One Wealth Advisors LLC purchased a new stake in shares of NXP Semiconductors N.V. (NASDAQ:NXPI - Free Report) during the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor purchased 1,159 shares of the semiconductor provider's stock, valued at approximately $253,000.

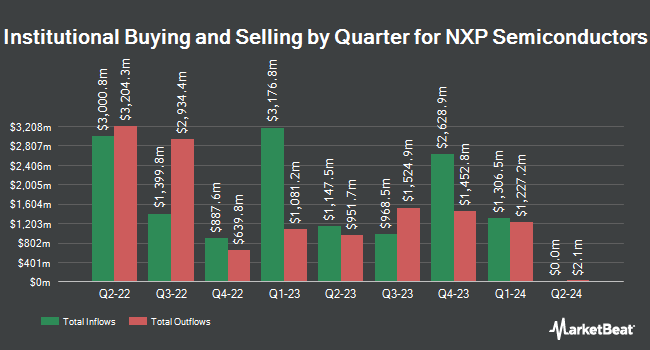

A number of other hedge funds also recently added to or reduced their stakes in NXPI. Hemington Wealth Management lifted its position in NXP Semiconductors by 50.0% in the 1st quarter. Hemington Wealth Management now owns 177 shares of the semiconductor provider's stock valued at $33,000 after acquiring an additional 59 shares in the last quarter. Brown Lisle Cummings Inc. lifted its holdings in shares of NXP Semiconductors by 121.7% during the second quarter. Brown Lisle Cummings Inc. now owns 153 shares of the semiconductor provider's stock valued at $33,000 after purchasing an additional 84 shares in the last quarter. Valley National Advisers Inc. boosted its position in shares of NXP Semiconductors by 118.9% during the first quarter. Valley National Advisers Inc. now owns 232 shares of the semiconductor provider's stock valued at $43,000 after buying an additional 126 shares during the last quarter. Rossby Financial LCC bought a new stake in NXP Semiconductors in the 1st quarter worth about $46,000. Finally, Zions Bancorporation National Association UT purchased a new position in NXP Semiconductors in the 1st quarter worth about $54,000. 90.54% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at NXP Semiconductors

In other news, President Rafael Sotomayor sold 2,000 shares of the business's stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $219.57, for a total value of $439,140.00. Following the transaction, the president directly owned 4,958 shares in the company, valued at $1,088,628.06. The trade was a 28.74% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO William Betz sold 6,785 shares of the stock in a transaction dated Monday, July 28th. The stock was sold at an average price of $227.34, for a total value of $1,542,501.90. Following the sale, the chief financial officer owned 1,520 shares of the company's stock, valued at $345,556.80. This represents a 81.70% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 9,785 shares of company stock valued at $2,197,852 over the last ninety days. 0.12% of the stock is currently owned by company insiders.

NXP Semiconductors Stock Up 0.7%

NXPI stock opened at $227.73 on Wednesday. The business's 50-day moving average price is $224.39 and its 200-day moving average price is $209.17. The stock has a market cap of $57.42 billion, a P/E ratio of 27.14, a PEG ratio of 2.56 and a beta of 1.43. The company has a quick ratio of 1.20, a current ratio of 1.74 and a debt-to-equity ratio of 0.99. NXP Semiconductors N.V. has a twelve month low of $148.09 and a twelve month high of $256.62.

NXP Semiconductors (NASDAQ:NXPI - Get Free Report) last released its earnings results on Monday, July 21st. The semiconductor provider reported $2.72 EPS for the quarter, topping analysts' consensus estimates of $2.66 by $0.06. The company had revenue of $2.93 billion for the quarter, compared to analysts' expectations of $2.90 billion. NXP Semiconductors had a net margin of 17.72% and a return on equity of 27.99%. The firm's revenue was down 6.4% compared to the same quarter last year. During the same quarter last year, the business earned $3.20 EPS. NXP Semiconductors has set its Q3 2025 guidance at 2.890-3.300 EPS. On average, equities research analysts forecast that NXP Semiconductors N.V. will post 10.28 EPS for the current year.

NXP Semiconductors Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 8th. Shareholders of record on Wednesday, September 17th will be paid a $1.014 dividend. This represents a $4.06 dividend on an annualized basis and a yield of 1.8%. The ex-dividend date is Wednesday, September 17th. NXP Semiconductors's dividend payout ratio is presently 48.39%.

Analyst Upgrades and Downgrades

A number of analysts have recently issued reports on the stock. The Goldman Sachs Group initiated coverage on shares of NXP Semiconductors in a report on Thursday, July 10th. They set a "buy" rating and a $276.00 price target on the stock. Stifel Nicolaus raised their target price on shares of NXP Semiconductors from $170.00 to $210.00 and gave the stock a "hold" rating in a report on Friday, July 18th. Citigroup boosted their target price on shares of NXP Semiconductors from $210.00 to $275.00 and gave the company a "buy" rating in a research note on Monday, July 7th. JPMorgan Chase & Co. raised their price target on NXP Semiconductors from $205.00 to $240.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 23rd. Finally, UBS Group lifted their price objective on NXP Semiconductors from $250.00 to $276.00 and gave the stock a "buy" rating in a report on Wednesday, July 2nd. Two investment analysts have rated the stock with a Strong Buy rating, fifteen have assigned a Buy rating and three have issued a Hold rating to the stock. According to data from MarketBeat.com, NXP Semiconductors currently has an average rating of "Moderate Buy" and an average target price of $256.05.

Get Our Latest Analysis on NXPI

About NXP Semiconductors

(

Free Report)

NXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.