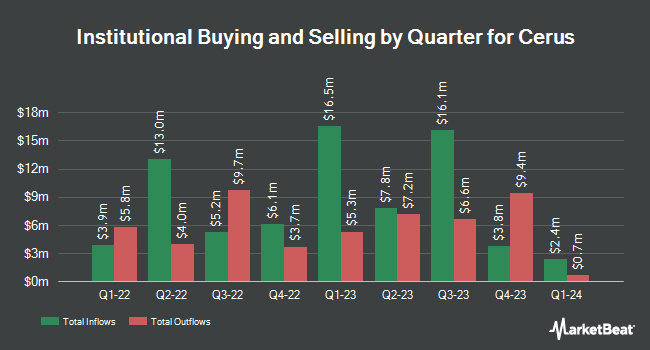

Nuveen LLC purchased a new position in shares of Cerus Corporation (NASDAQ:CERS - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 462,550 shares of the biotechnology company's stock, valued at approximately $643,000. Nuveen LLC owned 0.24% of Cerus as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also made changes to their positions in the company. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of Cerus during the fourth quarter worth approximately $25,000. Merit Financial Group LLC acquired a new stake in shares of Cerus during the first quarter worth approximately $25,000. Ameriprise Financial Inc. acquired a new stake in shares of Cerus during the fourth quarter worth approximately $40,000. Pallas Capital Advisors LLC acquired a new stake in shares of Cerus during the first quarter worth approximately $37,000. Finally, R Squared Ltd raised its position in Cerus by 106.7% during the first quarter. R Squared Ltd now owns 38,655 shares of the biotechnology company's stock valued at $54,000 after acquiring an additional 19,955 shares in the last quarter. 78.37% of the stock is currently owned by institutional investors and hedge funds.

Cerus Stock Down 1.1%

CERS traded down $0.01 during midday trading on Tuesday, hitting $1.29. 158,755 shares of the company's stock traded hands, compared to its average volume of 1,295,151. The company has a market cap of $246.53 million, a PE ratio of -12.85 and a beta of 1.63. The stock's fifty day simple moving average is $1.34 and its 200-day simple moving average is $1.37. The company has a debt-to-equity ratio of 1.01, a current ratio of 2.00 and a quick ratio of 1.35. Cerus Corporation has a one year low of $1.12 and a one year high of $2.24.

Cerus (NASDAQ:CERS - Get Free Report) last issued its quarterly earnings data on Tuesday, August 5th. The biotechnology company reported ($0.03) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.01). The business had revenue of $60.10 million for the quarter, compared to the consensus estimate of $51.80 million. Cerus had a negative net margin of 9.81% and a negative return on equity of 33.77%. Cerus has set its FY 2025 guidance at EPS. As a group, equities analysts anticipate that Cerus Corporation will post -0.08 earnings per share for the current fiscal year.

About Cerus

(

Free Report)

Cerus Corporation operates as a biomedical products company. The company focuses on developing and commercializing the INTERCEPT Blood System to enhance blood safety. Its INTERCEPT Blood System, a proprietary technology for controlling biological replication that is designed to reduce blood-borne pathogens in donated blood components intended for transfusion.

Further Reading

Before you consider Cerus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cerus wasn't on the list.

While Cerus currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.