Nvwm LLC increased its position in shares of Datadog, Inc. (NASDAQ:DDOG - Free Report) by 17.8% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 11,791 shares of the company's stock after acquiring an additional 1,784 shares during the period. Nvwm LLC's holdings in Datadog were worth $1,170,000 at the end of the most recent quarter.

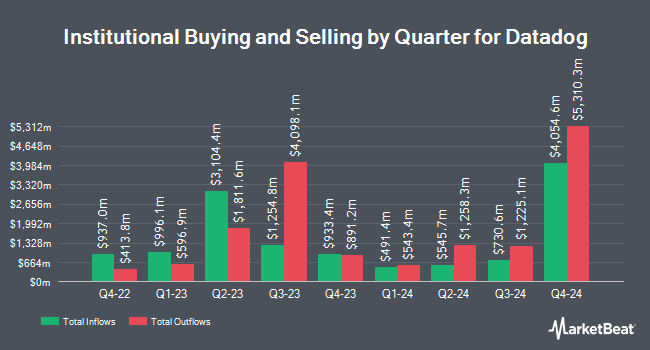

A number of other hedge funds have also recently bought and sold shares of the company. Wealth Enhancement Advisory Services LLC raised its stake in shares of Datadog by 32.0% during the 4th quarter. Wealth Enhancement Advisory Services LLC now owns 15,506 shares of the company's stock worth $2,216,000 after purchasing an additional 3,760 shares in the last quarter. LBP AM SA raised its stake in shares of Datadog by 40.2% during the 1st quarter. LBP AM SA now owns 419,805 shares of the company's stock worth $41,649,000 after purchasing an additional 120,343 shares in the last quarter. Envestnet Asset Management Inc. raised its stake in shares of Datadog by 24.7% during the 1st quarter. Envestnet Asset Management Inc. now owns 787,344 shares of the company's stock worth $78,112,000 after purchasing an additional 156,152 shares in the last quarter. Total Wealth Planning & Management Inc. purchased a new stake in shares of Datadog during the 4th quarter worth about $314,000. Finally, Soros Fund Management LLC raised its stake in shares of Datadog by 14.3% during the 4th quarter. Soros Fund Management LLC now owns 192,190 shares of the company's stock worth $27,462,000 after purchasing an additional 24,100 shares in the last quarter. 78.29% of the stock is owned by institutional investors and hedge funds.

Datadog Stock Up 0.6%

Shares of NASDAQ DDOG traded up $0.93 on Monday, reaching $150.77. 2,647,060 shares of the company's stock traded hands, compared to its average volume of 5,847,178. The company has a market cap of $52.07 billion, a price-to-earnings ratio of 327.77, a price-to-earnings-growth ratio of 82.40 and a beta of 1.03. The company has a quick ratio of 2.74, a current ratio of 2.74 and a debt-to-equity ratio of 0.34. The business's 50 day simple moving average is $130.32 and its two-hundred day simple moving average is $120.54. Datadog, Inc. has a 12 month low of $81.63 and a 12 month high of $170.08.

Datadog (NASDAQ:DDOG - Get Free Report) last posted its earnings results on Tuesday, May 6th. The company reported $0.46 EPS for the quarter, topping analysts' consensus estimates of $0.42 by $0.04. Datadog had a net margin of 5.85% and a return on equity of 6.39%. The business had revenue of $761.55 million during the quarter, compared to the consensus estimate of $741.73 million. During the same quarter in the previous year, the firm posted $0.44 EPS. The firm's revenue was up 24.6% on a year-over-year basis. As a group, equities research analysts forecast that Datadog, Inc. will post 0.34 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research analysts recently weighed in on DDOG shares. Barclays raised their price objective on Datadog from $128.00 to $170.00 and gave the company an "overweight" rating in a research note on Monday, July 21st. Bank of America raised their target price on Datadog from $150.00 to $175.00 and gave the company a "buy" rating in a report on Monday, July 7th. Stifel Nicolaus raised their target price on Datadog from $120.00 to $135.00 and gave the company a "hold" rating in a report on Thursday, June 26th. Canaccord Genuity Group decreased their price objective on Datadog from $150.00 to $145.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. Finally, Wedbush reissued an "outperform" rating and set a $140.00 price objective on shares of Datadog in a report on Wednesday, June 11th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and twenty-four have given a buy rating to the stock. Based on data from MarketBeat, Datadog currently has an average rating of "Moderate Buy" and an average target price of $146.79.

Check Out Our Latest Report on DDOG

Insider Activity at Datadog

In related news, CEO Olivier Pomel sold 107,365 shares of Datadog stock in a transaction on Monday, June 9th. The shares were sold at an average price of $121.71, for a total transaction of $13,067,394.15. Following the transaction, the chief executive officer owned 548,715 shares in the company, valued at approximately $66,784,102.65. The trade was a 16.36% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Amit Agarwal sold 25,000 shares of Datadog stock in a transaction on Wednesday, May 28th. The shares were sold at an average price of $117.02, for a total transaction of $2,925,500.00. Following the transaction, the director owned 76,052 shares in the company, valued at approximately $8,899,605.04. This trade represents a 24.74% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 957,666 shares of company stock worth $117,576,223 in the last 90 days. Company insiders own 8.70% of the company's stock.

Datadog Company Profile

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Articles

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report