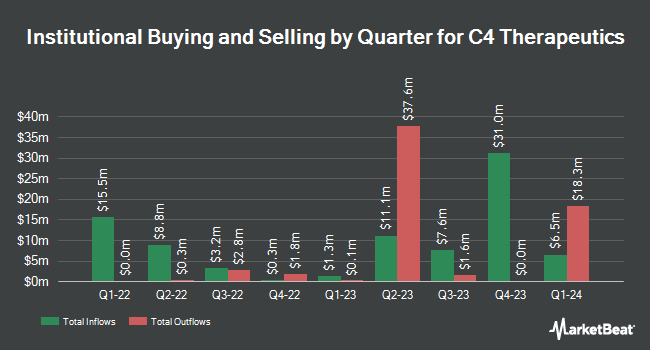

Nuveen LLC bought a new position in C4 Therapeutics, Inc. (NASDAQ:CCCC - Free Report) in the first quarter, according to the company in its most recent disclosure with the SEC. The fund bought 192,424 shares of the company's stock, valued at approximately $308,000. Nuveen LLC owned 0.27% of C4 Therapeutics at the end of the most recent quarter.

Other large investors have also added to or reduced their stakes in the company. XTX Topco Ltd bought a new stake in C4 Therapeutics in the 1st quarter worth approximately $64,000. Delta Investment Management LLC bought a new stake in C4 Therapeutics in the 4th quarter worth approximately $72,000. ProShare Advisors LLC grew its position in C4 Therapeutics by 83.1% in the 4th quarter. ProShare Advisors LLC now owns 20,283 shares of the company's stock worth $73,000 after purchasing an additional 9,204 shares during the period. Deutsche Bank AG bought a new stake in C4 Therapeutics in the 1st quarter worth approximately $74,000. Finally, Lazard Asset Management LLC bought a new stake in C4 Therapeutics in the 4th quarter worth approximately $81,000. Institutional investors own 78.81% of the company's stock.

C4 Therapeutics Stock Performance

Shares of C4 Therapeutics stock traded up $0.09 on Thursday, hitting $2.73. 849,200 shares of the company's stock were exchanged, compared to its average volume of 1,040,881. The company has a 50-day simple moving average of $2.34 and a 200-day simple moving average of $1.89. The stock has a market capitalization of $194.29 million, a PE ratio of -1.73 and a beta of 2.98. C4 Therapeutics, Inc. has a 1 year low of $1.09 and a 1 year high of $7.22.

C4 Therapeutics (NASDAQ:CCCC - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The company reported ($0.37) earnings per share for the quarter, topping the consensus estimate of ($0.38) by $0.01. C4 Therapeutics had a negative net margin of 325.88% and a negative return on equity of 53.91%. The business had revenue of $6.46 million for the quarter, compared to analysts' expectations of $5.24 million. On average, analysts expect that C4 Therapeutics, Inc. will post -1.52 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

CCCC has been the subject of a number of research analyst reports. Guggenheim initiated coverage on shares of C4 Therapeutics in a research report on Wednesday, September 3rd. They issued a "buy" rating and a $8.00 target price for the company. Zacks Research cut shares of C4 Therapeutics from a "strong-buy" rating to a "hold" rating in a research note on Friday, August 22nd. Finally, Wall Street Zen cut shares of C4 Therapeutics from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. Two analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $8.00.

Get Our Latest Report on CCCC

C4 Therapeutics Profile

(

Free Report)

C4 Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins for the treatment of cancer, neurodegenerative conditions, and other diseases. Its lead product candidate is CFT7455, an orally bioavailable MonoDAC degrader of protein that is in Phase 1/2 trial targeting IKZF1 and IKZF3 for multiple myeloma and non-Hodgkin lymphomas, including peripheral T-cell lymphoma and mantle cell lymphoma, currently under Phase 1/2 clinical trials.

Read More

Before you consider C4 Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C4 Therapeutics wasn't on the list.

While C4 Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.